It took 30 years for Bernard Arnault to build LVMH, the conglomerate that at one point in 2023 was Europe’s most valuable company, making its founder the richest man on the planet. Can anyone replicate this success especially out of the shifting sands we are witnessing in the sector?

Arnault started building LVMH at the age of 35, employing hostile M&A tactics he had picked up in the US. He sifted Dior out of the rubble of a bankrupt French textile conglomerate where he fired 9,000 people after acquiring it for 1 franc. He then earned his nickname “the Wolf in Cashmere” for his daring move to wrestle control of LVMH – the luxury luggage and cognac group. It was followed by three decades of empire building – pursuing and buying family-owned brands like Pucci, Fendi, Celine, and Loro Piana. He even tried and failed buying Gucci in 1999, a story so thrillingly depicted in Vanity Fair. In 2020 he bought Tiffany for $16bn, a price negotiated downwards but still making it largest deal ever in the sector, and expanding into the US, seen by many as the most promising luxury market.

As LVMH has amassed 75 brands, spanning the globe and categories, the obvious question on investors minds is whether anyone can rise to rival this empire?

The American LVMH? – Tapestry buys Capri

This August 2023 merger brings under one roof the two largest American luxury brands Coach and Michael Kors, as well as respective acquisitions such as Kate Spade, Stuart Weitzman and two European brands Versace and Jimmy Choo. This is a bold move by American fashion executives to create a $12bn conglomerate, which spans both near luxe and pure luxury brands. Some commentators have suggested this collection of brands, which are more modern, (all were founded in the last 50 years), could create a new type of more aspirational luxury conglomerate. Either way, the deal is expected to bring $200m in synergies which is worth on our estimates $2bn, and a demonstration of value conglomerates can create.

Financially this transaction is equally bold, taking net debt/EBITDA to 4.0x1, a significant potential risk. One secret weapon is digital and direct to consumer capabilities, something Tapestry has mastered and hopes to bring to Capri brands.

This is the biggest attempt yet at building a conglomerate based in the US. Others have tried to build from the ground up - such as Adam Pritzker and Vanessa Traina’s Assembled Brands, Andrew Rosen’s business interests2 and more recently Matt Scanlan’s explicit goal to build “the next LVMH in the US”.

Kering – The rival across the street?

From its beginnings as a timber trading business in the 1960s to retail conglomerate in the 1980s/90s the group pushed into luxury in 1999 with the acquisition of a controlling stake in Gucci and purchase of Yves Saint Laurent. Many more deals followed such as Boucheron (2000), Bottega Veneta (2001), Balenciaga (2001). In 2003 the reins were handed from father to son, while the luxury buying spree continued. Retail assets were offloaded in 2010s culminating in the Kering name change.

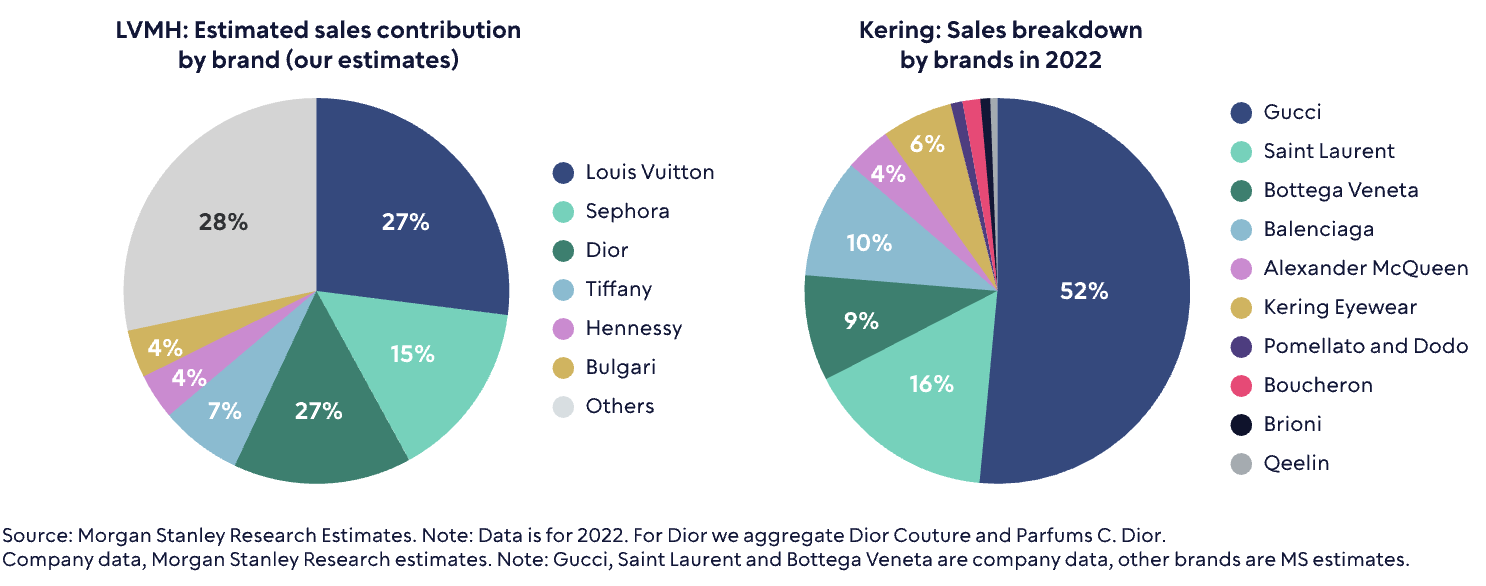

One would be forgiven to think Kering has already achieved conglomerate status, yet it is extremely reliant on its main brand Gucci which accounts for an estimated 50% of group sales and nearly 70% of profits3.

