By clicking below you acknowledge that you are navigating away from temaetfs.com and will be connected to temafunds. Tema Global Limited manages both domains. Please take note of Tema's privacy policy, terms of use, and disclosures that may vary between sites.

Get in Touch

Back

Back

MNTL

Neuroscience and Mental Health ETF

Investing in the future of cognitive health and science

Why MNTL ETF?

Unmet medical need

1 billion people worldwide suffer from CNS diseases. Many illnesses have limited disease modifying treatments and are a huge economic burden on healthcare systems.

Source: WHO

Innovation

An innovation wave is rising with the watershed launch of the first medicines for Alzheimer’s to breakthroughs in gene editing, non-opioid pain, and targeted treatments for depression.

Research expertise

The fund conducts deep and comprehensive research, in an effort to identify those companies that deliver breakthrough solutions at attractive valuations.

Growing Market

The outsized economic burden of these diseases means a large and fast-growing addressable market with high payer acceptance according to Tema’s research.

Uncorrelated

Performance of many companies relies on clinical or commercial success, which is an uncorrelated source of return.

Fund Overview

Fund Details

As of November 19, 2024

Fund Summary

The actively managed Tema Neuroscience and Mental Health ETF seeks to provide long-term growth of capital by investing in companies tackling diseases of the central nervous system and mental health. We have reached a watershed moment in innovation with the approval of the first disease modifying agent in Alzheimer’s with significant innovation following in neuropsychology and genetic neurological disorders. The complex combination of scientific, regulatory and financing risks requires investment and scientific expertise to navigate this secular theme.

Portfolio Manager

Investment Partner

David K. Song, MD, PhD, CFA

How does the Tema MNTL ETF fit in a portfolio?

Investment Style Box

Source: Tema. The investment style Box reveal’s a fund’s investment strategy by showing its investment style and market capitalization based on the fund’s portfolio holdings.

Potential Portfolio

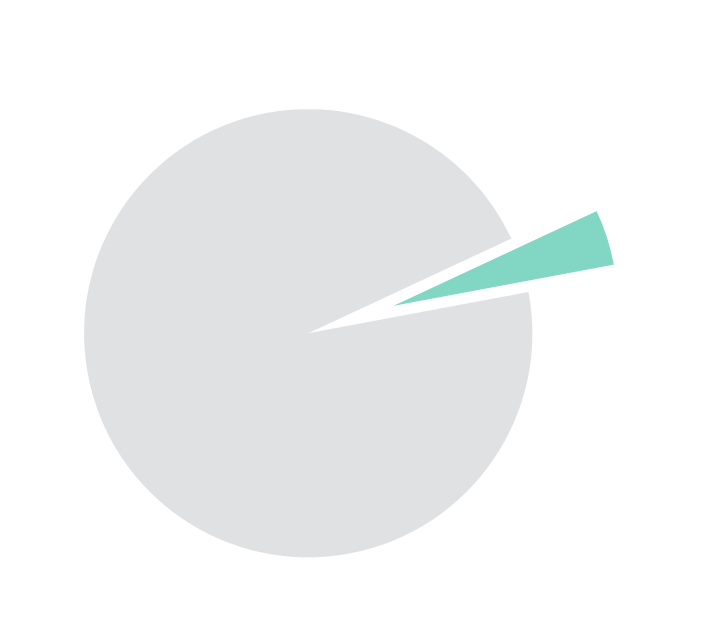

Equity Allocation

3-5%

Equity Satellite

MNTL ETF

Equity core

Where could a position be funded from?

- Could be a more targeted alternative to existing healthcare or biopharma exposure in a portfolio.

- Provides a balanced exposure across key technologies and company risk profiles.

- Could replace a satellite position or a growth-oriented alpha driver.

Portfolio Breakdown

Top 10 holdings

As of November 19, 2024

Country Breakdown

United States

73.66%Ireland

7.24%Netherlands

4.70%Israel

3.97%Others

10.43%Industry Breakdown

Healthcare

98.98%Cash & Cash Equivalents

1.00%- Performance

- Distributions

- Premium / Discount

Prices & Performance

- Oct 31, 2024

- Sep 30, 2024

MNTL

3 months

1 Year

3 Years

5 Years

Since inception

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted. Returns for periods of less than one year are not annualized.

The market price returns are based on the official closing price of an ETF share or, if the official closing price isn’t available, the midpoint between the national best bid and national best offer (“NBBO”) as of the time the ETF calculates current NAV per share, and do not represent the returns you would receive if you traded shares at other times. NAVs are calculated using prices as of 4:00 PM Eastern Time. The first trading date is typically several days after the fund inception date. Therefore, NAV is used to calculate market returns prior to the first trade date because there is no bid/ask spread until the fund starts trading.

Distributions

Record Date

Ex-Date

Payable Date

Total Distribution

Income

ST Cap Gains

Premium/Discount

Days Traded at Nav

Days Traded at Premium

Days Traded at Discount

MNTL NAV / Market Price

FAQ

What is a Neuroscience and Mental Health ETF?

The Tema Neuroscience and Mental Health ETF (MNTL) invests in companies that are developing treatments, medical devices and diagnostics to improve cognitive health and advance neuroscience.

How many holdings are in the Tema's Neuroscience and Mental Health ETF?

MNTL can hold anywhere from 15 to 100 holdings but typically aims to hold 30-50 companies in the neuroscience and mental health space.

What are the top companies included in Tema's Neuroscience and Mental Health ETF?

MNTL is an actively managed fund so the portfolio can change based on the investment process of our portfolio manager. Right now top stocks include Vertex, Regeneron, Argenx, Alnylam and Eli Lilly.

