Carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Fund’s prospectus or summary prospectus, which may be obtained by visiting www.temaetfs.com. Read the prospectus carefully before investing.

Diversification does not ensure profits or prevent losses.

Investing involves risk including possible loss of principal. The Funds may invest a significant portion of their assets in one or more sectors and thus will be more susceptible to the risks affecting those sectors than funds that have more diversified holdings across a number of sectors. There is no guarantee the adviser’s investment will be successful in identifying and investing in thematic trends.

The small- and mid-capitalization companies in which the Funds invest may be more vulnerable to adverse business or economic events than larger, more established companies, and may underperform other segments of the market or the equity market as a whole.

International and emerging market investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations. Frontier markets generally have less developed capital markets than traditional emerging market countries, and, consequently, the risks of investing in foreign securities are magnified in such countries

Because the Funds evaluate ESG factors to assess and exclude certain investments for non-financial reasons, the Funds may forego some market opportunities available to funds that do not use these ESG factors.

Specific fund risks:

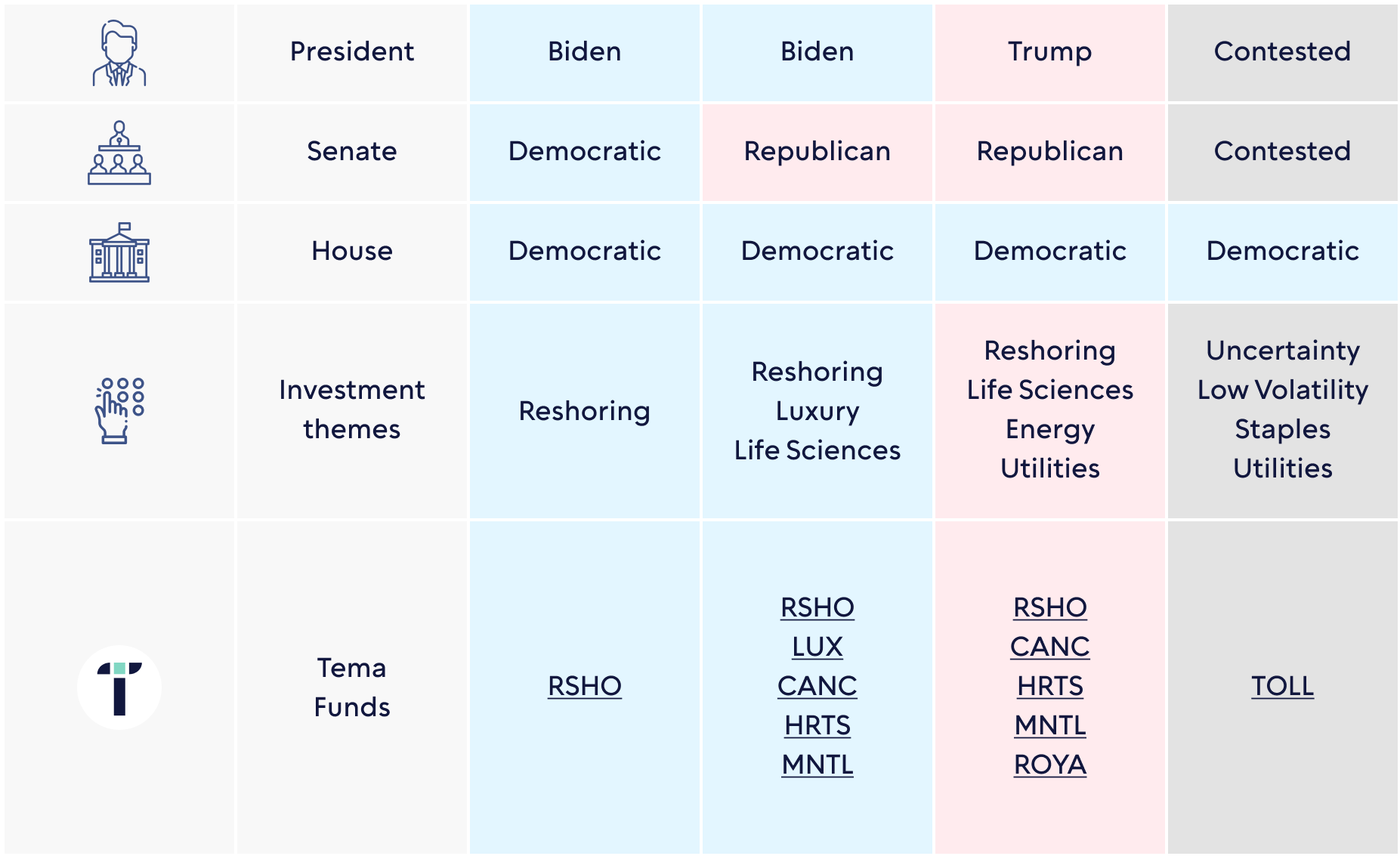

LUX: The success of companies that sell luxury goods and services may depend heavily on the disposable household income and consumer spending of a relatively small segment of the general population. Changes in consumer taste can also affect the demand for, and success of, luxury goods and services in the marketplace. Consumer spending on luxury goods and services can also be adversely affected as a result of declines in consumer confidence levels. In an economic downturn, consumer discretionary spending levels generally decline, often resulting In disproportionately large reductions in the sale of luxury goods and services.

TOLL: The success of the Fund's investment strategy depends in part on the ability of the companies in which it invests to maintain proprietary technology used in their products and services. Companies in which the Fund invests will rely, in part, on patent, trade secret and trademark law to protect that technology. Disputes as to ownership of intellectual property may arise. If a company is found to infringe upon or misappropriate a third-party’s patent or other proprietary rights, that company could be required to pay damages, alter its own products or processes, obtain a license and/or cease activities utilizing such proprietary rights. These disputes and litigations may be detrimental to performance.

RSHO: Companies may face significant legal, financial and political headwinds in the reshoring or onshoring of jobs into the United States, and these factors may be detrimental to performance. Industrial and Utilities sector companies will likewise be subject to the risks of Government regulation, world events, exchange rates and economic conditions, technological developments and liabilities for environmental damage and general civil liabilities. In addition, many materials companies are significantly affected by the level and volatility of commodity prices, exchange rates, import controls, worldwide competition, environmental policies and consumer demand.

