Reshoring is a powerful trend of businesses bringing manufacturing back to the US. It is aided by government support in the form of three major acts – Chips and Science Act (CHIPS), Inflation Reductio Act (IRA), and Infrastructure Investment and Jobs Act (IIJA). These were passed largely with bipartisan support and together total $1.85 trillion dollars.

Source: The White House.

But what does private and public reshoring look like at the state level? Below are four case studies.

Arizona

Total private sector investments: $122.7bn

Total public sector investments: $16.2bn

Major Project Examples

| Project Name | Amount | Private / Public | Notes |

| TSMC leading edge semiconductor | $65bn | Private (backed by CHIPS Act) | The largest investment in state history |

|

TSMC leading edge semiconductor |

$5.5bn | Private | Phoenix metropolitan region |

| Transport and roads | $4.9bn | Public funds | |

| St Luis land port entryModernization | $200m | Bipartisan Infrastructure Law | Double vehicle inspection |

- Arizona’s close proximity to major markets in the West with accessibility by rail or truck is a big advantage in terms of exporting manufacturing.

- Arizona also has a low incidence of natural disasters and greatest solar irradiance in America.

- Phoenix has affordable housing and is #1 out of the top 15 growth markets for manufacturing1

- As we observed on a recent trip to the region, the Phoenix metropolitan area has is unbounded geographically, with ample room to expand, unlike other major US cities. A 15 minute drive outside of the city center puts one into the open desert where the is considerable room to locate new factories and new housing. Water access is a critical factor in this expansion.

- Arizona’s manufacturing development is diverse across sectors

Arizona´s commercial and industrial growth is diverse:

Source: Arizona Commerce Authority.- Company spotlight: TSMC

- The leading semiconductor manufacturing business in the world is investing heavily in the US

- Their focus is the mega-complex in Arizona, essentially in the open desert with massive room to expand.

- TSMC will bring state of the art semiconductor manufacturing and create a forecast 6,000 new jobs.

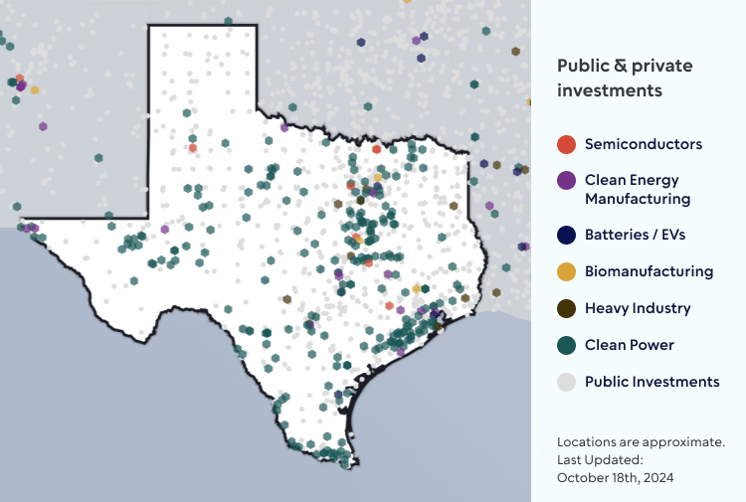

Texas

Total private sector investments: $157.4bn

Total public sector investments: $35bn

Major Project Examples

| Project Name | Amount | Private / Public | Notes |

| Samsung – semiconductor cluster in Taylor/Austin | $65bn | Private (CHIPS support announced) | Very large collection of facilities with multiple capabilities |

| Tesla – gigafactory | $5.5bn | Private | Phoenix metropolitan region |

| Roads/bridges | $4.9bn | Public | Producing model Y cars, planned production of the cybertruck |

- If Texas were a country, it would be the world’s 8th largest economy – surpassing Brazil, Italy, Russia, South Korea

- Until very recently, the State experienced economic growth well ahead of the rest of the nation

- With strong roots in agriculture and energy and due to its location in the Permian Basin, West Texas has grown to support thriving business services and manufacturing sectors

- West Texas also serves as a crucial gateway to Mexico and beyond. The North American Borderplex region, encompassing El Paso, is home to one of the world’s largest bilingual workforces and the fifth largest manufacturing hub in North America

- Company spotlight: Caterpillar

- Headquartered in Irving, Texas, Caterpillar is the world’s leading supplier of machinery

- A hidden gem within Caterpillar is its portable power generation equipment – a big business opportunity given the growth in data centers

