Major economic undercurrents, like the development of electric power or the microprocessor, evolve as powerful trends playing out over several decades. Reshoring is one such trend. This blog explores what reshorinng is, what it means for US firms, and how investing in reshoring is increasingly popular.

Key Takeaways

- Reshoring is a multi-year trend, defined as firms bringing manufacturing back to US shores.

- The underlying structural drivers include supply chain insecurity, geopolitical instability, and deglobalization.

- Reshoring firms have the potential to gain many advantages in terms of reduced order cycles, lower inventories, more reliable supply chains, and lower overall costs of production.

- Investing in reshoring isn’t about investing in the broad industrials sector and requires careful analysis of the trend’s beneficiaries.

- The reshoring trend is accelerating evidenced by data such as job announcements, company conference call mentions and factory construction spending.

- This trend is benefiting from unprecedented government support, most evident in several large legislative bills amounting to $1.85 Tn of total spending1.

- RSHO ETF aims to select reshoring manufacturers, facilitators, and beneficiaries.

For a list of current fund holdings, please visit the fund web page at www.temaetfs.com/rsho. All investments involve risks, including possible loss of principal. For a more complete discussion of the potential investment risks to the topics discussed below see the disclosure section at the end of the document.

What is reshoring?

Reshoring is the process of firms bringing production back to US shores. This multi-year megatrend is unfolding with far- and wide-reaching implications.

Offshoring

Starting in the 1960s, American industrial firms began to move production overseas. Their chief motivation was lower costs of production, primarily labor. This era of globalization and trade liberalization was spurred by two major events - the creation of the World Trade Organization (WTO) in 1995 and the accession of China in 2001. China benefitted more than any other country from offshoring, as the world’s supply chains took advantage of their rapid industrialization and abundant low-cost labor.

What is the difference between reshoring and nearshoring?

The world today is changing, as firms face a barrage of supply chain issues. The question for executives is where to build or move productive capacity?

They could take production to another country that is closer – termed “nearshoring”. This closeness can be defined as either geographical or political (sometimes referred to as “friendshoring”). An example of the former would be moving production to Mexico, which has geographical proximity to the US and is also part of the North American Free Trade Association (NAFTA2). An example of the latter would be moving production to India, a country perceived as politically and economically closer.

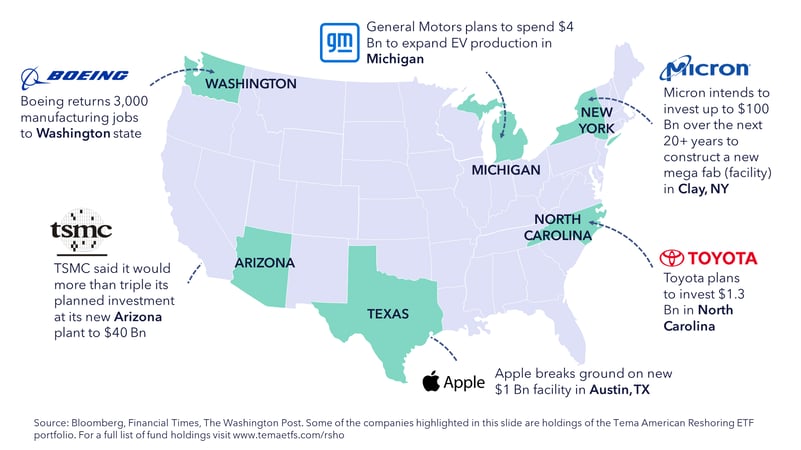

Alternatively, they can bring production back to their home country – defined as “reshoring”. There are many examples of this already happening in the United States from Boeing to Micron.

Why are companies reshoring?

Relations between nations are always in flux. We are potentially entering into a new era of de-globalization, which is forcing companies to adapt.

