On May 11th, 2023, Tema launched its first three funds.

It marks the start of a mission that we believe is the next chapter in thematic investing – one that focuses on investment substance and experience and moves beyond thematic narrative alone.

As these quarterly reflections will demonstrate over the coming years, our investment process is built on compelling structural themes, thematic precision in how these themes are expressed in portfolios, and a consistent investment process that aims to harness the best elements of active bottom-up investing in a risk-managed wrapper.

The funds’ first quarter was shortened and largely uneventful from a macro perspective, characterized by a rally in the market and a continued concentration around the “magnificent 7” mega cap tech stocks, led by AI darling Nvidia, that today represent almost 28% of the S&P 500 index [1] .

We feel this sort of environment creates opportunities as:

o It leads to participants overlooking segments of the market, like reshoring, that, as we write about below, are clearly inflecting upwards.

o It should force investors to think of ways to diversify beyond their core index exposure that is increasingly concentrated in a small number of stocks.

Tema American Reshoring ETF (RSHO)

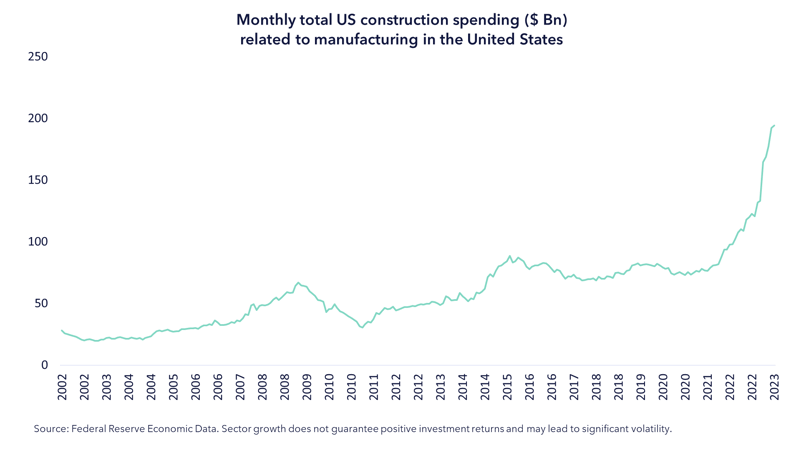

“America is back in the factory business” screamed a WSJ headline. Indeed, as the chart of the quarter shows below, there has been a parabolic increase in construction spending on new US manufacturing sites in the past 12 months.

This burst of activity is helping RSHO firms across the spectrum – from aggregates (Vulcan and Summit) to electrification (Eaton) and automation (Rockwell). As a result, the fund has had a strong start – rising +16.6% during this shortened quarter.

Interestingly, early cycle firms (such as Wesco and Herc) have materially outperformed late cycle firms (ABB, Linde)[1]. This is unusual in the face of a falling US institute of supply management (ISM) manufacturing index [2] and is likely the best evidence we have that the reshoring megatrend is taking hold in the US.

A case in point is Fastenal, an early cycle bellwether, where sales growth has decelerated from 11% to 5% in May[1], following ISM, but remains very robust.

This also supports our view that reshoring is about much more than just infrastructure, though the latter still has legs given only $210 Bn of the $1.2 Tn [3] of the Infrastructure Investment and Jobs Act (IIJA) [4] funds have been spent.

The performance data quoted represents past performance based on market price, not fund NAV. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost; current performance may be lower or higher than the performance quoted. For the current holdings and most recent month-end and standardized performance go to: RSHO

Tema Luxury ETF (LUX)

LUX, out of all the funds, had a harder start to its life – launching on the back of a record Q1 earnings season and a strong start to the year for many share prices. During the subsequent shortened quarter, questions arose about the sustainability of China’s consumer demand against high expectations of post Covid re-opening which itself helped propel luxury company valuations.

Despite this inducing an early swoon, the fund fared well in the period – clocking in +1.5% share price performance .

