While we believe the ideal approach should begin with a top-down segmentation of the life sciences landscape, in our view, an actively managed biotech ETF benefits more from a bottom-up approach to security selection, effectively addressing the challenges outlined earlier in this case study.

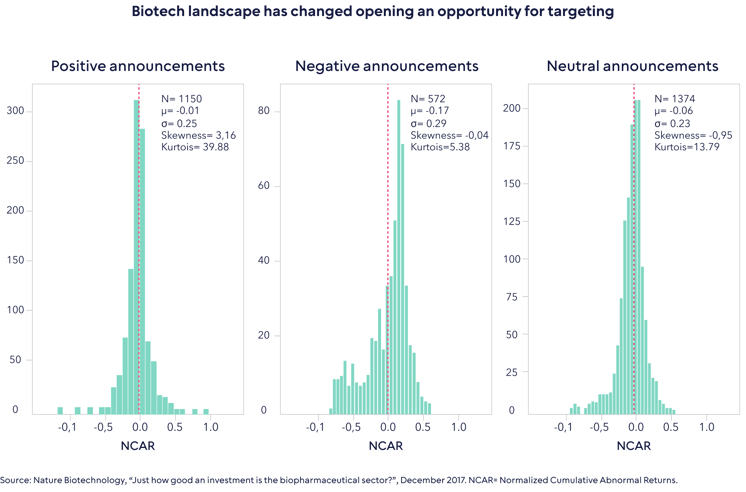

Our case for active begins with the need to understand clinical trials. A recent study published in Nature, which examined the results of over 5,000 clinical trial announcements, found that negative clinical trial results have a greater share price impact than positive ones. The chart below shows the respective price change distributions of positive, negative and neutral clinical trial results announcements. The mean values, depicted by the line in red, show that the responses to positive and negative announcements are inherently different. The greater skew of the negative outcomes shows that negative events lead to a greater and more definitive impact on share price than the positive ones.

Moreover, the lack of asymmetry in the negative announcements appear to show that in some cases there are extreme price corrections when a company announces a failed trial. The authors of the Nature paper attribute this to overconfidence assumed in the price of future success, hence, the share price would not change by an equal and opposite amount if the results of a trial are indeed positive. In other words, “buy the rumor, sell the news”.

The paper includes the somewhat obvious fact that a company with a larger pipeline of drug candidates is likely to see less of an impact on its share price.

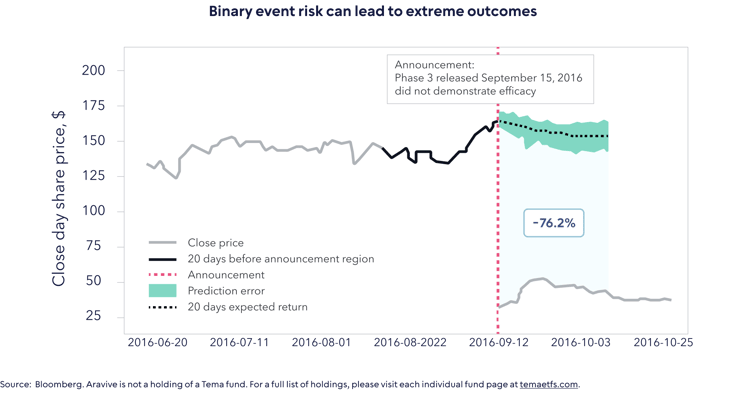

To demonstrate this, the authors include the example of Aravive’s Phase III VRS-317 VELOSITY trial, shown in the chart below.

Assuming an indexation approach, an investor would have indeed benefited from a c. 50% share price increase in the weeks leading up to the trial, when the market began to assume a positive outcome. That same investor would have also endured the 76% correction on the negative announcement. Our case is not that we could have predicted the outcome with respect to Aravive, but rather that a rigorous approach to risk-weighting positions ahead of clinical trial announcements is vital. Put another way, successful active management in life sciences is about understanding the confluence of scientific, clinical, regulatory and commercial risks in the context of how the market thinks about these. It is not about calling the outcome of a clinical trial but about knowing what is already priced in beforehand.

Our case for active is further underpinned by two commercial aspects: treatment pricing power and funding risk. Funding risk pertains largely to development-stage companies. The average cost of developing a new drug Is estimated to be between $1.8 billion and $4.2 billion1. Raising that amount of capital can be extremely difficult in certain market conditions, for example in 2023, especially when one considers the median market cap of companies in the Nasdaq Biotechnology Index is only $1.1 billion2. In our view, fundamental balance sheet and cash flow analysis combined with a deep understanding of clinical trials is necessary to mitigate the “funding gap” risk.