Reshoring is driven by supply chain disruption

One key driving force is the disruption of established supply chains. This is the result of several major economic processes:

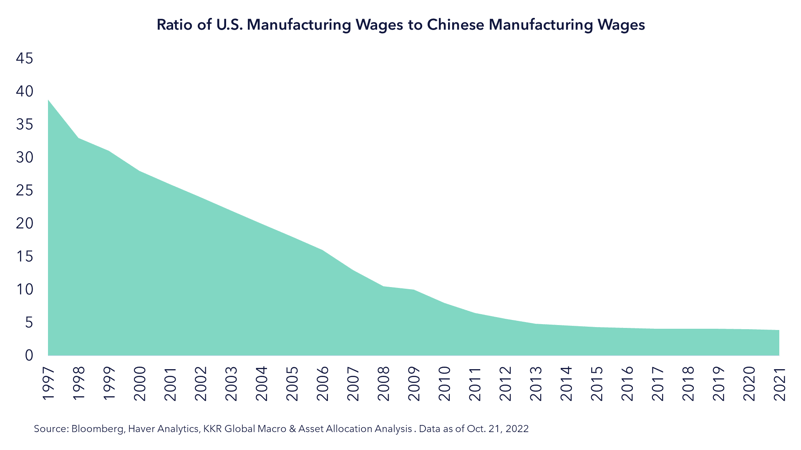

- Labor cost arbitrage has narrowed. China has lost wage competitiveness against the US in a dramatic way. In the late 1990s Chinese average wages were nearly 40x cheaper than those in the US. Thirty years later, driven largely by policy (Chinese domestic minimum wages were required to rise 13% p.a.) that figure is now closer to only 4x3.

- Supply chains have become insecure due to increasing geopolitical tensions, such as the war in Ukraine. Cost calculations are being augmented with considerations of risks to supply.

- Trade wars have proliferated. The mainstream view has held that the Biden administration would be good for trade, and that Trump’s tariff fights were an aberration. Yet this has not been the case, evidenced by recent legislation. In fact, it could be argued the US took a protectionist turn as far back as 15 years.

“If this analysis is correct, it should be clear that the American protectionist turn has been taken for a long time and will last long, as one doesn’t see the main forces that provoked it changing direction, starting with the desire to push China back.”

Pascal Lamy, ex World Trade Organization director general, March 2023

Which manufacturers are reshoring?

According to the Kearny Reshoring Index4, 92% of executives surveyed consider reshoring a part of their strategy5. Announcements abound as exemplified in the map below.

Interestingly, most recent reshoring activity has included products now deemed “essential” by the US government and include electric vehicle batteries, semiconductors, pharmaceuticals, and rare earth metals.

What are the advantages of reshoring on the US economy?

Reshoring firms gain several advantages:

- Reduced order cycles, resulting from the elimination of the 6–8-week container ship journey, are making companies more responsive to end demand. Lego A/S for example is building its first US plant in Richmond, VA, precisely for this reason.

“This allows us to rapidly respond to changing customer demand and helps manage our carbon footprint”

COO Carsten Rasmussen, WSJ

- Lower inventories can lead to better cash flow conversion.

- More reliable supply chains bring crucial component and ingredient production back home, reshoring entire supply loops. For example, the war in Ukraine pushed Allegheny Technologies, one of the largest American titanium manufacturers, to move its manufacturing capacity from Poland back to California. This not only alleviated a supply chain bottleneck but led Allegheny to subsequently win significant US aerospace market share.

- Lower total cost – when accounting for all factors, the cost of producing domestically becomes more attractive.

- Subsidies both at the federal and state level are being used as incentives for reshoring firms, which directly benefits the bottom line.

- Intellectual property protection – a key risk with offshoring is no longer present.

Together, we believe these improvements should bring durable competitive advantages to firms and potentially lead to sustainably higher growth outlooks.

Large pools of end demand are also driving this reorientation. Walmart has announced $350 bn of investment to support suppliers in making “made in America” goods to put on its shelves6. Companies are responding, from bicycle maker Kent International to nutritional supplement company Vireo Systems7. Walmart estimates that their investment will create 750,000 jobs and save 100m tons of CO2 emissions8.