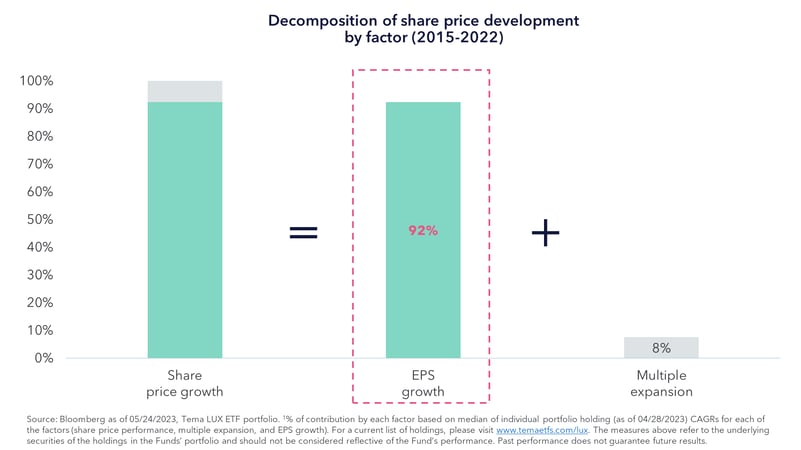

The stock market is notorious for this sort of short-term behavior, ignoring the fact that the majority of luxury company valuations still trade below their historic 10-year averages.

In fact, talk of valuations is moot, as our chart of the quarter shows that almost 92% of share price growth in the sector has historically come from earnings, with just 8% accounted for by multiple re-rating. Encouragingly, the latter is where we expend our security analysis work.

The performance data quoted represents past performance based on market price, not fund NAV. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost; current performance may be lower or higher than the performance quoted. For the current holdings and most recent month-end and standardized performance go to: LUX

Tema Monopolies and Oligopolies ETF (TOLL)

The fund had a solid start to its life, returning +4.9% over the period . Although it was a short period, positioning the fund in more cyclical monopolies (such as Moody’s, Airbus) was helpful as defensive sectors (such as healthcare) were a drag[1].

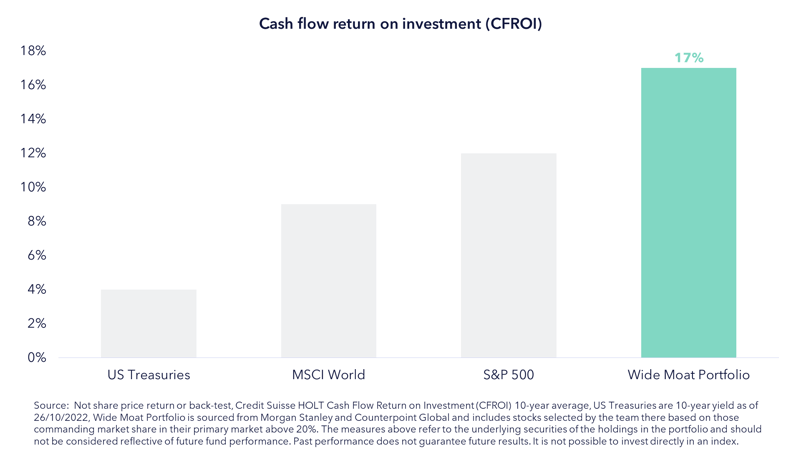

We often get asked: ‘surely buying high ROIC businesses is just a matter of simple screening?’. The truth is far from it, as recently relayed by Michael Mauboussin, the Morgan Stanley guru.

“A good company, which has a high ROIC, and a good stock, which has a high total shareholder return (TSR), are two different things […] the stock of a company with a high ROIC will not deliver attractive returns if it fails to exceed expectations over time.”

Michael Mauboussin

We believe that the stocks in the TOLL portfolio not only have high ROIC [5] , as we can see in the Chart of the Decade, but also potential for long-term shareholder return because:

• The market tends to expect ROIC to regress to the mean, but monopolies by their nature have much more durable returns - i.e., ROIC won’t fall.

• Our process layers on top of that and selects stocks where expectations could be exceeded – i.e., where ROIC might rise faster than anticipated.

• Together, we feel the combination of these factors create the best potential for excess returns.

The performance data quoted represents past performance based on market price, not fund NAV. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost; current performance may be lower or higher than the performance quoted. For the current holdings and most recent month-end and standardized performance go to: TOLL

Outlook

As we enter the second half of the year as ever the outlook is uncertain. Weakening economic growth and sharp monetary policy tightening over the last year are battling for mind share against record order books, a clear reshoring boom, consumer savings and resilience in areas like housing. In the face of this type of environment, we believe it is important to stick to the process and strong themes that aim to allow our investors to stay the course over the long term.

For each of our themes there are key risks we are watching:

• For LUX: the China growth slowdown against heightened expectations is an area of potential risk, especially as the comparable period gets hard again in Q3.

• For RSHO: our eyes are firmly on the direction of the US economy, where our base case for now is likely a recession in mid-2024 that might come as a surprise to markets.

• For TOLL: we are looking further out to 2025E to see if anything will change the prospects for our companies especially when compared to what is priced into the valuations.

Back

Back

.png)