The start of this decade has been marked by impactful events which have unleashed a wave of change that is increasingly touching the American industrial complex through reshoring. As outlined in our introduction to American reshoring blog, reshoring is a structural trend acting through multiple verticals, with strong tailwinds from bipartisan government support and deglobalization.

Reshoring is not solely an infrastructure play

Reshoring, though ultimately about bringing jobs and investment back to America, is a dynamic process that impacts multiple industries in different ways. While reshoring is often conflated with American infrastructure, it is a megatrend that extends beyond that. Rebuilding infrastructure, like roads and bridges, is an important short-term first order enabler of the reshoring process but isn’t a key driver or main beneficiary. For example, a classic infrastructure play like the electricity utility Sempra [1] in California and Texas, has no identifiable benefit from reshoring. Conversely, API group[1] is not an infrastructure company, but we believe that it benefits from reshoring over the very long term through the inspection services it provides to government and private installations. Infrastructure is also exposed to broader factors beyond reshoring. As a result, we believe a pure-play infrastructure investment is not a precise way to achieve targeted exposure to the reshoring theme.

Industrialization and automation are at the core of reshoring

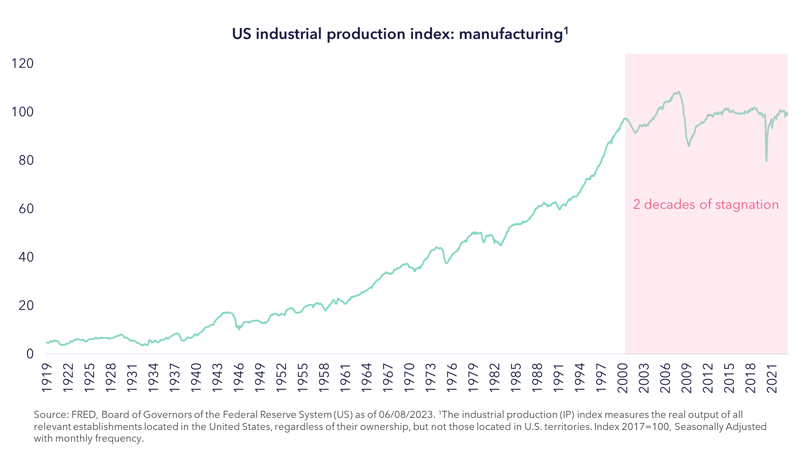

Reshoring starts on the American factory floor. Manufacturing capacity has been severely neglected since 2000, held back by lack of investment at the cost of jobs and technology leadership.

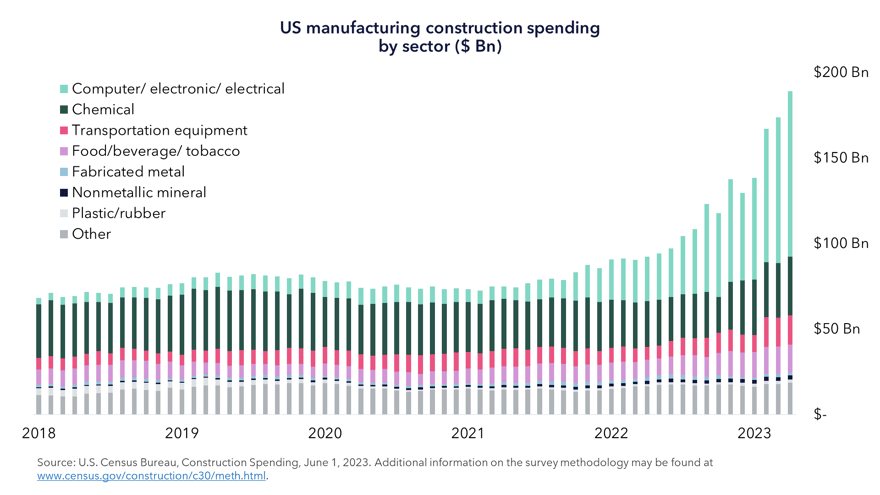

This has started to change rapidly in the last 24 months, with a ~40-year record US manufacturing job growth in 2022 [2] , unprecedented levels of manufacturing construction spending [3] , and decade-low share of Chinese goods as a percentage of US imports [4] . Many companies that we speak to consistently refer to reshoring as being a multi-year opportunity that could change the secular growth trajectory of their industries.

As US re-industrialization accelerates, automation starts to play a crucial role in transforming production processes. Automation technology has the potential to enable companies to achieve higher levels of productivity and improved product quality. All this extends well beyond simply bricks and mortar infrastructure. Reshoring is also spreading to more sectors including business equipment, autos, electrical supplies and non-energy materials.

How Tema identifies reshoring beneficiaries

The landscape of reshoring investment opportunities is wide and varied and requires a bottom-up approach. Ideas include all types of manufacturing equipment as well as related process, discrete and hybrid automation. It also includes suppliers and service providers that add value to the manufacturing process such as fasteners, compressors, and robotics as well as services that focus on factory safety and inspections. We also consider construction of the actual factory structure along with entry systems and logistics services that are necessary to transport goods into and out of the manufacturing facility to be within the scope of potential investment opportunities.

Bottom Line

Thematic purity is core to Tema’s investment process, and our focused approach to reshoring underscores why one cannot access this megatrend through just US infrastructure.

Back

Back