The global luxury market is home to iconic brands and outstanding businesses. This blog explores why the luxury sector stands out by the nature of its products and services, how those qualities translate into company fundamentals and how to invest in this theme most effectively.

Key Takeaways

- Luxury is defined by quality, craftmanship, and desirability, creating the world’s most iconic brands that travel across geographies and product categories.

- Luxury consumption is aspirational, going beyond functionality to desirability.

- As a result, luxury companies command pricing power well above other consumer goods, derived from their heritage and limited exclusive supply.

- Their fundamentals – return on equity and organic growth – rival those of technology stocks.

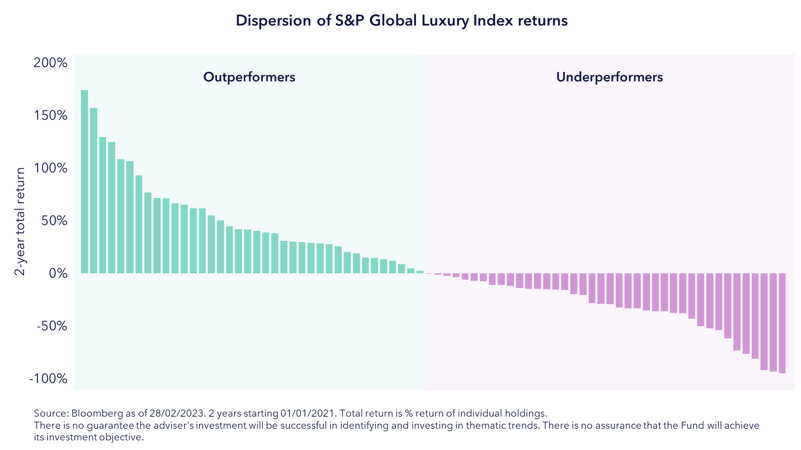

- Investing in luxury is not effectively achieved through an index as they include substantial exposure to mass-market consumer stocks and are undermined by the dispersion of returns seen in this sector.

- As the luxury customer base broadens across geographies and income levels, the industry is building greater resilience and reducing cyclicality.

- Investing in the luxury sector is possible through the Tema Luxury ETF (LUX), which is the first pure luxury ETF available in the US.

For a list of current fund holdings, please visit the fund web page at www.temaetfs.com/lux. All investments involve risks, including possible loss of principal. For a more complete discussion of the potential investment risks to the topics discussed below see the the disclosure section at the end of the document.

What are luxury goods?

Five characteristics that define luxury goods

Luxury is defined by quality, craftmanship, heritage, timelessness, and desirability. Together these traits coalesce into the world’s most powerful and iconic brands – like Louise Vuitton, Ferrari, Channel, and Hermes.

Hermes was founded in 1837 to make high-quality wrought harnesses and bridles for the horse drawn carriages of European noblemen. They were world famous for their leather craftsmanship and quality, purchased by kings and queens. Today the brand spans across a range of products from silk scarves to leather goods and homeware.

No product is more exclusive than the invitation-only Birkin bag, designed for the actress Jane Birkin, who in a chance encounter with then executive chairman Jean-Louis Dumas complained about a lack of aesthetic yet practical bags1. These bags are still hand-made in France by artisans and waitlists stretch out over a year.

Luxury travels across geographies and product categories

Luxury travels. It travels across geographies, with luxury being one of the few segments with universal brands that are truly global. This is evidenced by Asia’s rise over the last two decades as the world’s second largest luxury consumption market.

Luxury travels across product categories. Gucci now has homeware offerings, Valentino cosmetics. Brands are exploring the food and beverage space. Vera Wang now makes prosecco, Ralph Lauren has a bar in Chengdu, where you will also find Louis Vuitton’s restaurant.

Luxury goods market overview

Today, global luxury products and services span a diverse set of offerings from fashion and accessories to jewelry, automobiles, experiences, and wellness. This is a large market with retail sales of €1.4 Tn in 2022, and consumer population set to hit 500 M by 20302.

