Historically, investing in life sciences through public equity has resulted in a choice between broad healthcare funds or slightly narrower but still all-encompassing biotech funds. However, knowing what we know about science today, one might reasonably segregate the market along different lines.

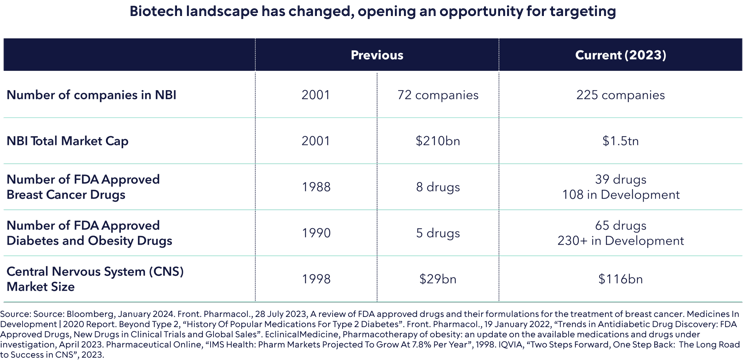

In 1990, when biotech investing really first became “a thing”, this immature corner of the public equity market barely had enough companies to form an investable index; the Nasdaq Biotechnology Index (NBI) launched in 1993 with 100 companies. The prospect of dividing up the healthcare market into disease areas would never have been feasible.

The picture is now entirely different. The NBI has 225 companies. The total market cap has grown over one trillion dollars. There are 3,275 listed companies in the wider life sciences universe today according to GICS.

At the treatment level the story is the same. In 1988, there were eight drugs available for breast cancer. Today there are 39. The American Medical Association only officially classified obesity as a chronic disease in 2013. Today, there are 65 drugs for obesity and diabetes and more than 100 in development. In 1998 the market for neurological and CNS drugs was $29bn. Today it is $116bn.

The unexpected result of this growth is that "investing in healthcare" today often means an extremely broad and hard-to-define fund. The drivers of success of any such fund may not always be clear. While generally population growth (particularly in moats magnified by regulatory barriers and IP) lifts all boats, the industry also has its share of winners and losers, and significant return dispersion, particularly in biopharma, but occasionally disruption of legacy business models over a long period of time. Some of the criticisms levied on a general healthcare fund, particularly around winners and losers, can also be levied on passive investing.

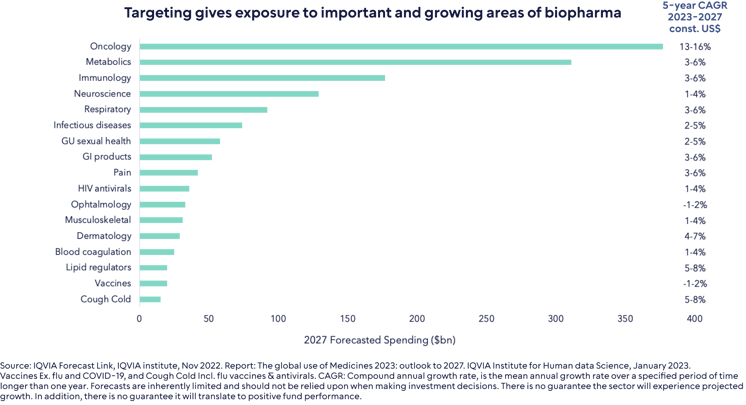

Not only does that advocate for active management, we believe it calls for portfolios designed around the most pressing and pioneering treatments available. Dissecting by disease verticals allows a focus on those areas that are predicted to have the largest spend in the next decade, as shown by the chart below, but also allows a focus beyond biopharma. For example, some of the most innovative companies in the oncology space are within med tech, diagnostics or tools. A narrow biotechnology fund, with its focus only on therapeutics, would miss these potential growth opportunities.

Our three funds, Tema Oncology ETF, Tema GLP-1, Obesity & Cardiometabolic ETF, and Tema Neuroscience and Mental Health ETF, aim to address these areas.

Focusing on these very sizeable but growing markets also aims to give investors what we believe they want from life sciences: a genuine prospect of growth. By segmenting in this way, we aim to overexpose investors to the opportunities and by taking an active approach we aim to underexpose investors to the challenges.

Back

Back

.png)