By clicking below you acknowledge that you are navigating away from temaetfs.com and will be connected to temafunds. Tema Global Limited manages both domains. Please take note of Tema's privacy policy, terms of use, and disclosures that may vary between sites.

Recent Posts

Industrial earnings show signs of improvement, boosted by reduced uncertainty and strategic business enhancements. Discover what that means for investors.

Discover how GE Vernova is transforming from a turbine manufacturer into a diversified energy infrastructure leader with strong growth in electrification and services.

Caterpillar's record $51 billion backlog highlights the resurgence in U.S. industrial demand driven by AI infrastructure, federal spending, and reshoring initiatives.

Discover how automation and digital industry trends are driving the resurgence of US manufacturing, enabling domestic re-industrialization.

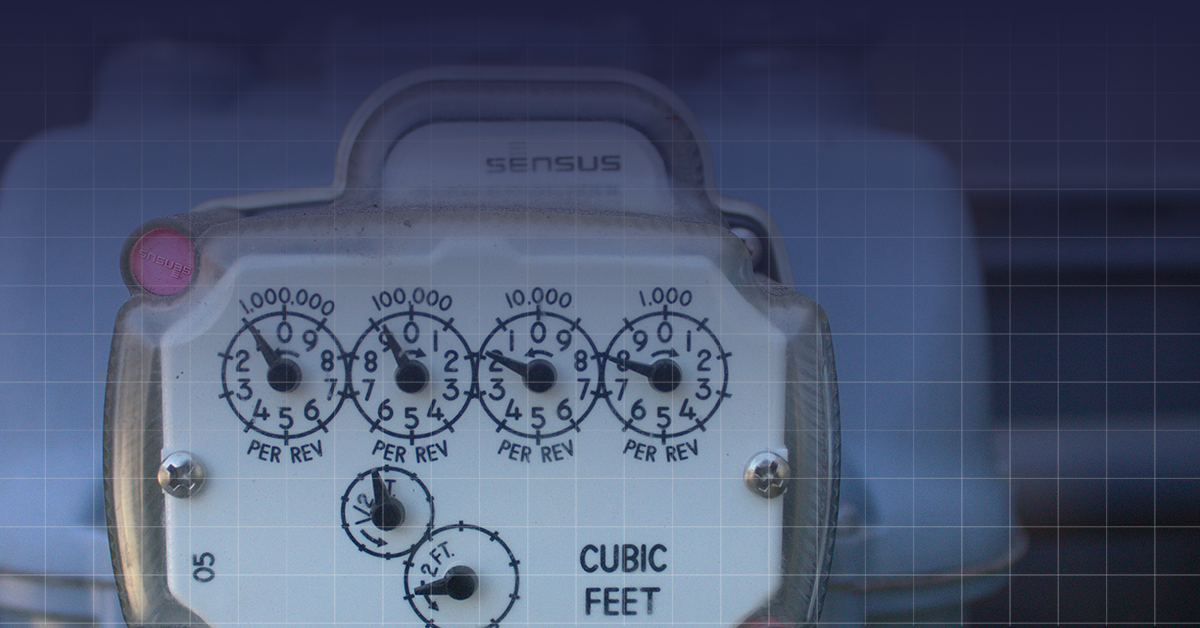

Investing in natural gas infrastructure is key to fueling US electrification and offers attractive opportunities for investors as demand continues to rise.

Insights from Q3 2025 earnings calls on how reshoring and US manufacturing trends are impacting companies like Cognex, Caterpillar, and Eaton.

Discover how to prudently invest in the nuclear renaissance amid rising power demands and technological advancements in nuclear energy.

Explore how AI's rapid growth is transforming global electrification and driving significant investments in power infrastructure, reshaping the future of energy consumption.

Discover how Newell, Amkor, Hyundai, and Eli Lilly are driving the U.S. reshoring movement with significant investments in manufacturing and job creation.

Discover the rising momentum in non-residential construction and its impact on reshoring efforts, as highlighted by the latest Dodge Momentum Index report.

Record-breaking power auction prices highlight urgent need for more electrification investments to meet rising demand and improve grid infrastructure.

Digital assets i.e. crypto currencies continue to expand. Through price appreciation, new use cases, and institutionalization, digital assets are a growing part of the financial system.

Explore the resurgence of Made in America through reshoring, evolving trade policies, and electrification, unlocking investment opportunities in critical industries poised for growth.

Explore the impact of Trump's tariffs on reshoring, manufacturing, and the reshaping of the US economy in this insightful analysis by Chris Semenuk.

Explore the electrification megacycle's $7 trillion opportunity, driven by AI, EVs, and reindustrialization through Tema Electrification ETF (VOLT).

Discover how state level reshoring is transforming manufacturing in the U.S. with major investments in states like Arizona, Texas, New York, and Indiana.

Reshoring to the US offers better supply chain security compared to nearshoring, which poses significant geopolitical and economic risks.

Discover key differences between ETFs & mutual funds. Learn what ETFs & mutual funds are, to decide which is better for your investment strategy.

Discover how investors can capitalize on the reshoring manufacturing trend with insights into emerging opportunities and growth strategies.

Private sector companies are making independent decisions to reshore manufacturing operations as companies navigate global risks and supply chain stress.

Gain insights into the reshoring phenomenon and its impact on infrastructure, manufacturing and supply chain.

Learn about the reshoring megatrend and how American manufacturing is being revitalized. Discover how you can invest in reshoring with the Tema American Reshoring ETF (RSHO).

Explore how reshoring could impact the US economy and drive investment opportunities

No results found

Back

Back

.jpg)

.jpg)