Quarterly Market Commentary

Markets continued their rally in Q1 2024, clocking in +10.6% for the S&P 500 and 9.0% for MSCI World. Our guiding principle of scarcity of growth has played well with areas like obesity, US construction materials, semiconductor equipment monopolies for AI, aerospace helping all Tema funds outperform their benchmarks. Life sciences overall continued their recovery, and we became increasingly confident in our differentiated approach, laid out in our latest white paper on the space.

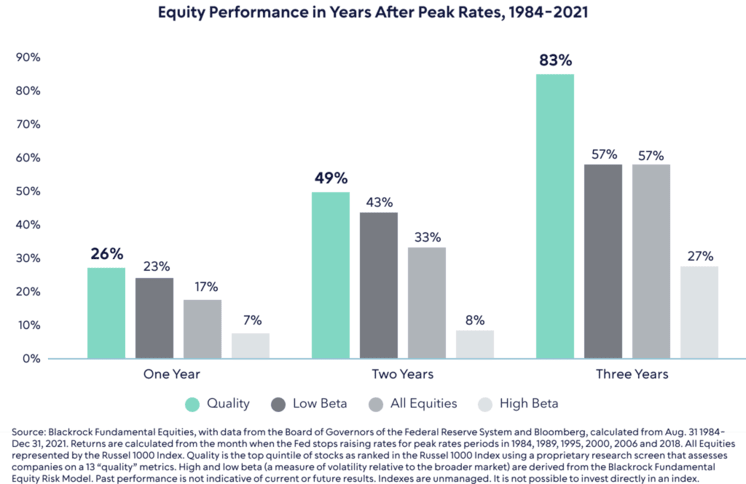

Unlike Q4 2023, the backdrop was one of a move upwards in the policy rate forward curve – suggesting that what matters for equities is that the peak in rates is in. In fact – quality, a key tenant of Tena’s investment process tends to do best in the years that follow peak rates.

2024 is also an election year. What does it mean for markets? The short answer is not much for the overall market, but there is likely to be further cross currents under the surface. Areas like reshoring are likely to see continued support while healthcare could come under scrutiny if there is a democratic sweep. You can read how to position for it here.