Reshoring is also addressing a legacy infrastructure deficit. For 19 straight years, the US has been awarded a D grade for its infrastructure by its own American Society of Civil Engineers (ASCE)9. The US lags best-in-class countries in terms of percentage of GDP spent on infrastructure – a gap that today amounts to 0.7% of its GDP.

Signs of an impact are already evident. US manufacturing job growth in 2022 was at its highest level since 198410. Although it isn’t all about jobs. Reshoring firms, when building new production capacity, are focused on automation, which is a key sub-theme. Automation, though it means less jobs, drives labor productivity, which contributes to economic growth.

“You’ve gone from a situation where if you did a power tool assembly in China or Mexico, you might have 50 to 75 people on a line … the automated solution that we’ve created in North Carolina, current version, has about 10 to 12 people on that line because of the high level of automation, and the 2.0 version looks like it’s going to get down to two to three people on the line”

Donald Allan Jr, CEO of Stanley Black and Decker, Investor Event quoted in WSJ

Exploring investment opportunities in reshoring

Reshoring is primarily benefiting the industrial sector, which currently represents just 8% of the S&P 50011, down from 14% in the 1990s12. However, to get precise exposure to reshoring requires a more targeted approach . Why? First, expert analysis is needed to dissect the landscape of firms and identify true reshoring companies. Second, it is not just industrials that stand to benefit, so creative analysis is required to uncover “under the radar” companies in other sectors.

Is there an American Reshoring ETF?

The Tema American Reshoring (RSHO) is the first ETF solely focused on the relocation of manufacturing and supply chains back to the United States. RSHO seeks to provide long-term growth through investment in the enablers and beneficiaries of this ongoing American industrial renaissance.

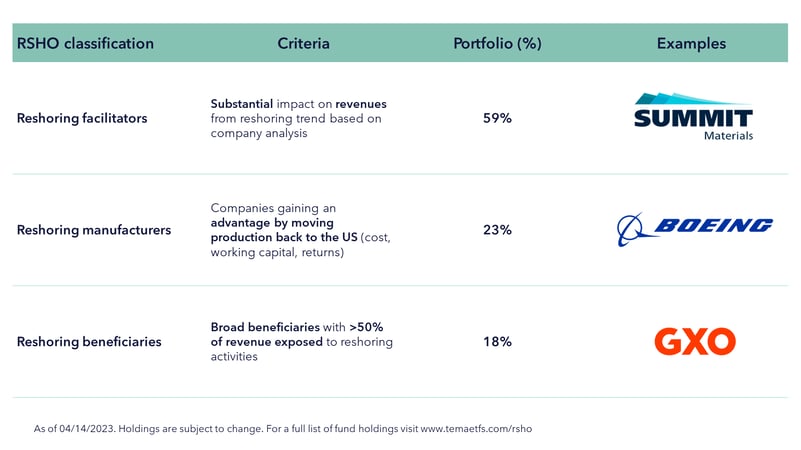

RSHO focus is to identify three categories of reshoring firms. The first is manufacturers that are reshoring their own operations and gaining the advantages described above. The second is facilitators, that provide products and services to facilitate reshoring, for example automation, inspection, and construction. The final category are beneficiaries who broadly benefit from reshoring happening, for example logistics firms.

Why should I consider investing in American Reshoring ETF in the current environment?

The reshoring trend is accelerating

The renaissance of American manufacturing is accelerating. Companies are making record job announcements related to reshoring and inward investment. Last year alone 364,000 such job announcements were made according to the Reshoring Initiative13.

