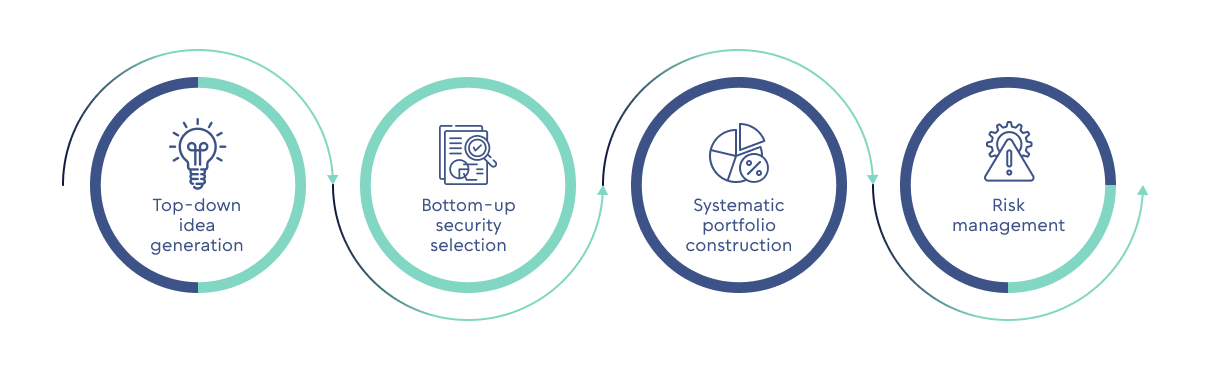

Tema’s active investment process consists of four key steps

Each process step is either fundamental (human driven) and/or systematic (rules based/quantitative), depending on which approach lends itself best to producing positive outcomes.

-

Idea generation – starts with a carefully built and maintained proprietary universe that we believe is a precise expression of the strategy. Within these universes, individual fund managers employ a combination of experience, insights and quantitative screening to distill a research set. From there creativity and serendipity are principles that guide idea generation. You can read about how this happens in more detail here.

- Security selection – according to analysis of over 750 successful funds with long term track records, over 100% of alpha generated came from security selection. To produce this source of alpha our portfolio managers engage in pure fundamental research. At the core of this process step are assessing each security on the basis of four key pillars:

The first two pillars are objective criteria and involve assessing downside risk. We will not make any investments that do not meet these two criteria:

-

- Does the business have a strong operating base? This is defined broadly to include anything from the business model, competitive position, management track record and incentives. In short, businesses must have solid operational foundations that can be identified and qualified. Though not an off-the-shelf investment concept readers can find it explained in more depth here along with examples.

- Does the business have a solid balance sheet and sustainable cash generation profile? We place significant emphasis on this type of financial analysis, as problems in this area can lead to permanent impairment of equity capital. Balance sheet analysis includes everything from standard debt metrics to working capital, off-balance sheet arrangements, pensions, use of factoring, and much more. Cash flow generation is the life blood of a business, and we employ detailed financial modeling to understand, for example, the quality and quantity of cash conversion. For more details including examples from our investment record read here.

The second two pillars are focused on more subjective criteria and the upside potential.

-

- What is the valuation case for this stock? Valuation is an open concept and a case can be built using a multitude of methods. For example, one approach is to assess the valuation today vs. the stock’s 10-year historic multiple. Here, we prefer investments that trade at or below 1 standard deviation vs. the 10-year average. Beyond this framework, fund managers can employ other valuation measures (for example valuation vs. fundamentals or peers). Valuation analysis is a critical step in the process before making any investment and you can read more about our approach here.

- What is our edge in this investment? This is a delicate question that starts with acknowledging what the biggest unknowns are in any business. Edge can take the form of being informational, analytical or behavioral. In some cases, we also apply risk-reward analysis. Managers craft an upside case and downside case for a stock on a 3-5 year view. The ratio of these cases must at least be >2x to make an investment. This framework allows us to identify, quantify and build up investments with asymmetric risk/reward. For some examples read more about how we identify edge here.

If all four criteria are met, we will make an investment decision to buy the security.

- Portfolio construction – Whereas more than 100% of alpha generated by successful funds comes from security selection, portfolio construction is in most cases a detractor. When setting out at Tema we conducted a comprehensive study of academic literature and investment practice to answer a key question: how does one optimally size positions and build portfolios. The result is a systematic (i.e., rules-based) approach to portfolio construction that harnesses the best of stock-picking alpha, while managing risks and counteracting inevitable behavioral biases. To learn more about this work head here.

- Risk management – the final part of Tema’s core investment process involves a multi-layered approach that involves both operational risk oversight (liquidity, diversification rules, trading), portfolio risk oversight (exposure monitoring, macro-overlay, risk analysis), as well as investment diligence oversight (investment process steps). Risk management consists of both systematic and fundamental elements – each building on the other. To learn more about how we lead with risk management read here.

Back

Back

.png)