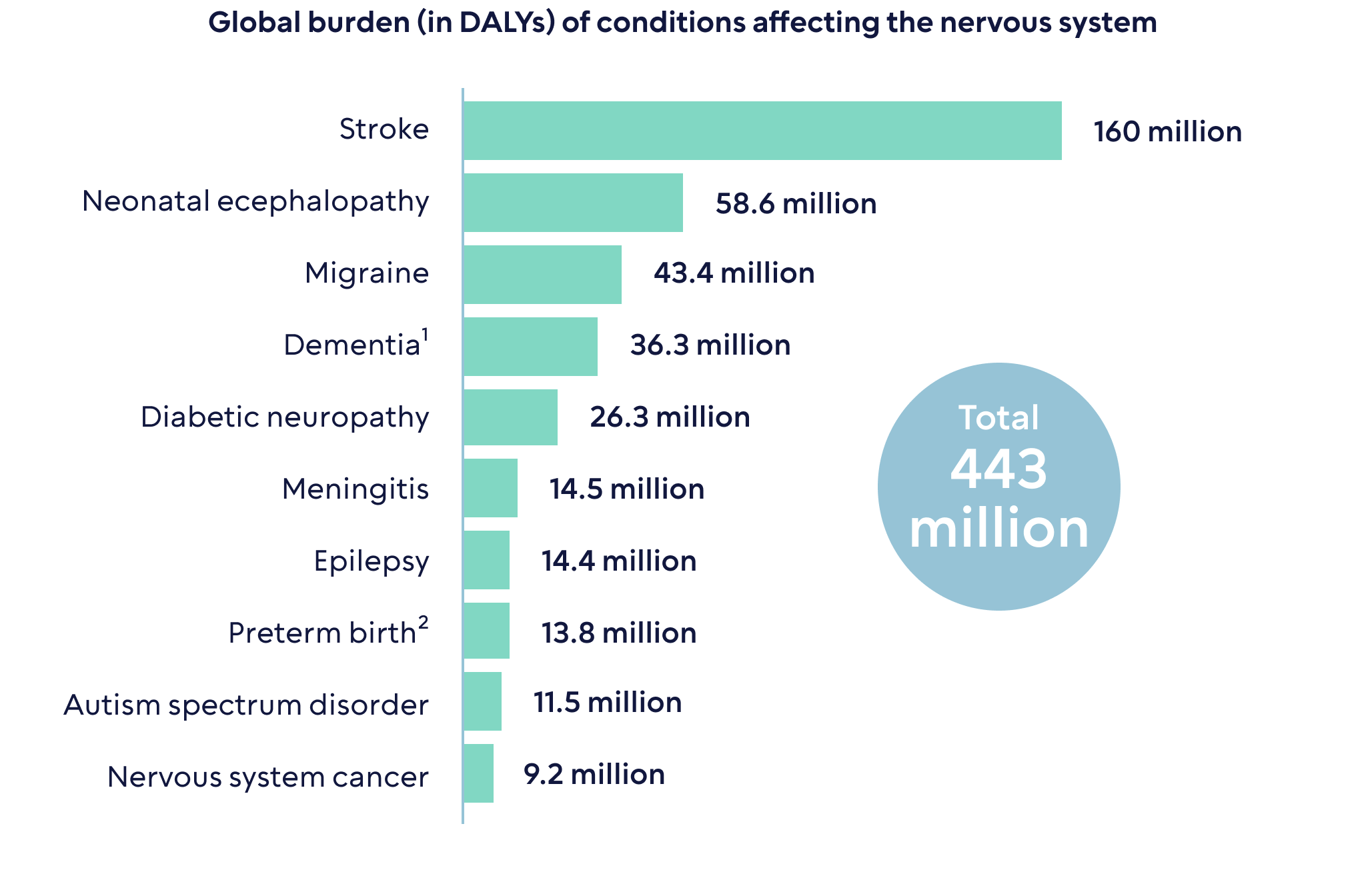

During this period we launched the third fund in our healthcare suite managed by Dr. David K. Song, MD, PhD, CFA, the Tema Neuroscience and Mental Health ETF (MNTL). New estimates suggest 43% of the world’s population suffer from conditions affecting the nervous system – from Alzheimer’s to depression – and these represent one of the highest and, sadly, fastest growing disease burdens. Encouragingly there are many breakthroughs happening, creating one of the fastest growing and diverse segments of healthcare. This is the final frontier of modern biopharma and medical technology.

HRTS GLP-1, Obesity & Cardiometabolic ETF: Had a stellar first complete quarter, far outstripping its benchmark.

By far the lead contributor was our position in Viking Therapeutics. During the quarter the company released two positive data sets related to their obesity asset VK-2735. Both datasets showed a very competitive profile. The oral formulation, though only in Phase I, showed remarkable safety with 0% vomiting. If this can be shown in a bigger patient population there is potential for a near best in class asset. The market, which has over the past 18 months woken up to the huge potential in the obesity space, promptly put in a big M&A premium in the stock. As a result we have trimmed our position but remain invested.

In terms of detractors we saw underperformance from Insulet, the continuous glucose monitoring device company, that gave weaker commentary about 2024 and potentially faces new competition. There were also some updates that disappointed investors such such as BridgeBio partnering with Bayer and Alnylam changing their late stage clinical trial design. We continue to hold or add to all three stocks.

Obesity as an area is transforming. A paper published in The Lancet journal now estimates that over 1 billion individuals, 800m adults and 200 children and adolescents, live with obesity. Novo Nordisk recently highlighted that less than 2% of those are treated with anti-obesity medication, compared to 15% for diabetes. The potential is huge, an estimates for market size keep getting revised up. Helping this along is more and more data showing how GLP-1 drugs work in cardiovascular disease or chronic kidney disease with more to come. Following behind the GLP-1 drugs are a new generation of medicines for obesity addressing efficacy, tolerability, supply and muscle loss. We wrote about the next ten here and expect many more significant updates through the rest of the year.