The universe incorporates many large companies including conglomerate LVMH, the first company in Europe to cross $500 Bn3 in market cap. This achievement propelled its founder Bernard Arnault to overtake Elon Musk and Jeff Bezos as the wealthiest man on earth4. Arnault embodies the sector. So much so that, unlike his billionaire peers, he won’t consider splitting the shares of his conglomerate. At an April shareholder meeting, he stated: “LVMH shares are also a luxury product”.

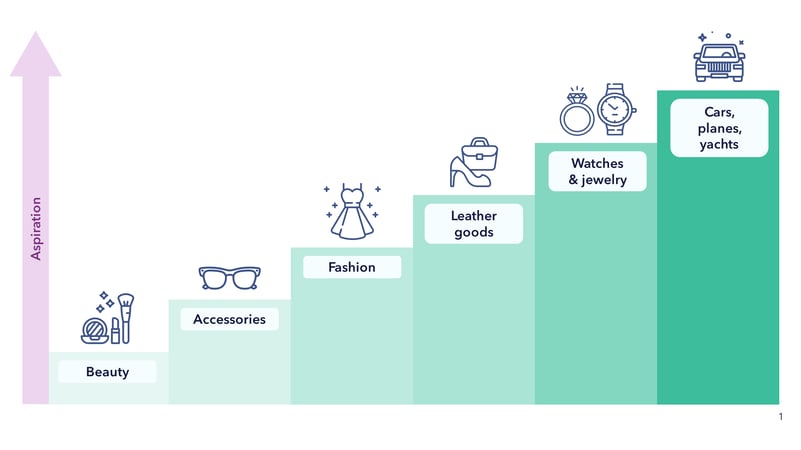

Luxury goods are aspirational

The aspirational nature of luxury goes beyond functionality and into desirability. Customers making an initial entry level purchase are enticed up the product ladder. Luxury brands curate and innovate along this ladder to tempt customers into larger and more premium product ranges, to satisfy their aspirational desires.

“What I like the most is the idea of transforming creativity into profitability.”

Bernard Arnault, Founder and CEO, LVMH

Why should I consider investing in luxury stocks

The inherent qualities of luxury products and services lead to attractive business fundamentals for investors in these stocks.

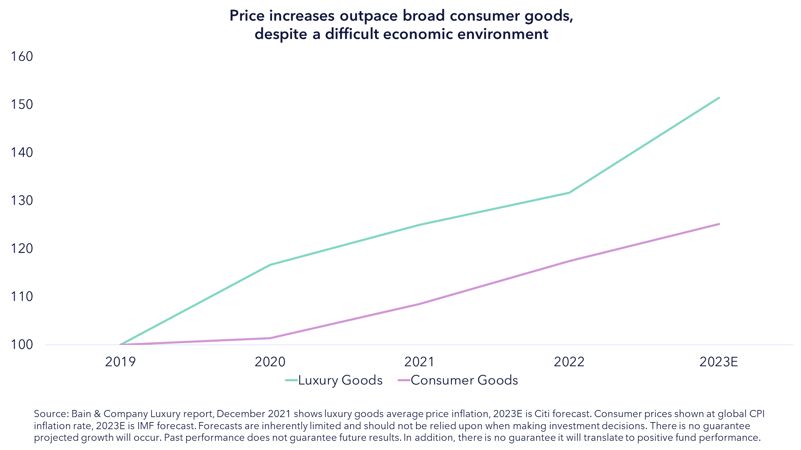

Luxury has strong pricing power

Luxury has high barriers to entry and as a result can be characterized as exhibiting superior pricing power.

“So, we don't know whether this will be a trend or not in the coming quarters, but in any event, we are ready to offer clients products that will suit their needs.”

LVMH CEO (Q1 2023 Sales Call)

This superior pricing power arises from several factors:

- Heritage - Customers appreciate the safety and prestige of heritage. Louis Vuitton, Chanel, Gucci are all brands that are over 100 years old.