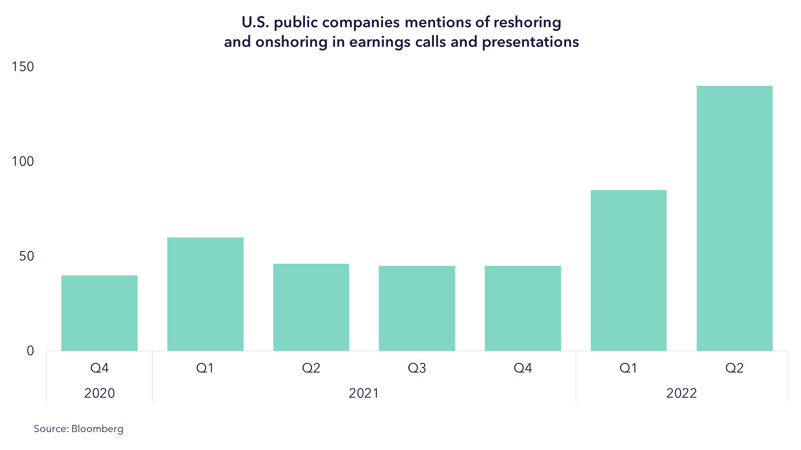

Companies are mentioning “reshoring” on their earnings calls at a record rate. Citing both how they plan to move production but also the impact it is having on revenue streams.

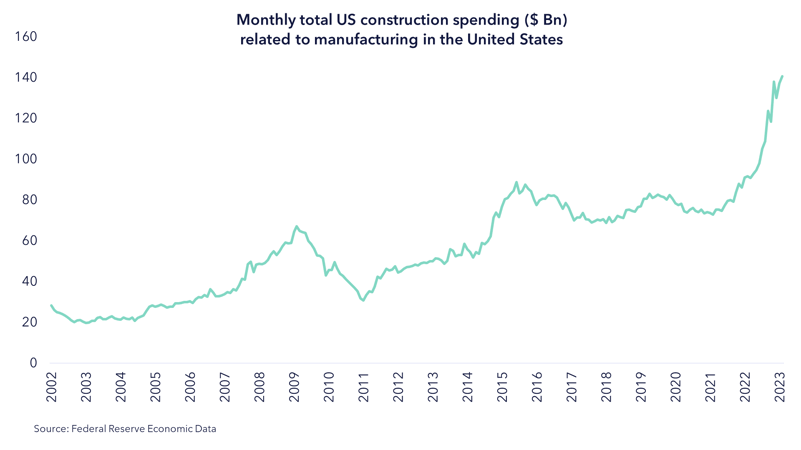

Construction spending related to manufacturing, i.e. new factories, has also taken a step up, amounting to $108 Bn last year.

What does the Infrastructure Bill and Chips Act mean for manufacturing?

Whereas the confluence of factors described above is driving the trend, it is being supported by America’s most significant industrial government policy for decades.

In total, $1.85 Tn of funding has been allocated across three major bills:

- The Chips and Science Act ($280 Bn) with $39 Bn in direct subsidies for chip manufacturing on US soil, and 25% investment tax credits for costs of manufacturing equipment. There have been 200 statements of interest received14 related to this bill, which has led to large investment plans including chip plants from Micron ($40 Bn) and new factories from Honda/LG ($4.4 Bn).

- Inflation Reduction Act ($369 Bn) which, among other things, is likely to have an outsized impact on electrical vehicles and batteries, both of which were previously heavily offshored. The act offers $11,500 of total tax credits per vehicle, representing nearly 30% of total manufacturing costs.

- Infrastructure Investment and Jobs Act ($1,200 Bn) is building the backbone of the transportation infrastructure needed to connect future and planned factories.

What are the risks of investing in reshoring?

There are several risks for investors to consider:

- Cyclical risk - The reshoring transformation is happening primarily in the industrial sector, which has a history of cyclical revenues and margins.

- Political risk - American reshoring isn’t going unnoticed around the world as rival manufacturing nations respond. The EU for example has also introduced a European Chips Act, aimed at bolstering their domestic supply of semiconductors. These tit-for-tat trade wars can often have a negative impact on reshoring firms.

Bottom Line

Reshoring is a multi-year trend. Its drivers are intensifying, supported by government initiatives. Evidence suggests a potential industrial revival in the United States is in the cards.

Back

Back