Why invest in a Mental Health ETF?

MNTL is exposed to a growing market because of the outsized economic burden of cognitive diseases. It is also exposed to innovation with breakthroughs from gene therapy to Alzheimer’s. MNTL is actively managed benefitting investors from our research expertise and providing them with an uncorrelated source of returns.

What types of companies are included in a Neuroscience and Mental Health ETF?

MNTL invests in therapeutics, such as biotech and large pharmaceutical companies, medical devices, and diagnostics companies that are fighting to improve cognitive and neurological health. These businesses are listed either in the US or abroad.

Why should I consider investing in a Mental Health ETF over other healthcare ETFs?

Other healthcare ETFs may dilute exposure to innovation and growth within the neuroscience space, a final frontier for healthcare. They also could be over or under exposed to smaller biotechnology firms that account for the majority of innovation in neuroscience, something MNTL tries to balance. MNTL is also actively managed benefitting investors from our research expertise and experience.

How do biotech ETFs differ from neuroscience and mental health ETFs?

Biotech ETFs can miss many of the exposure that we believe benefit MNTL. MNTL takes a balanced approach to investing in smaller companies which drive innovation in the space, while other biotech ETFs may be over (creating undue risk) and under (missing returns) exposed. Biotech ETFs also have no exposure to medical devices or diagnostics which are important parts of investing in a targeted therapeutic area like neuroscience.

Are there any risks associated with investing in a Mental Health ETF?

Investing is always risky so it is important to check that this fund fits your overall investment objectives and criteria. MNTL is exposed to biotechnology company risks – which range from scientific risks to regulatory ones. These can be hard to navigate and require expertise.

What factors should I consider before investing in a Mental Health ETF?

You should carefully consider whether this is the right investment for you and check with a financial advisor if appropriate. You should carefully consider whether you want exposure to innovation and growth, whether you are prepared for the risks associated with biotechnology investing. MNTL offers exposure to growth and innovation in the final frontier for healthcare.

How are the companies within a Neuroscience and Mental Health ETF selected?

Within MNTL we construct a proprietary universe of neuroscience and mental health companies. We then apply a bottom up research led fundamental process to select what we believe to be the best companies. These must offer asymmetric return potential. You can find more information about our process on our website.

Is there a minimum investment required for a Neuroscience and Mental Health ETF?

No there is no minimum investment. You must purchase a minimum of one share and the price of the shares can be found on our website. Your brokerage may charge fees to purchase our ETF.

How often are the holdings of a Neuroscience and Mental Health ETF updated?

MNTL is actively managed and holdings can be changed at any point. This decision is entirely at the discretion of our portfolio manager Dr. David Song who has 25 years industry and investing experience.

What is the future outlook for Mental Health ETFs?

With over 1 billion people globally suffering from central nervous system (CNS) diseases we believe there is vast unmet medical need. This is being met with fierce innovation in areas like gene therapy or brain shuttle technology. MNTL gives exposure to this innovation as it addresses this large and fast growing market.

How can a Neuroscience and Mental Health ETF benefit my investment portfolio?

We recommend you read carefully all the benefits and risks associated with investing and speak to a financial advisor. MNTL offers high growth and innovation potential. It also benefits from a source of uncorrelated return, driven by drug development and approvals, which could benefit your investment portfolio.

Risk Information

Carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Fund’s prospectus or summary prospectus, which may be obtained by visiting www.temaetfs.com. Read the prospectus carefully before investing.

Investing involves risk including possible loss of principal. There is no guarantee the adviser’s investment strategy will be successful.

Industry Concentration Risk: Because the Fund's assets will be concentrated in an industry or group of industries, the Fund is subject to loss due to adverse occurrences that may affect that industry or group of industries.

Biotechnology Industry Risk: The biotechnology industry can be significantly affected by patent considerations, including the termination of patent protections for products, intense competition both domestically and internationally, rapid technological change and obsolescence, government regulation and expensive insurance costs due to the risk of product liability lawsuits. In addition, the biotechnology industry is an emerging growth industry, and therefore biotechnology companies may be thinly capitalized and more volatile than companies with greater capitalizations.

Sector Focus Risk: Neuroscience companies are often subject to the potential or actual performance of a limited number of products or technologies and may be greatly affected if any of their products or technologies proves to be, among other things, unsafe, ineffective or unprofitable.

Neuroscience companies may not be able to capitalize on such products or technologies. Neuroscience companies may face political, legal or regulatory challenges or constraints from competitors, industry groups or local and national governments. They are also subject to product liability claims, patent expirations and intense competition, which may affect the value of their equity securities. Neuroscience companies may be thinly capitalized, and their equity securities may be more volatile than companies with greater capitalizations. Neuroscience companies are also susceptible to the market and business risks of related industries, such as the biotechnology, pharmaceutical and health care equipment industries.

Investing in Foreign and emerging markets involves risks relating to political, economic, or regulatory conditions not associated with investments in U.S. securities and instruments. In addition, the fund is exposed to currency risk.

Because the Fund evaluates ESG factors to assess and exclude certain investments for non-financial reasons, the Fund may forego some market opportunities available to funds that do not use these ESG factors.

Tema Global Limited serves as the investment adviser to Tema Neuroscience and Mental Health ETF (the “Fund”), and NEOS Investments, LLC serves as a sub-adviser to the Fund. The Fund is distributed by Foreside Fund Services LLC, which is not affiliated with Tema Global Limited nor NEOS Investments, LLC. Check the background of Foreside on FINRA’s BrokerCheck.