- Broad offerings - Fashion is often prone to the vagaries of changing trends, but today’s luxury conglomerates are so broad they cater to every taste and can price discriminate effectively.

- Limited exclusive supply - Ferrari sells 10,000 cars per year5, often requiring ownership of all previous models to even get on a waiting list for the newest cars. In comparison, VW group (Volkswagen) sold 8.4 million vehicles last year6. Exclusive supply means consumers accept high and rising prices. In contrast, Tesla’s recent price cuts mean their Model Y is now priced below the average US car7.

- Investment-like - Luxury items themselves are increasingly seen by their customers as investments holding their value or even rising in value. This has been the case for several segments such as fine wine, watches, art, jewelry, classic cars, and rare whiskies8.

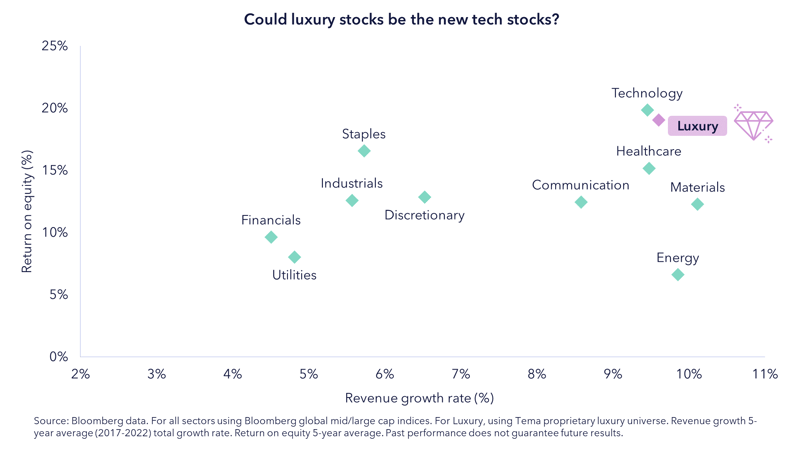

Are luxury stocks the new tech stocks?

Pricing power has the potential to translate to high organic revenue growth, expanding margins and strong earnings growth.

In fact, luxury9 looks a lot like technology stocks on financial fundamentals. The below chart plots all the major industry sectors by five-year average revenue growth (x-axis) and five-year average return on equity (ROE10) (y-axis).

Exploring investment opportunities in luxury stocks?

Why indices could be a suboptimal way to invest in luxury

In our opinion, an index approach has two major drawbacks that can hinder an optimal outcome:

- Indices lack pure luxury exposure by construction. They conflate mass-market consumer exposure with quality luxury exposure – with almost a 25% weighting in non-luxury consumer names such as Nike, Diageo and Tesla11.

- High performance dispersion exists between outperforming and underperforming companies. The chart below shows the 2-year return of the constituents of the S&P Global Luxury Index12. For example, among single-brand companies, Bruno Cucinelli (+93%) significantly outperformed Tod’s (+9%) and Ferragamo (+0%) over this period.

Is there a Luxury ETF?

Tema Luxury ETF is the first of its kind as an professionally managed ETF. It looks to avoid the potential drawbacks of indexes in two ways. The fund seeks to invest only in pure luxury stocks, deemed as such by our experienced consumer research team. The fund also aims to select, via a disciplined investment process, the best-in-class stocks uncovering long term winners (left side of the above chart) and seeking to avoid underperformers.

Why should I consider investing in LUX ETF in the current environment?

Investors might look at luxury stocks today through two skeptical lenses – recession risk and rising share prices.

Are luxury stocks recession proof?

Economic cycles affect consumer incomes and confidence and can lead to slowdowns or outright contractions in consumption. The luxury industry, in part due to expanding globally, has historically displayed increasing resilience with minimal cyclicality . This is largely due to a series of underpinning growth drivers.

