One of the surprising findings of a large academic study of 750 successful managers1 relates to portfolio construction. While this universe of managers generated 308 basis points of alpha, surprisingly, sizing and portfolio construction on average detracted 11bps.

What does this mean? On average the outperforming managers are excellent at selecting stocks but lose money trying to size positions.

This finding led us to set off to answer a research question – what is the optimal way to construct portfolios to avoid this alpha loss? The project spanned several months and involved consulting academic literature and interviewing over a dozen industry participants from long-only to hedge funds.

Key Takeaways

- The majority of the industry invests too little in understanding portfolio construction.

- The academic literature is often too focused on multi-asset and efficient frontiers instead of being practical for fund managers.

- There are plenty of consultancies and services driven by data and AI – however their underlying ideas can be distilled into heuristics, which are far more user-friendly.

- The three most important principles are a portfolio construction process that accounts for 1. risk management, 2. behavioral biases, and 3. conviction.

To capture these findings, we implemented what we call an active systematic portfolio construction process2.

Position sizing

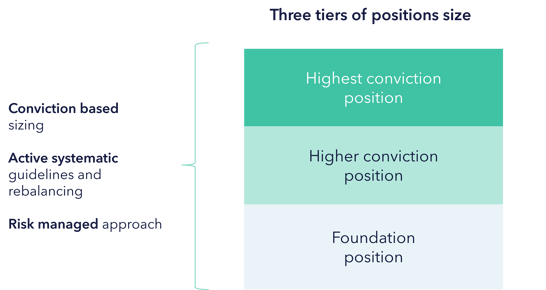

First, we size positions based on three conviction tiers – for example 5% for highest conviction position, 3% for a higher conviction position and 2% for a foundation position. Within each tier the stocks are all weighted equally. Trading involves moving from one tier to the next – this reduces trading activity by creating a higher hurdle for trades.

Having a sizeable minimum lower tier means that we don’t have a tail of small positions. This matters because alpha in ideas tends to decay over time, its life is usually 18-24 months. Having too small a position leaves fund managers invested with no real outcome to the clients’ result. By the time the position is sized up as conviction is built, alpha could be gone. Hence when taking foundation positions, it is beneficial to invest a minimum size. Conversely, having a high conviction position size helps with risk management in terms of concentration limits.

Portfolio Management

In terms of portfolio management we take an active approach – rebalancing when necessary. This rebalancing is aware of market conditions, something a periodic rebalancing fails to do. It differs from purely active as there is an objective to rebalance at least every six months, identified in the literature as the optimal frequency.

This portfolio construction approach has several benefits. It allows portfolio managers to express conviction but in a risk managed way. The approach also helps limit trading activity which saves on tax and costs. Behaviorally it is conducive to long-term investing, which benefits from a time-arbitrage against an increasingly short sighted market. This approach also helps mitigate other human biases such as overconfidence, by for example limiting the maximum position size, and risk aversion bias, by creating a minimum position change size.

Naturally there are drawbacks. For example, it can’t be used for every kind of equity investment risk with areas like biotechnology, where binary event risk dominates, requiring a different approach.

Conclusion

Portfolio construction is often a neglected area among active equity managers. At Tema, based on academic and best practice, we have built what we believe to be a portfolio construction process that harnesses the best of stock picking alpha.

Back

Back

.png)