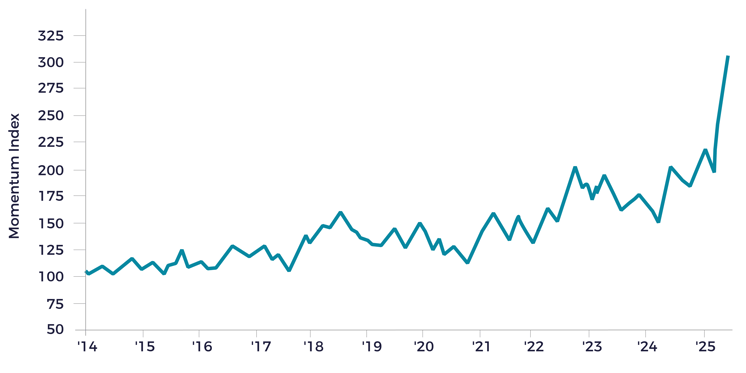

Reshoring continues to take place, as non-residential construction has seen strong forward momentum over the summer. This is best captured by the Dodge Momentum Index (DMI) which tracks the initial reports of non-residential projects in planning every month.

The latest reading in August showed the index up +7.5% from July. Year to date the index is up 30% from the same period in 2024 with 51 projects entering planning in August.

“After months of wait-and-see due to tariff uncertainty, owners and developers have begun to move forward with projects and assumed higher costs for them.“

Sarah Martin, Associate Director of Forecasting at Dodge Construction Network

This panning activity is not just data centers. Even if data centers are removed entirely, commercial planning, a subset of the overall index, would still be up 38% from year ago levels.

Dodge Momentum Index

(2000=100, seasonally adjusted)

Source: Dodge Construction News as of September 8, 2025. Past performance is not an indicator of future performance.

We believe non-residential construction is a key variable to track the progress of the US manufacturing and infrastructure renaissance. As firms move manufacturing back, new facilities need to be built and planning is the first step. Rising construction potentially directly benefits the following firms:

- Herc Holdings rents equipment used for construction benefiting from increased utilization of their fleet.

- Vulcan Materials mines aggregates. Aggregates are a material used in construction – often mixed with cement to make concrete.

- Caterpillar produces heavy construction machinery such as dozers and excavators.

Disclosures

Some of the companies highlighted are holdings of the Tema American Reshoring ETF portfolio. Please see the fund page for complete holdings information. Holdings are subject to change.

The Dodge Momentum Index (DMI) is a monthly measure that tracks the initial report of nonresidential building projects entering the planning stages. It serves as a leading indicator for construction spending, typically forecasting actual construction activity by a year to 18 months. The index is based on a three-month moving average of projects, providing insights into future construction trends.

Back

Back