We believe life sciences are an important allocation in any portfolio. Yet despite its historical outperformance of the broader market, executing an investment strategy in this complex sector is not easy.

Framing the Opportunities of a Life Sciences Allocation

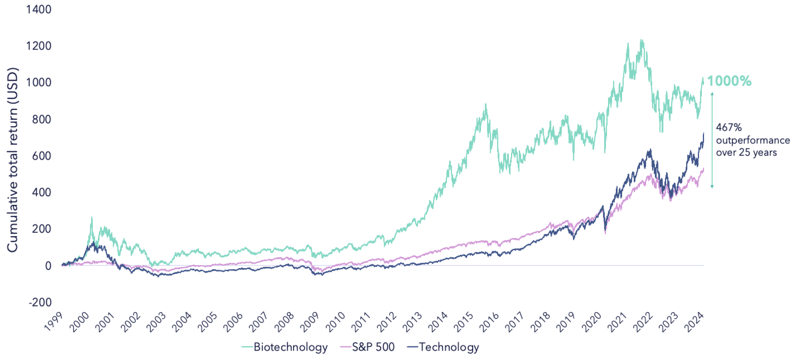

Biotech Returns Has Outperformed the Market Over the Long-term

Source: Bloomberg as of 01/25/2024. Biotech represented by the Nasdaq Biotechnology Index, which contains securities of NASDAQ-listed companies classified according to the Industry Classification Benchmark as either Biotechnology or Pharmaceuticals which also meet other eligibility criteria. Technology represented by the MSIC World Information Technology Index, which is designed to capture the large and mid cap segments across 23 Developed Markets countries. All securities in the index are classified in the Information Technology sector as per GICS. The S&P 500 includes 500 leading companies and covers approximately 80% of available market capitalization. Past performance is not indicative of future results. You cannot invest directly in an index.

Source: Bloomberg as of 01/25/2024. Biotech represented by the Nasdaq Biotechnology Index, which contains securities of NASDAQ-listed companies classified according to the Industry Classification Benchmark as either Biotechnology or Pharmaceuticals which also meet other eligibility criteria. Technology represented by the MSIC World Information Technology Index, which is designed to capture the large and mid cap segments across 23 Developed Markets countries. All securities in the index are classified in the Information Technology sector as per GICS. The S&P 500 includes 500 leading companies and covers approximately 80% of available market capitalization. Past performance is not indicative of future results. You cannot invest directly in an index.

Valuations at Historic Lows

Biotechnology valuations are at historic lows. The sector has been out of favour with investors for some time, especially with respect to small and mid-cap names. In fact, nearly a quarter of listed SMID biotechnology companies are trading below the level of cash currently held on their balance sheets1.

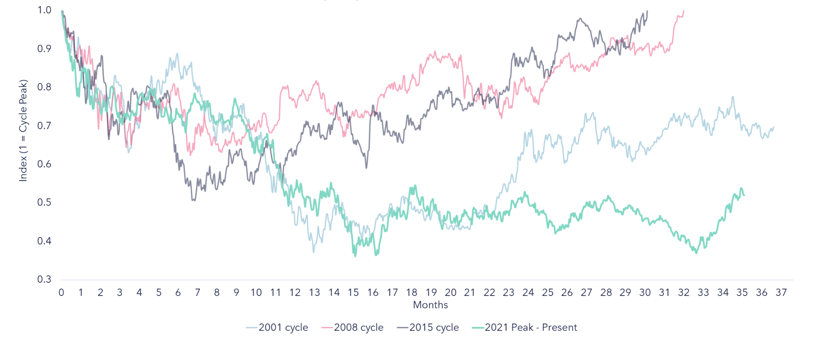

Biotech is coming out of the worst downcycle in recorded history

Source: Bloomberg as of January 2024. S&P Biotechnology Select Industry Index used for 2008, 2015, 2021 cycles. Cycles start dates are defined by index price peaks for each year. Nasdaq Biotech Index used for 2001 cycle. Past performance is not indicative of future results. 1Bloomberg as of January 2024, biotech defined by GICS definition of the biotechnology sub-industry, small cap defined by North American companies under $2 billion mkt cap. The referenced index is shown for informational purposes only and is not meant to represent the Fund. You cannot invest directly in an index. The measures are representative of the indexes underlying holdings and are not indicative of future performance.

As shown in the chart above, the biotechnology sector is going through its worst downcycle in decades. Returning to the point around tech vs biotechnology stocks, the performance differential has never been wider.

The Challenges of a Life Sciences Allocation

Binary Event Risk

Binary event risk in clinical trials refers to the manner in which the outcome of a single clinical trial can determine whether, in some cases, an entire company succeeds or fails. Clinical trials are complex, involving intricate biological processes, diverse patient populations and the potential for unforeseen adverse events. Trial design, patient characteristics and the viability of the science all need to be considered at great length to understand the investment merit of any company approaching a binary event.

Regulatory Uncertainty & Drug Pricing

Another hallmark of life sciences is regulatory uncertainty. The intricate nature of innovation often leads to regulatory agencies, such as the FDA, taking a cautious stance or varying interpretations of the rules, so it can be difficult to predict whether – and when – a new drug application will be approved. The FDA is tasked with balancing the promotion of innovation with ensuring the safety and efficacy of drugs. This phenomenon is fairly unique to the life sciences industry. For example, when investing in the technology sector, one doesn’t have to predict whether Meta will receive regulatory approval for its launch of Threads. Chat GPT was able to become an almost instantaneous success without regulatory approval.

This regulatory landscape is often complicated by the changing nature of US politics. Leaving personal affiliations to one side, there are clear differences in how the last two administrations have handled both the FDA and healthcare in general. The discussion around the healthcare system continues to challenge the life sciences sector, giving rise to the complex problem of drug pricing. Drug pricing and its impact on a company is a complex topic that requires careful consideration on a case-by-case basis.

Funding Risk

The capital-intensive nature of lengthy clinical trials means that funding is an inherent risk, particularly to smaller companies. High R&D costs can be exacerbated by unexpected delays or uncertainty over drug pricing. The volatility of the biotech market compounds these risks by often providing only a short window in which a company can execute a successful (and less dilutive) fundraise in the public market. We believe that understanding and analyzing balance sheets and carefully constructing a balanced portfolio are key to success.

Read more: Investing in Biotech Stocks: The Case for Active ETFs

Back

Back

.png)