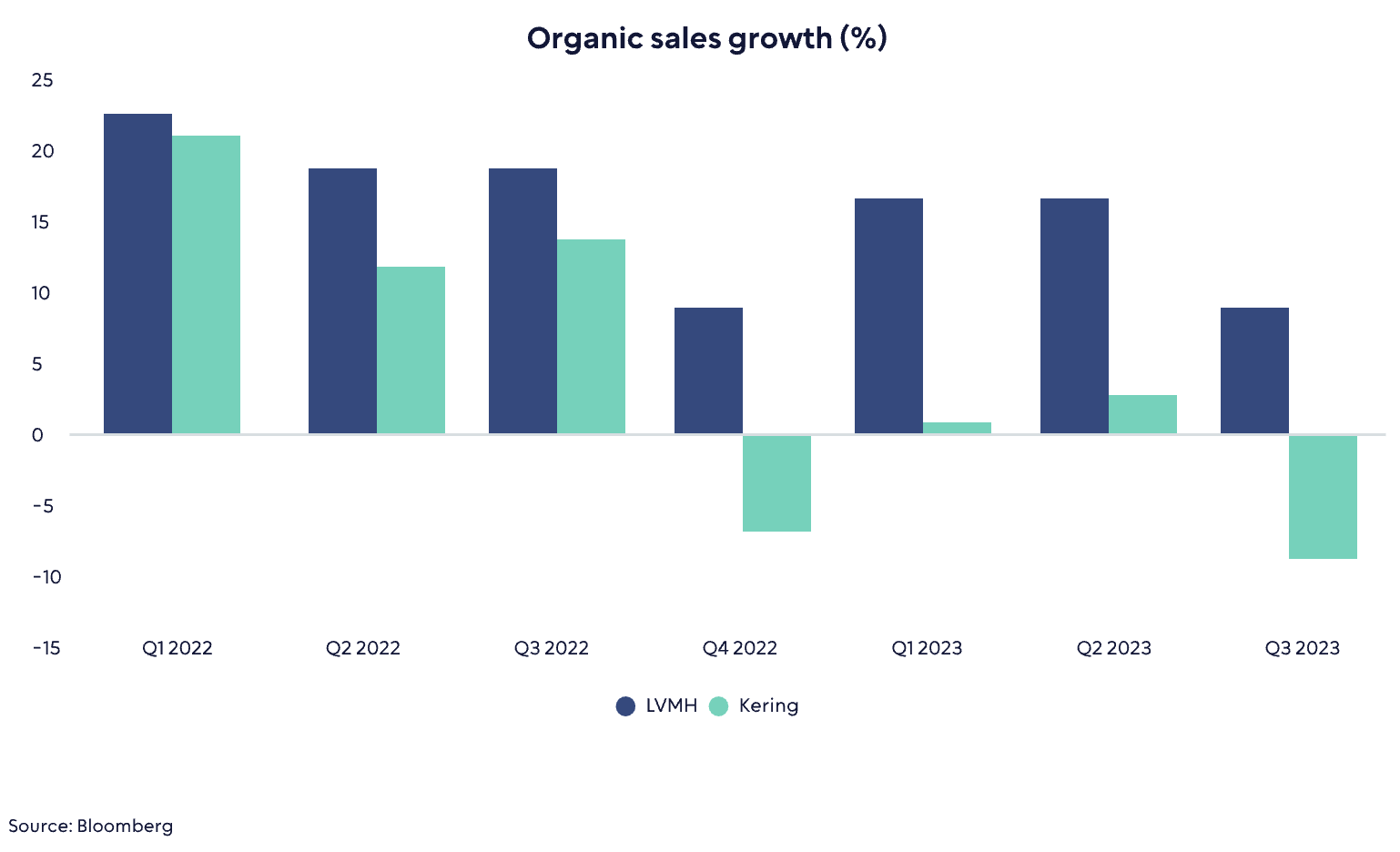

The volatility in group sales demonstrates how fashion winds at a single brand affect the whole business, especially the most recent underperformance as seen in the last two years

Struggles and activist pressure are forcing the group to attempt once again to push for stability of conglomeration, via the recently announced deal to acquire 30% of Valentino. This deal brings with it a formidable partner in the form of Mayhoola, the Qatari investment firm, who could become Kering’s biggest shareholder and “strategic partner”. There are plenty of paths forward – Kering also acquired an option to acquire the remaining 70% of Valentino, Mayhoola also owns Balmain, and the combined expertise and fire power could create a formidable force.

Yet it is not as easy as it seems

LMVH shares have compounded 10.6% p.a. since 19903 and it is no wonder that in the luxury space the hunt is on for a firm that can recreate this success. The ingredients of a true luxury conglomerate are harder than they seem. Although synergies by bringing multiple brands under one roof create value, as synergies show, it is important to nurture and build brands which takes investment. It remains to be seen if the digital mastery of Tapestry can be a suitable substitute for this. Equally, a stable of successful brands is necessary but not sufficient, as the trouble of Kering have demonstrated, where the portfolio remains unbalanced. Bringing financial fire power has the potential to address this through larger deals, although key management challenges, not least the geographic location of chairman, HQ, and main brand need to be addressed.

Back

Back