CANC: Oncology companies are highly dependent on the development, procurement and marketing of drugs and the protection and exploitation of intellectual property rights. A company’s valuation can also be greatly affected if one of its products is proven or alleged to be unsafe, ineffective or unprofitable. The stock prices of oncology companies have been and will likely continue to be very volatile. The costs associated with developing new drugs can be significant, and the results are unpredictable. Newly developed drugs may be susceptible to product obsolescence due to intense competition from new products and less costly generic products. Moreover, the process for obtaining regulatory approval by the U.S. Food and Drug Administration or other governmental regulatory authorities is long and costly and there can be no assurance that the necessary approvals will be obtained or maintained.

HRTS: Obesity and Cardiology companies are highly dependent on the development, procurement and marketing of drugs and the protection and exploitation of intellectual property rights. A company’s valuation can also be greatly affected if one of its products is proven or alleged to be unsafe, ineffective or unprofitable. The stock prices of oncology companies have been and will likely continue to be very volatile. The costs associated with developing new drugs can be significant, and the results are unpredictable. Newly developed drugs may be susceptible to product obsolescence due to intense competition from new products and less costly generic products. Moreover, the process for obtaining regulatory approval by the U.S. Food and Drug Administration or other governmental regulatory authorities is long and costly and there can be no assurance that the necessary approvals will be obtained or maintained.

MNTL: Neuroscience companies are often subject to the potential or actual performance of a limited number of products or technologies and may be greatly affected if any of their products or technologies proves to be, among other things, unsafe, ineffective or unprofitable. Neuroscience companies may not be able to capitalize on such products or technologies. Neuroscience companies may face political, legal or regulatory challenges or constraints from competitors, industry groups or local and national governments. They are also subject to product liability claims, patent expirations and intense competition, which may affect the value of their equity securities. Neuroscience companies may be thinly capitalized, and their equity securities may be more volatile than companies with greater capitalizations. Neuroscience companies are also susceptible to the market and business risks of related industries, such as the biotechnology, pharmaceutical and health care equipment industries.

Adviser: Tema Global Limited

Distributor: Foreside Fund Services, LLC.

The information on this website does not constitute investment advice or a recommendation of any products, strategies, or services. Investors should consult with a financial professional regarding their individual circumstances before making investment decisions. Tema Global Limited or its affiliates, nor Foreside Fund Services, LLC, or its affiliates accept any responsibility for loss arising from the use of the information contained herein.

Back

Back

.png)