.jpg?width=1600&height=900&name=table-drugs-16_9%20(1).jpg)

For a full list of holdings, please visit the HRTS fund page.

TOLL Monopolies and Oligopolies ETF: Had a strong quarter, further extending since inception performance.

It was an encouraging quarter in terms of contribution with key monopolistic sub-themes leading the way. One is aerospace with Safran and Airbus – pulling in at the top. Aerospace is a unique duopoly in that aircraft and aircraft engine design cycles are extremely long and once on a program it is not possible to be dislodge. The high performing companies use the resulting cash flows to reinvest in the next generation. Since covid, aircraft traffic has recovered to 2019 levels and continues to grow, creating strong demand. The supply situation however continues to hamper ability to deliver. Tight supply and strong demand create a positive environment, and this is forecast to last well into the end of decade. Both companies continue to win share against key duopoly rivals in terms of orders.

On the opposite side, we saw negative performance from Cellnex, the mobile tower infrastructure company. We halved the position last quarter and have recently exited fully. Cellnex pursued a strategy of acquisition over the past 10 years which created immense value. However this built up a large amount of debt that will keep rising this year as they pay for capex committed to sellers, who leased the towers back.

A new CEO, disposals of tower assets t attractive prices and a new strategic plan have not led to the re-rating our analysis suggested and with these catalysts out of the way we chose to use the capital in more attractive ideas.

One thing worth highlighting for TOLL is the types of moats we don’t invest in. We avoid consumer focused or media companies that are often grouped under the concept of a brand or intangible moat. We prefer to invest in more tangible, durable and dominant moats. Brand moats are also increasingly prone to disruption through changing consumer habits, VC capital and the power of the internet. A few examples we have looked at and avoided are listed below.

For a full list of holdings, please visit the TOLL fund page.

LUX Luxury ETF: The fund had a strong quarter bringing us back in-line with our benchmark since inception.

A top contributor to the fund was L’Occitane, encouraging for a new idea. The stock is benefitting from continued high growth at breakout brand Sol De Janeiro. There also continue to be rumors of a take private deal for the company. In fact sleuthing around the interim report published in December 2023 we calculated that the company’s auditors value the brand at EUR 2.7bn or 77% of the entire market cap of L’Occitaine at the start of the quarter – leaving the rest of the business on a low single digit EV/EBIT multiple. This is a great example of analytical edge we aim to cultivate.

The other top contributors were Hermes and LVMH, two luxury bellwethers. This is encouraging and was the result of much better than feared Q4 2023 growth at LVMH (+10% organic) and yet another stellar +20% from Hermes. We are starting to see green shoots of recovery in the space after a torrid H2 2023, against much reset expectations.