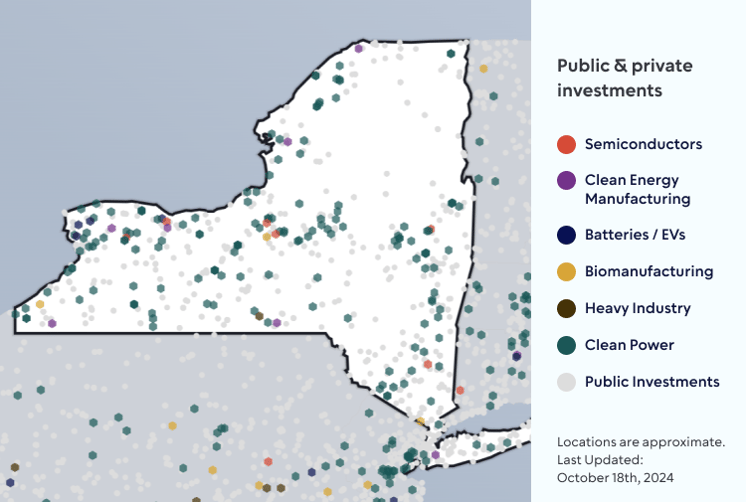

NY State

Total private sector investments: $90.2bn

Total public sector investments: $28.2bn

Major Project Examples

| Project Name | Amount | Private / Public | Notes |

| IBM – Hudson valley | $20bn | Private | Investing to expand quantum computing development and semiconductor ecosystem |

| Micron – Clay, NY | $50bn | Private | Investing to expand quantum computing development and semiconductor ecosystem |

| Hudson river tunnel | $3.8bn | Public | New railways connection between NYC and NJ |

- Governor Kathy Hochul recently celebrated National Manufacturing Month by unveiling New York’s nation-leading manufacturing job growth numbers. The State has added more than 13,300 new manufacturing jobs since 2021 – leading the nation in manufacturing jobs brought back to the US from overseas

- Micron Technology, Inc., the world's fourth-largest semiconductor company — and the only memory and storage manufacturer in the United States — will invest $100 billion to build the largest semiconductor fabrication facility in the history of the US in New York State. Spanning 1,400 acres, Micron’s new megafab will create nearly 50,000 jobs, which includes 9,000 high-paying company jobs, further positioning New York State as a national leader in reshoring and working towards the goal of “future-proofing” the semiconductor industry

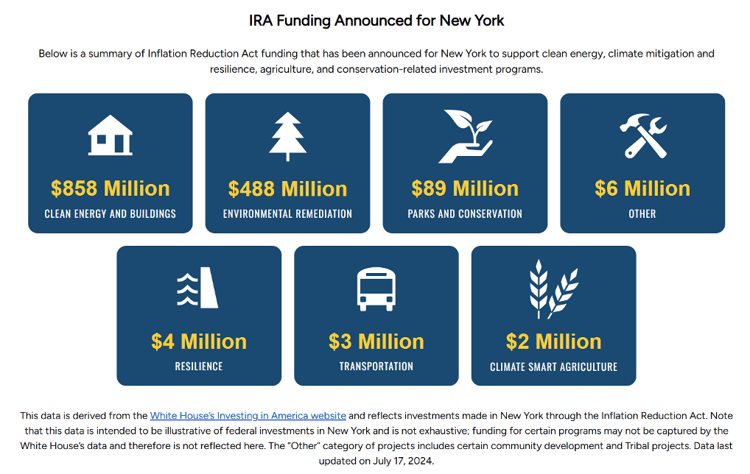

- The Inflation Reduction Act directly supported spending in New York State:

- Company spotlight: CRH

- CRH is the leading asphalt supplier in New York State benefiting from IIJA funding for new roads and highways

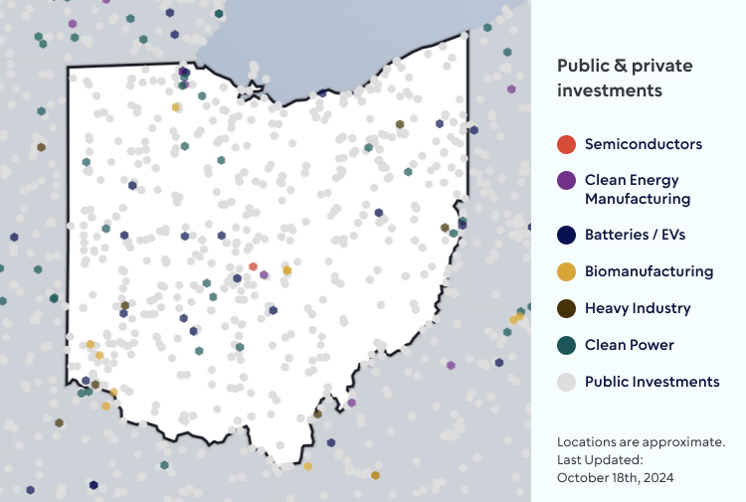

Ohio

Total private sector investments: $42.9bn

Total public sector investments: $13.8bn

Major Project Examples

| Project Name | Amount | Private / Public | Notes |

| Intel – New Albany | $28bn | Private / Public | The CHIPS Act supported two new fabs, making it one of the largest semi manufacturing sites in the world over the next decade. Includes education investment |

| Honga/LG - Jeffersonville | $4.4bn | Private | Electric vehicle plant |

| Brent-Spence bridge | $1.6bn | Public | Upgrading bridge that connects Covington Kentucky and Cincinnati, Ohio. The current bridge is the second worst truck bottleneck in the nation and carriers $400bn of freight per year |

