By clicking below you acknowledge that you are navigating away from temaetfs.com and will be connected to temafunds. Tema Global Limited manages both domains. Please take note of Tema's privacy policy, terms of use, and disclosures that may vary between sites.

Back

Back

ROYA

Global Royalties ETF

Companies extracting royalty streams from music catalogues, pharmaceutical assets and natural resources

Why ROYA ETF?

Differentiated commodity exposure

Royalties can provide exposure to the revenue streams of a collection of assets related to commodities such as gold, oil and gas, and base metals

Capital light and scalable

Royalties provide scalable exposure to cash flow streams while mitigating operational and financial risks

Contractual real income

The contractual, inflation-sheltered cash flow stream of a royalty business allows it to pay out competitive and compelling real dividend income

Alternative asset class features

Royalties are typically structured products that provide exposure to unique private assets, like pharmaceutical patents and intellectual property, while minimizing dilution risk

Inflation hedge

Inflationary environments will typically benefit royalty companies as they earn cash flow directly from revenue lines, that benefit from rising prices

Fund Overview

Fund Details

As of May 03, 2024

Fund Summary

Portfolio Manager

Investment Partner

Chris Semenuk

How does the Tema ROYA ETF fit in a portfolio?

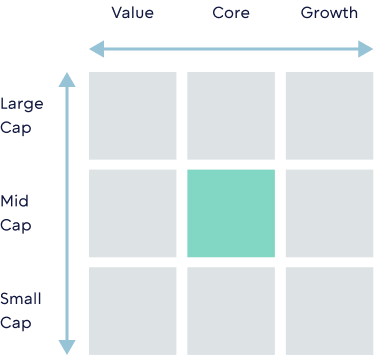

Investment Style Box

Source: Tema. The investment style Box reveal’s a fund’s investment strategy by showing its investment style and market capitalization based on the fund’s portfolio holdings.

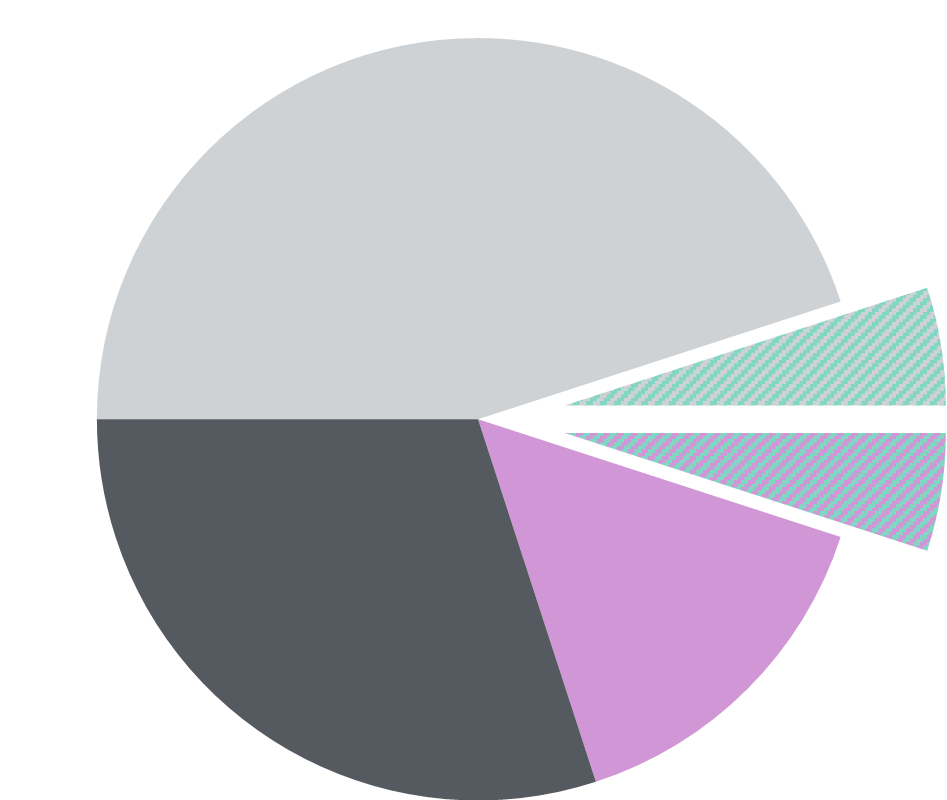

Potential Portfolio

Equity Allocation

5-10%

Equity, Commodities, & Alternatives

ROYA ETF - Equity

ROYA ETF - Alternatives

Equity

Fixed Income

Commodities & Alts

Where could a position be funded from?