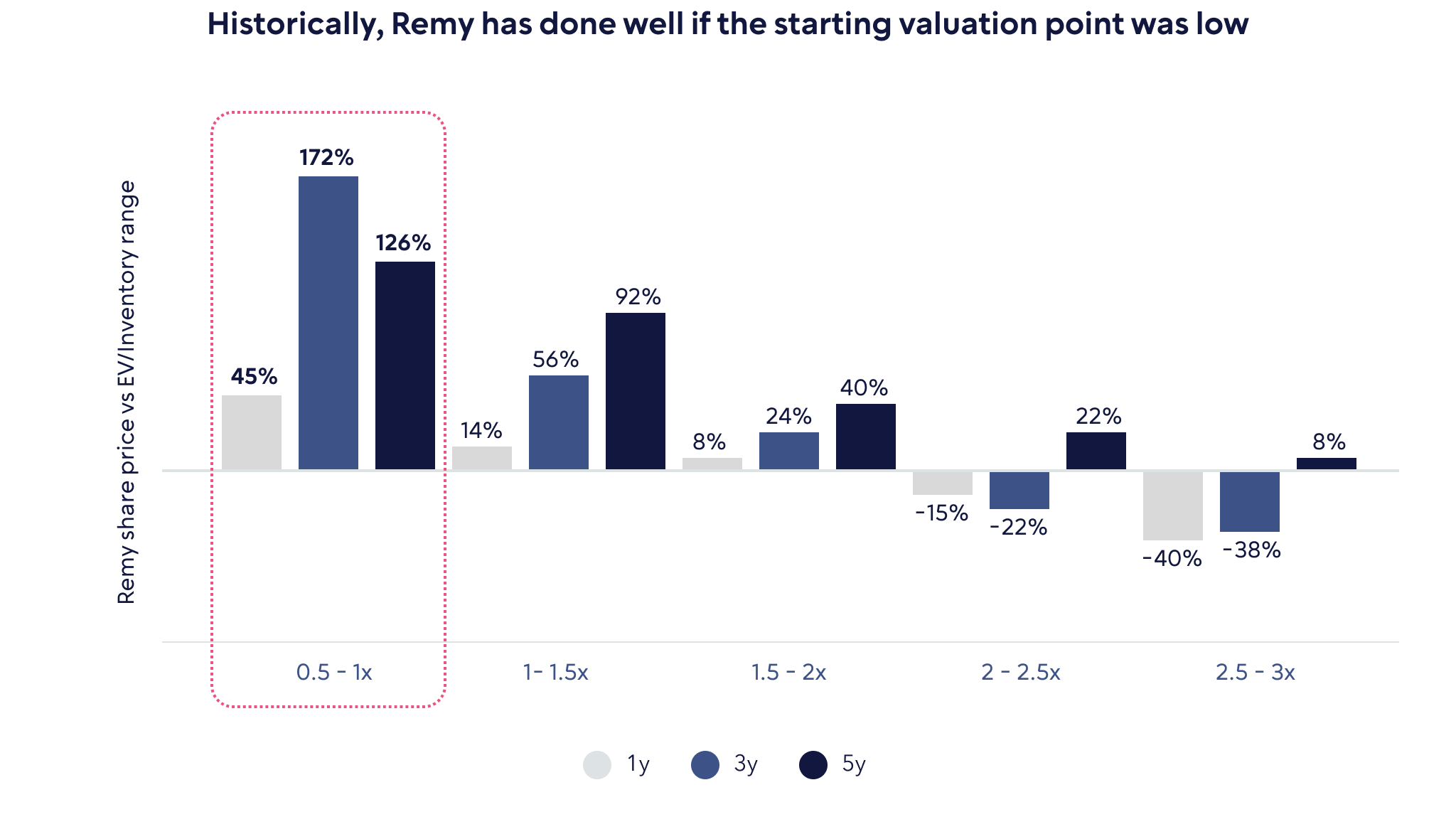

Low expectations however were not enough to help our luxury spirits holdings with Remy Cointreau being a top detractor. Remy shares were hit by reports of a potential import tariff on French brandy in China and further de-stocking in the US. We continue to invest in the luxury cognac category, which is arguably experiencing peak, or close-to peak, negative newsflow. The category is structurally one of the most attractive in the luxury spirits industry, commanding the highest average pricing and positioning. The high barriers to entry (due to the large inventory requirements) in the industry means only 3 players control most of the global market, with Remy enjoying a privileged position in the very high end (XO and above categories). The stock currently trades below the value of inventory of cognac on their balance sheet and historically when this happens the subsequent three year performance has been very strong.

Source: Company reports, Bloomberg. For a full list of holdings, please visit the LUX fund page.

CANC Oncology ETF: Strong first full quarter

Biotechnology continued to recover during the quarter. There are green shoots everywhere, from successful IPOs (CG Oncology), to rising share prices on well received secondary placings.

M&A continued in the space. The top contributor in the quarter was Fusion Biopharma which was acquired by Astra Zeneca at nearly 100% premium. Fusion develop radiopharmaceuticals, a much more precise, and hence safer, version of radiotherapy which is still given to 50% of cancer patients at some point in their illness.

