Artificial intelligence in the form of natural language models burst onto the scene with the launch of Chat GPT from Open AI, which gained one million users in a blistering five days. Steven Wolfram explains that1, although it looks like magic, large language models are grounded in statistics and their fuel is data. AI is in effect leading to a drastic collapse in the cost of compute/software, with every programmer suddenly 10x more productive. This naturally means that data becomes the real constraint, and its relative value also rises dramatically. As the market attempts to understand the disruption from this new technology, we believe the next trend will be incumbent companies showcasing the power of the data positions they have built

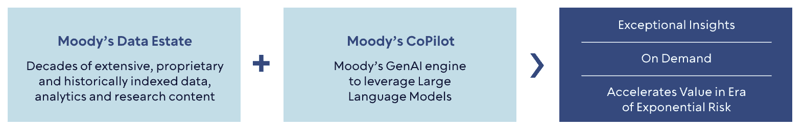

Data is an enormous moat that many information services businesses have amassed over the past 30-40 years. Moody’s for example owns the world’s largest company database focused on private companies – Orbis. They also, through their CreditLens product, collect banking loan officer decisions and default data which they use to create better datasets via a positive feedback loop. This data advantage can’t be recreated by a competitor.

Instead of resting on their laurels, many of the best monopolistic information service firms are investing in building AI tools on top of these datasets, further expanding their advantage. Moody’s has a 25-person dedicated team building generative AI tools. These products can sit on top of Moody’s content allowing users to generate insights in just seconds and interact with their databases in a natural way. Commercialization is just around the corner as most products are in final stages of testing.

Investing in AI is not new for these firms

It is important to note that information firms have been investing in this area for years. For example, as far back as 2018, S&P Global acquired Kensho, a leader in artificial intelligence and machine learning. Today, this business forms the cornerstone of their efforts to build out AI products.

Trust and data integrity

It isn’t just about data depth and breadth, an equally important element is trust and quality of data. Building AI products on broad but poor-quality data leads to the “garbage in garbage out” problem, which products like ChatGPT have faced. Having a trusted brand backed by good quality data will be an important competitive advantage as these markets evolve. Privacy is also important. For example, Reed Elsevier has committed not to use front end prompts to improve its Lexis Plus AI because of the sensitivity of these requests.

Why this matters for TOLL?

Data moats combined with Gen AI product development should extend the durability of information business monopolies. It is both a defensive move, to ward off would be start up competition or assert data sovereignty, and an offensive one, to add extra revenue uplift.

Back

Back

.png)