- Proximity to suppliers and customers is just one of the benefits of reshoring; and Ohio is ideal for reaching both. Within a one-day drive, companies have access to 60% of the U.S. and Canadian populations. Ohio also offers road, rail, ports, and air infrastructure as well as foreign trade zones, all to make moving goods, products, and materials easier for companies

- Ohio is built on a legacy of manufacturing and has the labor pool and expertise to staff facilities in every part of the supply chain. Additionally, Ohio has the third largest manufacturing workforce in the United States. Ohio’s affordable cost of living is another advantage. Companies looking to reshore while still realizing cost savings on labor benefit from manufacturing wages roughly 9% lower than the U.S. average

- Ohio is productive, too, ranked second in the nation in raw steel production in every year of the last decade. Ohio is also the top employer for the plastic and rubber manufacturing industry, representing the largest plastic and rubber talent pool in the US

- Company spotlight: Applied Industrial Technologies

- Applied Industrial Technologies is headquartered in Cleveland, Ohio

- AIT has broad exposure to reshoring across the US as the leading supplier of motion and control equipment across multiple manufacturing verticals

- This is the largest holding in RSHO

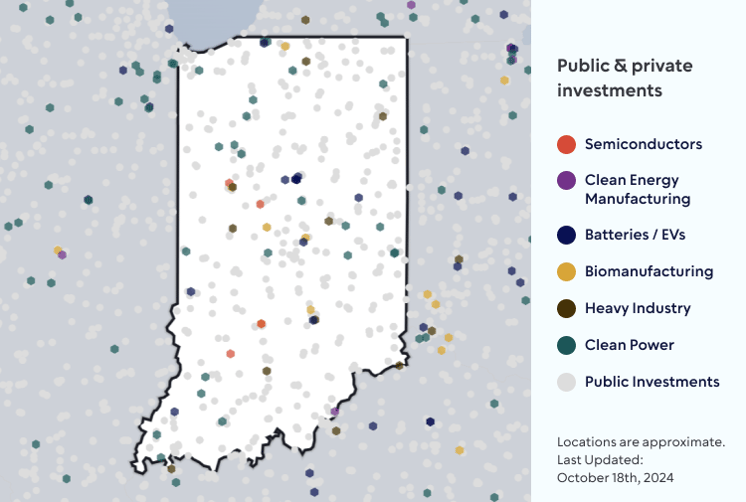

Indiana

Total private sector investments: $32.5bn

Total public sector investments: $8.3bn

Major Project Examples

| Project Name | Amount | Private / Public | Notes |

| Eli Lilly – Boone county | $9bn | Private | Target is to create 1,300 new jobs |

| SkyWater | $1.8bn | Private / Public | Semiconductor R&D and manufacturing facility |

| Transport infrastructure | $3.7bn | Public | Including Fort Wayne International Airport and the Grand Calumet river restoration |

- Indiana is a also a key focus of reshoring, especially around biopharmaceuticals, led by Eli Lilly. The firm is investing $10bn into the state via a massive expansion in Boone County and further $1.2bn investment into its existing manufacturing plant in Indianapolis

- Indiana has been designated the Heartland Bioworks Tech Hub. The aim of this hub, led by the Applied Research Institute, is strengthening national biotechnology supply chains. This is a key theme for the next stage of reshoring

- Indiana is also seeing sizeable investment in semiconductors with SkyWater and SK Hynix investing a total of $5.1bn across R&D and manufacturing within the State.

- NiSource is one of the largest Indiana utilities and will be investing heavily as the state has recently become a focus area for data center investment. According to NiSource Chief Financial Officer, Shawn Anderson,

- "We expect our system to see substantial load growth over the next five years due to data centers and reshoring of manufacturing. Northern Indiana offers constructive fundamentals for data center development through robust electric transmission, overall energy system capacity, plentiful land, limited physical disaster risk, tax incentives, and a pro-business policy environment.”

- "We are receiving robust inquiries from potential customers looking to invest in our northern Indiana electric service territory due to the attractive business climate we know and appreciate in Indiana. We are focused on developing accretive projects across all utility companies to support our stakeholders, and we intend to move projects from the upside category into our base capital plan as they meet our threshold of stakeholder alignment and execution visibility, just as we've done this quarter."

Back

Back