By clicking below you acknowledge that you are navigating away from temaetfs.com and will be connected to temafunds. Tema Global Limited manages both domains. Please take note of Tema's privacy policy, terms of use, and disclosures that may vary between sites.

Get in Touch

Back

Back

HRTS

Heart & Health ETF

Invest in Healthcare, Chronic Disease and Weight Loss Innovation.

Why Invest in HRTS?

Breakthrough Innovation

General healthcare and cardiology have witnessed breakthrough medical innovation, such as GLP-1 therapies for diabetes and obesity.

Impact & Scale

Heart disease remains the largest killer in the world today, while diabetes rates are rising globally expanding patient needs.

Source: Novo Nordisk, World Obesity Atlas

Investment Expertise

HRTS is managed by a veteran investor with over 20-year investment track record covering these companies.

Fund Overview

Fund Details

As of February 18, 2026

Fund Summary

The Tema Heart & Health ETF (HRTS) seeks to invest in companies that potentially stand to benefit from further advances in biotechnology and healthcare, specifically companies involved in cardiology, metabolic diseases and weight loss therapies.

Introducing HRTS

Portfolio Breakdown

Top 10 holdings

As of February 18, 2026

Country Breakdown

United States

74.93%Switzerland

9.01%United Kingdom

4.79%Denmark

4.63%Others

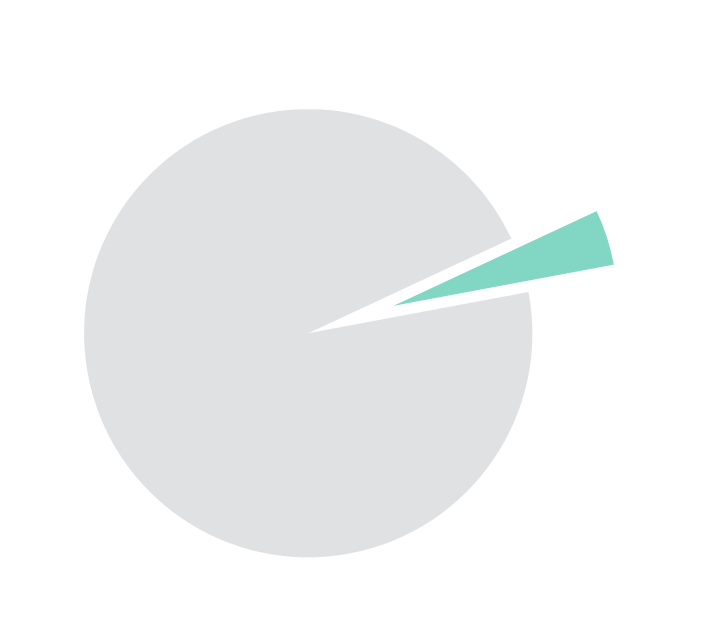

6.64%Industry Breakdown

Health Care

99.25%Cash & Cash Equivalents

0.74%- Performance

- Distributions

- Premium / Discount

Prices & Performance

- Jan 31, 2026

- Dec 31, 2025

HRTS

3 months

1 Year

3 Years

5 Years

Since inception

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted. Returns for periods of less than one year are not annualized.

The market price returns are based on the official closing price of an ETF share or, if the official closing price isn’t available, the midpoint between the national best bid and national best offer (“NBBO”) as of the time the ETF calculates current NAV per share, and do not represent the returns you would receive if you traded shares at other times. NAVs are calculated using prices as of 4:00 PM Eastern Time. The first trading date is typically several days after the fund inception date. Therefore, NAV is used to calculate market returns prior to the first trade date because there is no bid/ask spread until the fund starts trading.

Distributions

Record Date

Ex-Date

Payable Date

Total Distribution

Income

Premium/Discount

Days Traded at Nav

Days Traded at Premium

Days Traded at Discount

HRTS NAV / Market Price

How does the Tema HRTS ETF fit in a portfolio?

Investment Style Box

Source: Tema. The investment style Box reveal’s a fund’s investment strategy by showing its investment style and market capitalization based on the fund’s portfolio holdings.

Potential Portfolio

Equity Allocation

3-5%

Equity Satellite

HRTS ETF

Equity core

Where could a position be funded from?

- Could be a more targeted alternative to existing healthcare or biopharma exposure in a portfolio.

- Provides a balanced exposure across key technologies and company risk profiles.

- Could replace a satellite or a growth-oriented position.

Latest Research & Insights

White Paper: Healthcare’s Next Cycle is Taking Shape

An in-depth perspective on the recovery and future growth of the healthcare sector, driven by innovation and AI, as outlined in Dr David Song's latest whitepaper.

Why Healthcare is Going Back on Offense in 2026

Discover why healthcare is poised for growth in 2026, driven by policy clarity, AI advancements, and strategic M&A initiatives in pharma, biotech, and medtech.

Emerging Investing Opportunities in Large Chronic Disease Therapies

Discover emerging investment opportunities in chronic disease management and how companies are shifting to holistic treatments for lasting impact.

Subscribe for Updates

Risk Information

Carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Fund’s prospectus or summary prospectus, which may be obtained by visiting www.temaetfs.com.

Read the prospectus carefully before investing.

On 06/27/2025 the Tema GLP-1, Obesity & Cardiometabolic ETF was renamed Tema Heart & Health ETF. Investing involves risk including possible loss of principal. There is no guarantee the adviser’s investment strategy will be successful.

Industry Concentration Risk: Because the Fund's assets will be concentrated in an industry or group of industries, the Fund is subject to loss due to adverse occurrences that may affect that industry or group of industries.

Biotechnology Industry Risk: The biotechnology industry can be significantly affected by patent considerations, including the termination of patent protections for products, intense competition both domestically and internationally, rapid technological change and obsolescence, government regulation and expensive insurance costs due to the risk of product liability lawsuits. In addition, the biotechnology industry is an emerging growth industry, and therefore biotechnology companies may be thinly capitalized and more volatile than companies with greater capitalizations.

Sector Focus Risk: Obesity and Cardiology companies are highly dependent on the development, procurement and marketing of drugs and the protection and exploitation of intellectual property rights. A company’s valuation can also be greatly affected if one of its products is proven or alleged to be unsafe, ineffective or unprofitable. The stock prices of Obesity and Cardiology companies have been and will likely continue to be very volatile. The costs associated with developing new drugs can be significant, and the results are unpredictable.

Newly developed drugs may be susceptible to product obsolescence due to intense competition from new products and less costly generic products. Moreover, the process for obtaining regulatory approval by the U.S. Food and Drug Administration or other governmental regulatory authorities is long and costly and there can be no assurance that the necessary approvals will be obtained or maintained. Companies in the medical equipment industry group may be affected by the expiration of patents, litigation based on product liability, industry competition, product obsolescence and regulatory approvals, among other factors.

Investing in foreign and emerging markets involves risks relating to political, economic, or regulatory conditions not associated with investments in U.S. securities and instruments. In addition, the fund is exposed to currency risk.

Because the Funds evaluate ESG factors to assess and exclude certain investments for non-financial reasons, the Funds may forego some market opportunities available to funds that do not use these ESG factors.

Tema ETFs LLC serves as the investment adviser to Tema Heart & Health ETF (the “Fund”), and Tidal Investments LLC serves as a sub adviser to the Fund. The Fund is distributed by Vigilant Distributors, LLC, which is not affiliated with Tema ETFs LLC nor Tidal Investments LLC. Check the background of Vigilant Distributors, LLC on FINRA’s BrokerCheck.