Since inception we calculate that the fund has owned 5 out of the 8 M&A deals in the oncology space. This 63% hit rate is outstanding in light of a concentrated 46 holding fund. It is also impressive as many of the positions like Mirati, Immunogen, and Fusion were sized at 2-3% of the fund.

In terms of detractors, we continued to see weakness in our cancer diagnostic names such as 10x Genomics and Guardant Health. The latter, was due to worries in the market of a competitor dataset from a private company called Freenome. In fact, this data was released after the end of the quarter and proved to be disappointing, which we think sets the stage for a recovery in the names.

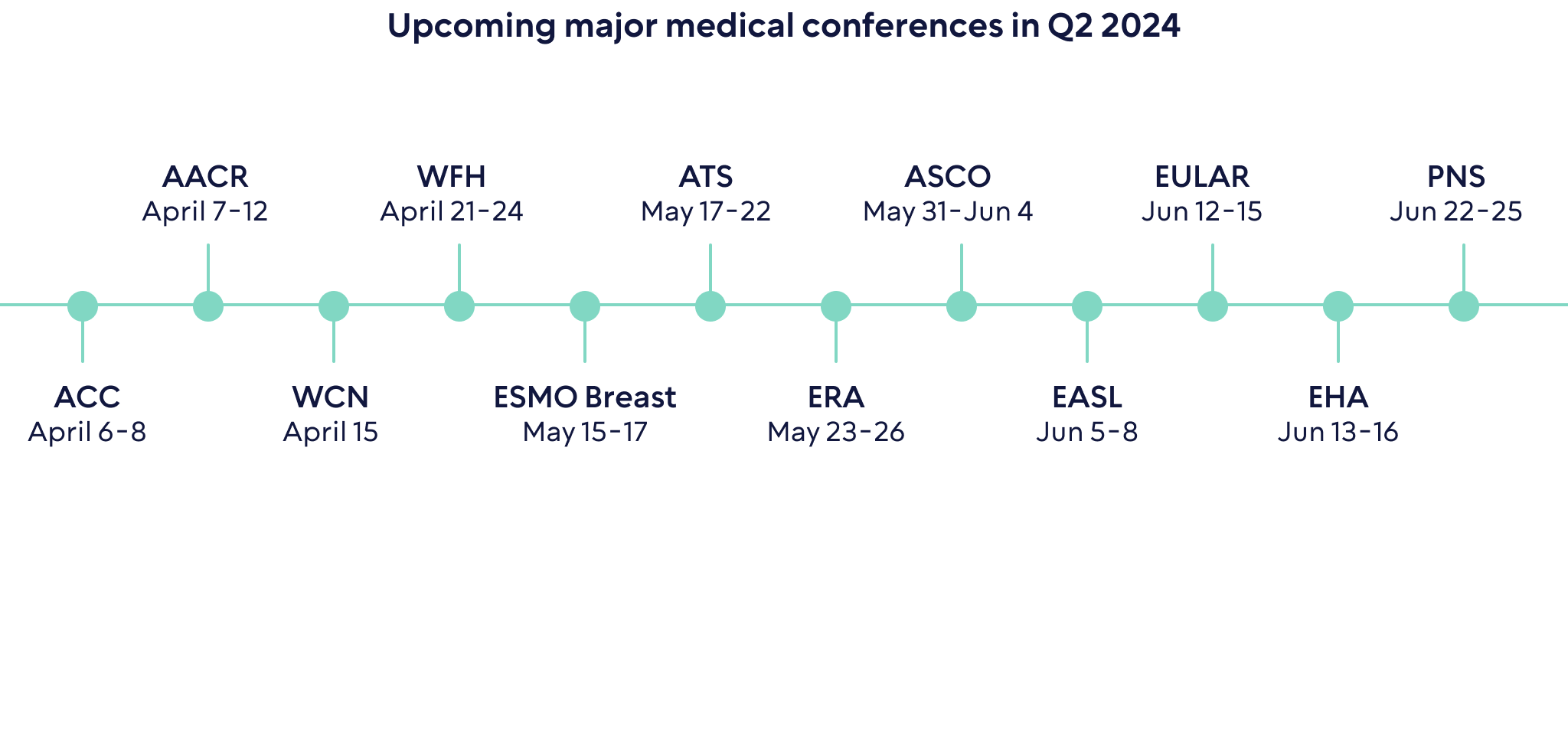

Looking forward, we are about to enter the busy period of major medical conferences which will bring catalysts from data read outs to M&A. We will be attending ASCO this year and look forward to reporting on the conference next quarter. Encouragingly our top five technologies in oncology paper remains prescient as it correctly identified many of the big trends in precision oncology, from ADCs to radioligand therapies, that big pharma is now snapping up.

For a full list of holdings, please visit the CANC fund page.

RSHO American Reshoring ETF: Clocked in another very strong quarter ahead of its benchmark

Almost every company contributed to performance, again highlighting the breadth of the reshoring theme. A key detractor was Boeing, as the company struggled with fall-out from the Alaska Air incident. We made the decision to cut our losses and sell the entire position as government involvement is rarely resolved quickly and without significant interruption to a corporation.

A top contributor during the quarter was CRH. The company has now successfully relisted in the US from the UK and has seen a re-rating in the run up to the event. As imitation is the best form of flattery, Holcim of Switzerland, is looking to do a similar thing by listing its North American business in the US. More than 75% of CRH’s EBITDA now comes from North America and they are the largest building materials company in the US. Reshoring is fueling what the company has started to call “The Golden Age of Construction”. Construction is indeed booming – attendance at the World of Asphalt (WOA) event this year was 2x the level of 2018, an event that sold out in a one week.

