Weight-loss drugs have seen tremendous growth since the approval in mid-2021 of Wegovy (the brand name of semaglutide, also found in Ozempic, and approved for obesity). Their potential is unfolding as evidence comes in showing benefits in the important diseases associated with obesity such as cardiovascular, kidney and liver disease. There are 220 such co-morbidities. Coming hot behind the GLP-1 drugs is a diverse pipeline across numerous companies to solve issues of supply, safety/tolerability, muscle loss and improve efficacy.

We believe that Investors interested in gaining exposure to this theme need to tread carefully. In our view, it requires expertise, experience and careful risk management to navigate – found only with an actively managed fund run by a veteran life science team. Here is why.

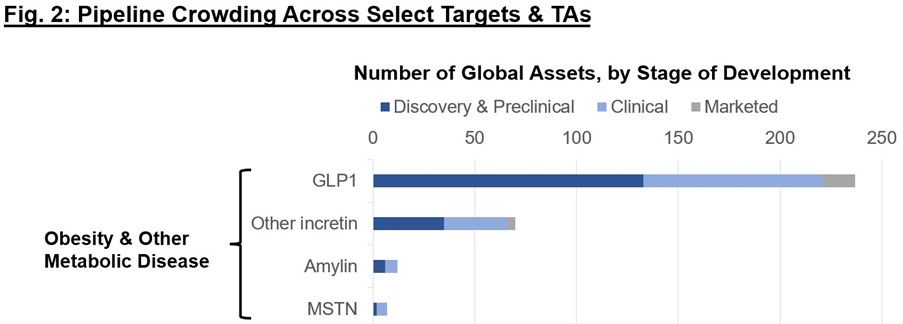

1. A proliferation of innovationBy some estimates there are nearly 400 different assets focused on the obesity and metabolic space. Pair this with the fact that only 15% of metabolic assets make it from Phase I to approval, and much smaller if you start at pre-clinical stage. Which one will be the next disruptive innovator requires fundamental research to identify and understand the risks and rewards involved.

Source: Atlas Ventures

2. Overvaluation risk in the powerful obesity trendThe market is prone to bouts of exuberance, especially when investors become obsessed with a powerful theme. Think back to the dotcom bubble or the tech stock craze during Covid-19. There is a risk this happens in the obesity space as well and calls for careful appreciation of valuation and expectations. Valuation is one of Tema’s four key pillars when evaluating a stock investment, helped along by an investment team that has seen many market cycles. These aspects are totally ignored by passive funds, where investors are left on their own.

3. Clinical trials are binary eventsClinical trials are complex with a vast number of variables. Their outcomes are binary resulting in the case of some companies either a total wipe out or a big success. Evaluating them requires assessing the myriad of variables and risks that all need careful consideration. We believe It is also important to spread bets wisely in positive risk reward situations, as opposed to concentrating them.

4. Return dispersion is highLife science inherently gives rise to a few winners and a lot of losers, a profile that is difficult to index.

To really “play” this theme requires a broadening of horizons to the entire cardiometabolic space and how it interplays with obesity. There are complementary areas, like continuous glucose monitoring, that are undergoing powerfully inflecting product cycles. These areas rarely find their way into a passive approach as the initial reaction from the market was to see them as losers from the rise of GLP-1 medications.

6. Evolving landscapeAs the obesity trend evolves so too does the landscape. The success of GLP-1s has led to supply constraints, pricing pressures, access issues with payers and governments. We have also seen successful read outs of huge outcomes trials – like SELECT that recruited 17,000 patients and took five years1. All these elements change the environment that new entrants must navigate, meaning winning gets harder.

7. M&A and recycling of capitalThe obesity and cardiometabolic space is attracting immense interest from large pharma, who are realizing the full potential of this market. M&A is a powerful source of inorganic return. However, knowing which stocks are most likely to attract interest and sizing those investments accordingly requires an active approach. Equally once M&A happens recycling the resulting capital into new ideas is an important form of compounding returns.

Conclusion

Investing in unfolding mega trends can be rewarding, especially if they combine potential for financial return with backing the fight against the obesity epidemic. There are many pitfalls, listed above, that we believe necessitate an active approach.

Back

Back

.png)