- Could be funded from an existing broad market equity exposure.

- Could be funded from a commodities and alternatives exposure.

- May play an income provider role in a portfolio

Portfolio Breakdown

Top 10 holdings

As of May 03, 2024

Country Breakdown

United States

49.75%Canada

38.59%Netherlands

4.57%Australia

4.15%Others

2.94%Industry Breakdown

Non-Energy Materials

34.70%Finance

25.18%Technology

14.52%Consumer Services

14.51%Healthcare

10.28%Cash & Cash Equivalents

0.79%- Performance

- Distributions

- Premium / Discount

Prices & Performance

- Apr 30, 2024

- Mar 31, 2024

ROYA

3 months

1 Year

3 Years

5 Years

Since inception

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted. Returns for periods of less than one year are not annualized.

The market price returns are based on the official closing price of an ETF share or, if the official closing price isn’t available, the midpoint between the national best bid and national best offer (“NBBO”) as of the time the ETF calculates current NAV per share, and do not represent the returns you would receive if you traded shares at other times. NAVs are calculated using prices as of 4:00 PM Eastern Time. The first trading date is typically several days after the fund inception date. Therefore, NAV is used to calculate market returns prior to the first trade date because there is no bid/ask spread until the fund starts trading.

Distributions

Record Date

Ex-Date

Payable Date

Total Distribution

Income

ST Cap Gains

Premium/Discount

Days Traded at Nav

Days Traded at Premium

Days Traded at Discount

ROYA NAV / Market Price

Risk Information

Carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Fund’s prospectus or summary prospectus, which may be obtained by visiting www.temaetfs.com.

Read the prospectus carefully before investing.

Diversification does not ensure profits or prevent losses.

Investing involves risk including possible loss of principal. There is no guarantee the adviser’s investment strategy will be successful.

Royalty Trust Structure Risk: the success of the fund is heavily dependent on royalty investments including investments in Royalty Income Trusts (RITs). Cash flows from royalty income can be contingent on the production of energy commodities. As such, the level of income received can be volatile as commodity prices, production levels, and production costs all vary wildly. Another consideration is that some royalty investments own intellectual property. In those cases, the trust could be subject to changes in intellectual property laws, which can impact the value of the assets held by the trust. Royalty trusts generally do not guarantee minimum distributions or even return of capital. Finally, Royalty Income Investments are still subject to market risks, such as interest rate fluctuations, currency risks, and overall market volatility.

Industry Concentration Risk: because the Fund's assets will be concentrated in an industry or group of industries, the Fund is subject to loss due to adverse occurrences that may affect that industry or group of industries.

Sector Focus Risk: the Fund may invest a significant portion of its assets in one or more sectors and thus will be more susceptible to the risks affecting those sectors than funds that have more diversified holdings across a number of sectors. The Fund anticipates that it may be subject to some or all of the risks described below.

Investing in Foreign and emerging markets involves risks relating to political, economic, or regulatory conditions not associated with investments in U.S. securities and instruments. In addition, the fund is exposed to currency risk.

Because the Fund evaluates ESG factors to assess and exclude certain investments for non-financial reasons, the Fund may forego some market opportunities available to funds that do not use these ESG factors.

Tema Global Limited serves as the investment adviser to Tema Global Royalties ETF (the “Fund”), and NEOS Investments, LLC serves as a sub-adviser to the Fund. The Fund is distributed by Foreside Fund Services LLC, which is not affiliated with Tema Global Limited nor NEOS Investments, LLC. Check the background of Foreside on FINRA’s BrokerCheck.