- Affluent consumers, the ranks of which have doubled in the past decade,13 have consumption patterns more linked to financial net worth than income (the latter is typically more volatile).

- Aspirational inelastic demand has meant that the customer base has broadened across income levels, creating new sources of demand. This cohort of customers is far larger and brands increasingly tailor "accessible level" products to them in the <$3,000 price range.

- Geographic proliferation of luxury goods has reduced dependency on the economic growth in the US or Europe, by also growing into Asia and the Middle East. The US itself is home to 40% of the world’s high net worth individuals, yet only represents 20% of global luxury goods sales – a clear opportunity. The Indian luxury market could expand 3.5x its size by 203014, and other markets such as South Korea and southeast Asian countries are showing significant potential as long-term runways of growth.

- Regional growth asynchrony means that by virtue of being global, one region might pick up another’s fading growth, creating the potential to drive revenues higher. The current 2022-23 period is a case in point. Most companies are signaling that US growth is slowing, but China’s is accelerating through reopening. There are few sectors in the world that are exposed to this type of asynchrony.

- The current inflationary environment allows the pricing power described above to be even more prominent. Luxury goods stand out not only in the ability to price up but, given supply constraints, to benefit from inelastic volumes. For example, 2022 witnessed significant price increases without impacting near-term volume growth.

“The ceiling [on price] is: as long as there is quality and experience,

people are open to it”

Roberto Costa, Head of Luxury Banking at Citi, Quoted in FT

The sector’s historic track record during recession speaks for itself. The 2009 recession saw only a modest decline in luxury sales and rebound was quick from the covid-recession in 2020 and 2022. Despite a background of decelerating economies around the globe, the sector posted an impressive 22% growth15 in 2022.

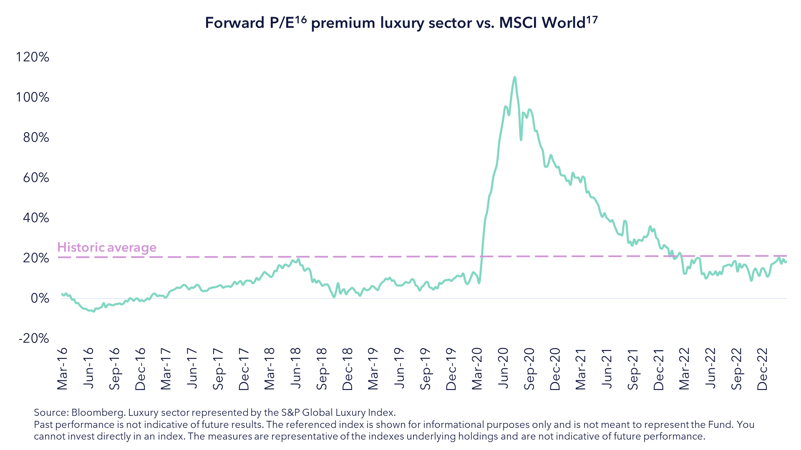

Are luxury stocks good value now?

The recent rise in luxury share prices can in large be explained by earning upgrades from strong performances in China. Valuation multiples haven’t moved much and sit near their historic premium to the market. This is despite rising evidence of the quality of these businesses.

What are the risks of investing in luxury now?

There are several risks worth considering:

- Slowing US Consumer - Several of the large luxury companies noted a deceleration in the US during the most recent set of results, particularly LVMH in their more cyclical cognac category.

- Taiwan - China is a very important end market for luxury goods. If something should happen in Taiwan, there would be a big knock on effect to demand.

- Trade protectionism - Luxury has undoubtedly benefited from a more open world and the proliferation of travel. Should this reverse, demand for luxury goods could suffer.

Bottom line

Luxury companies in many ways look like tech stocks – boasting attractive revenue growth rates and returns on equity. Yet, unlike tech stocks, they trade at much more reasonable valuation multiples. Luxury’s broadening growth drivers are reducing the sector’s cyclicality. These factors may not be fully appreciated by the market.

Back

Back