As we enter an election year in 2024, the trend that we are hearing most from firms is how reshoring is increasingly being made as an independent corporate decision. Companies are finding, when they weigh the cost and benefits, bringing manufacturing closer to home makes sense independent of any bipartisan supported government initiatives.

Why companies make a reshoring decision?

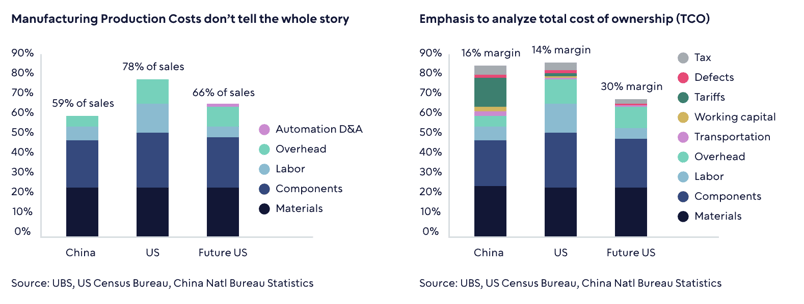

To understand the motivation behind a boardroom decision to reshore it is important to appreciate, as this

UBS analysis shows, that companies take a wholistic approach to costs known as total cost of ownership

Risks mitigation increasingly dominates cost decisions.

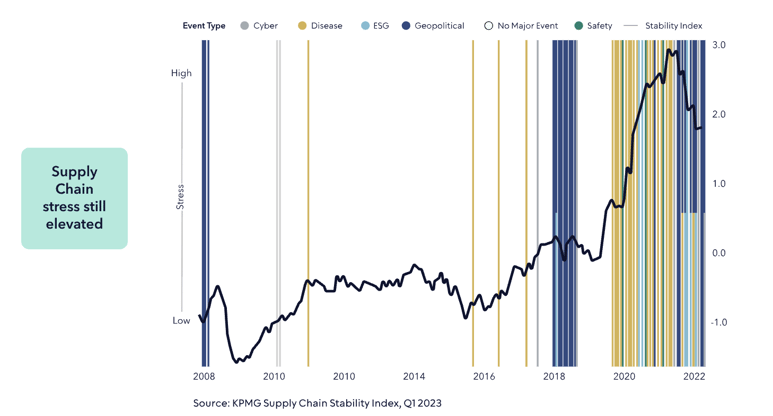

The water level in the Panama Canal has been at critical levels since this summer. This is forcing authorities there to restrict number of daily ship transits by nearly a quarter1. Such a delay could add a week to ten days to transit times, causing huge headaches for supply chain executives across the US. This canal handles 40% of all US container traffic1. The cause of the drought is the worst El Nino weather phenomenon recorded, which has meant 26% less accumulated rainfall than the average over 73 years2. Conditions are so bad restrictions are likely to stay in place until February.

The troubles in the canal are just one of the many global risks that firms are having to navigate. As KPMG estimates, despite falling from their pandemic related peak, supply chain stress remains highly elevated and recent geopolitical issues are not improving the situation.

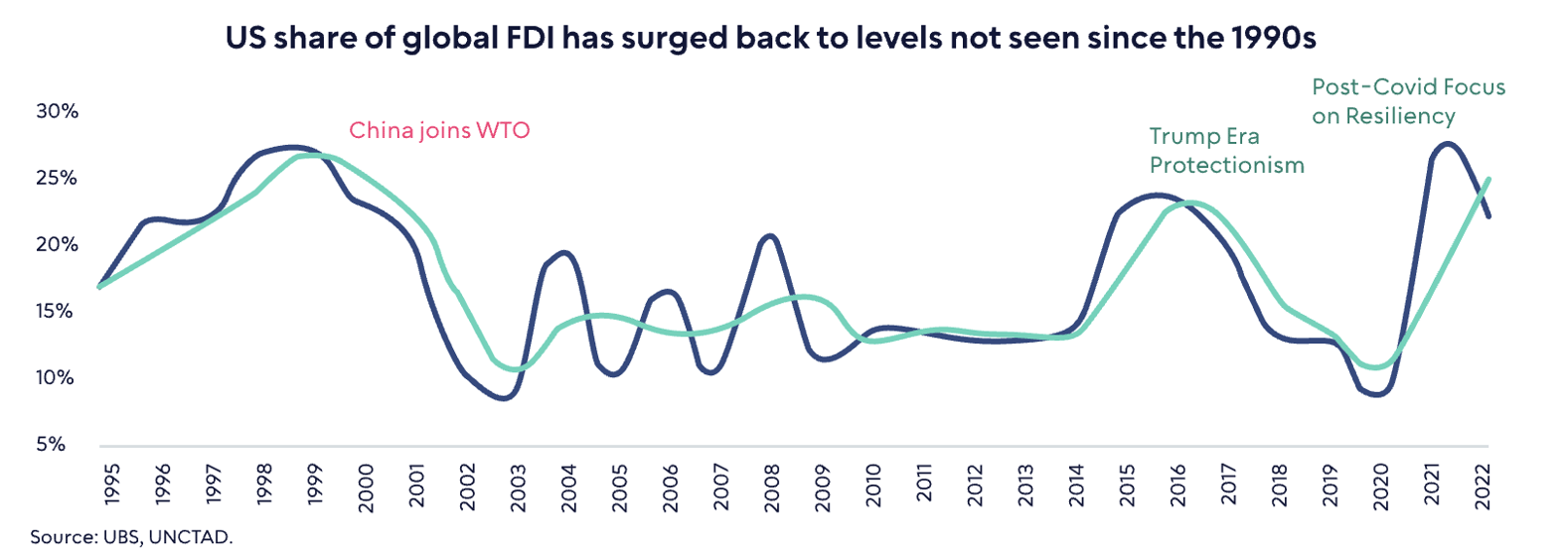

To manage these risks, and independent of subsidies and government support, good managers are starting to build resilience in their businesses which is often in direct contradiction to low-cost sourcing and involves reshoring new manufacturing capacity closer to the US home market. A powerful trend can only be sustained by private sector buy-in.

Over the last two years, the US has attracted 24% of the global foreign direct investment (FDI), an 800bps spike vs. the prior decade levels1. Capital is being attracted at a rate not seen since the 1990s, prior to China joining WTO. While undoubtably this $100bn of FDI is being accelerated by government policy, as it did during the Trump era protectionism, the magnitude and nature of what we are hearing on the ground suggests a substantial private sector groundswell.

Back

Back