Treatment or drug pricing power refers to the strong economic moat established by certain treatments. Drugs that are innovative and unique, targeting high areas of unmet medical need with little competition, are more likely to command higher prices. Drugs with longer patents can command these prices for longer.

On the other hand, drugs with near-term patent expiry that are targeting highly competitive disease areas are unlikely to have much of an economic moat. Drug sales fall significantly when a patent expires because the company has to reduce the price to compete with generic versions. The solution to this problem is to continually assess a company’s current and future treatments against the broader market in an effort to select only those companies with the requisite pricing power.

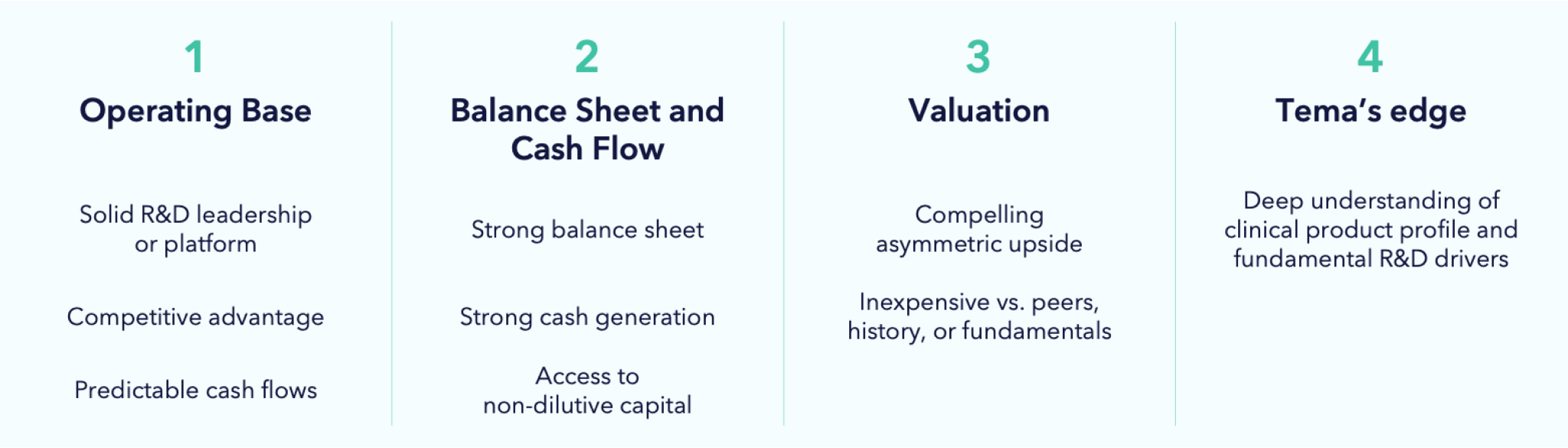

As such, Tema’s investment process for this sector can be described as investing in stocks that meet four pillars:

Portfolio companies must have a solid operating base, which means compelling innovation that has the potential to produce differentiated clinical data in an unmet medical need. We don’t buy “me too” product companies and we also tend to back scientific and management teams that have pedigree. In the case of pre-revenue companies, we seek to establish a clear line of site for the funding of all projected R&D expenditures. For product companies, our model must show strong cash flows to back investment. In the case of pre-revenue companies, we assess asymmetric risk-reward opportunities around timely catalysts where we can form a differentiated view. To gain an edge, these catalysts must be within our area of competence or that of our network of key opinion leaders.

We then build a careful analysis of upside potential involving commercial outcomes should the trial read out positive. We also build a downside case to distinguish between temporary and permanent loss of capital. Underpinning this is a review of medical data and literature, scientific conferences, financial analysis and speaking to our key opinion leader network. We don’t participate in binary risk for the sake of doing so. The ratio of upside to downside creates a risk-reward, and we only invest where we believe this is asymmetric. This asymmetry also dictates how we size our positions.

Building a balanced portfolio is also an important risk management tool. We aim to strike a balance between technologies, stage of company and type of company (for example, therapeutics vs. healthcare services firms). We believe this approach only works if it is complimented by the right mix of experience. A solid understanding of the science, as well as its clinical application, needs to be backed up by a demonstrable history of fundamental equity analysis over the many highs and lows of the last 30 years. In our view, those skills are a necessity for active management to succeed in life sciences, but they must also be complimented with a wide network of key opinion leaders, scientific conferences, and third-party data.

Back

Back

.png)