Many active managers shy away from explicitly discussing edge in their investment process. Others give convoluted or complicated answers. We firmly believe that if we can’t explain our edge in five minutes, we don’t have a very good one. The question also acknowledges that the market, though often vilified, is also full of smart and skilled investors that we need to beat. This is why as our fourth pillar we ask this difficult question – what is our edge in this investment?

Edge in investing can be divided into three categories:

- Informational edge – We have some public information the market probably doesn’t know.

- Analytical edge – We have put the facts together in some analysis that the market has failed to do.

- Behavioral edge – Ability to control emotions better than the market which is prone to bounce between bouts of exuberance and fear.

Informational edge

To gain this edge requires a lot of careful work. For example, we have devoted a considerable amount of time to working on myelofibrosis, a rare blood disorder. From this work we built significant conviction that Morphosys’ pelabresib could potentially change the standard of care. This led us to build a position ahead of pivotal Phase III data. Fortunately, these data read out positively confirming our view and subsequently led to an acquisition of the company by Novartis.

Analytical edge

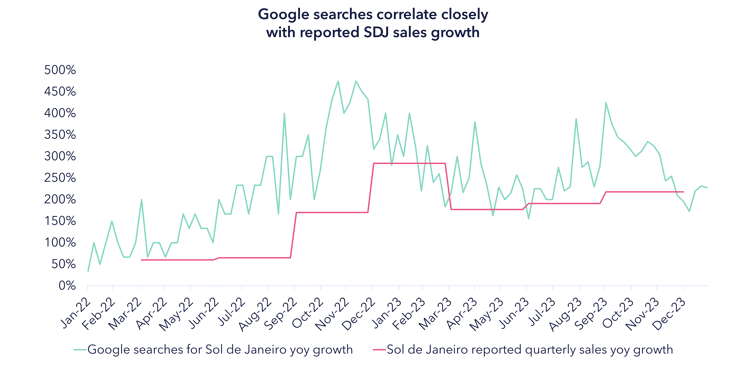

Analysis can also lead to a clear edge in a stock. An example is our investment in L'Occitane. Experience suggests that their Sol de Janeiro brand was ticking all the key drivers of a potential multi-billion-dollar valuation. These included

- Breakout digital media growth.

- Track record of building more than one hero product.

- Distribution strategy that had potential to scale internationally.

This view was supported by analysis of their interim report published in December 2023. Sol de Janeiro isn’t owned fully and a 17.3% stake was retained by the founder under a put contract. This means an auditor must value the brand regularly. As of September 2023, the valuation was of this 17.3% was set at EUR 548m meaning the stake owned by L’Occitane was worth nearly EUR 2.7bn or 77% of the entire market cap of L’Occitane at the time, leaving the rest of the business on a low to mid-single digit EV/EBIT.

Combining this with our view of an inevitable relisting of the company from Hong Kong to the US, where valuations are higher, led us to scale the holding to one of our biggest positions.

Behavioral Edge

In investing having a more structured, common sense and emotion free approach wins out in the long run. This advantage arises because collectively investor sentiment often causes prices in the market to diverge from the intrinsic value of securities. The market is prone to wild swings from optimism to pessimism. A behavioral edge counteracts this.

A clear example here is our TOLL strategy. In many of our holdings the market does not appreciate the durability and longevity of these businesses. This is partly because of an inherent suspicion of returns that stay above the cost of capital for long periods of time. The market, supported by a chorus of sell side analysts, inevitably fades them. In the right investments taking the other side of this fade trade requires an emotionless and measured approach. This is especially true if some sort of short-term issue arises. The market, always searching for a narrative, confounds short term issues with structural issues. In TOLL companies this creates fantastic investment opportunities from a valuation perspective. One example has been Idexx Laboratories, where the market obsession with short term vet visit numbers created a period of underperformance where we picked up the shares. Here investors failed to look forward to a new product cycle and strength in the growing installed base of this veterinary diagnostic leader.

Conclusion

Asking what our edge is a key pillar to making an equity decision. Stocks where we have no edge are rarely those that go up. One type of edge that doesn’t feature for individual stocks but underlies everything we do can be termed organizational edge. At Tema we believe we have the elements of this type of edge:

- A consistent investment decision making framework for each of our funds

- The right culture and organization to make clear unbiased decisions

- A focus on the long term

Back

Back

.png)