During the quarter board rooms were given yet another reason to consider reshoring – the Baltimore port bridge disaster. The port is 9th in the US handling 3.3% of all import tonnage. It leads the nation in imports of cars, plywood, wood, gypsum, zinc, certain types of stainless steel. The list goes on. These supply chains need to be re-routed causing disruption and costs.

In terms of changes, we are recycling some capital into the healthcare reshoring subtheme. 83% of generic medicines for example have no US based source. The government is taking notice with the introduction of the The Biosecure Act. The same is true of large pharmaceutical companies like Astra Zeneca.

We have spent the quarter researching the area and have initiated positions in Danaher, a leader in lab tools and bioprocessing equipment, and Lonza, a contract pharmaceutical manufacturing business. Lonza for example recently acquired a Genentech manufacturing facility for $1bn to bolster its US presence for US customers. Both companies stand to benefit from both the secular theme of reshoring biological production as well as a more cyclical recovery from depressed end markets.

Source: CRH investor presentation. For a full list of holdings, please visit the RSHO fund page.

MNTL Neurology and Mental Health ETF: Good start as a fund in this partial quarter, outperforming its benchmark since inception.

Performance was helped by Eli Lilly, who are, if approved, on track to launch the first real disease modifying drug in Alzheimer’s. The shares were strong off the back of good earnings and continued momentum from the launch of obesity drug Zepbound. The fund also benefitted from Shockwave Medical, a medical device company pioneering lithotripsy, which reported strong results and potential acquisition interest from J&J. This stock is also held in HRTS, as these procedures are applied to vascular intervention as well.

In terms of detractors, Biogen struggled due to a slower than expected launch of Leqembi, its recently approved Alzheimer’s drug marketed in collaboration with Eisai. Similarly, Ionis shares were driven lower by lower than expected revenues from its spinal muscular atrophy drug and diminished expectations from one of its pipeline drugs.

During the quarter The Lancet published the following slide which shows just how staggering the medical need in this space is. 43% of the world’s population are affected by these conditions and they are a leading cause of disease burden (measured by disability adjusted life years (DALYs).

1Alzheimer´s disease and other mentias, 2Neurological complications associated with preterm birth. For a full list of holdings, please visit the ROYA fund page.

Back

Back

.png)