By many measures, neurological disorders remain the final frontier of life science research. Recent breakthroughs offer hope that we are at a turning point across multiple areas. This blog explores this exciting theme and what the launch of the Tema Neuroscience and Mental Health ETF (MNTL) means for investors.

Key Takeaways

- Diseases of the central nervous system (CNS) are a huge burden on society.

- Breakthroughs are happening across the field – from the first disease modifying agents for Alzheimer’s disease, to new genetic tools for rare children’s neurological disorders, and precision approaches to treating mental health.

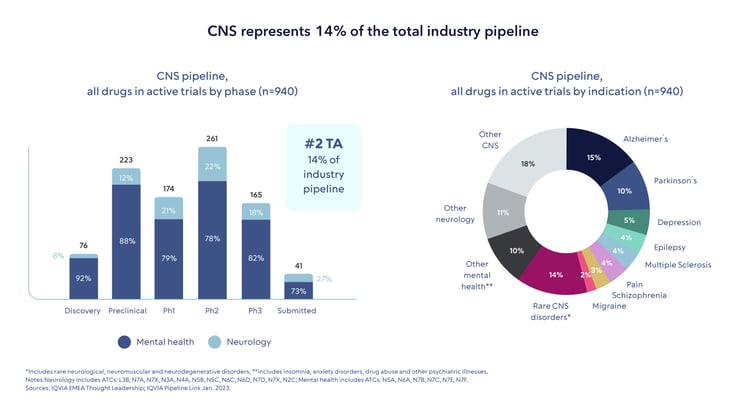

- CNS is the second most important therapy area in industry pipelines creating what we believe is a rich and varied investment universe.

- The biotech sector has undergone a sharp downturn, offering in our view a compelling valuation opportunity set against accelerating innovation.

- The Tema Neuroscience and Mental Health ETF (MNTL) aims to select the firms that are advancing breakthroughs in the treatment and diagnosis of this disease burden.

For a list of current fund holdings, please visit the fund web page at www.temaetfs.com/mntl All investments involve risks, including possible loss of principal. For a more complete discussion of the potential investment risks to the topics discussed below see the disclosure section at the end of the document.

Why are neurological diseases such a burden?

Over 1 billion people worldwide suffer from central nervous system diseases1. Some of the biggest burdens are:

- Dementia, of which 70% of cases are Alzheimer’s disease, is estimated to affect 55m people worldwide2. Until last year the treatments available for patients only focused on treating symptoms and not modifying the disease. As a result, the economic cost of caring for these individuals in the US alone is 12x that of cancer3.

- Depression and Schizophrenia together affect 300m people globally or nearly 6% of all adults4. Even though some treatments exist, the unmet medical need is acute. For example, 70% of patients with major depressive disorder who take standard of care experience residual symptoms5. Poor mental health is estimated to cost the global economy $6 trillion by 20306.

- Rare neurological genetic disorders, a group of 1,700 different diseases, though rare, can be devastating particularly as they tend to disproportionately affect children.

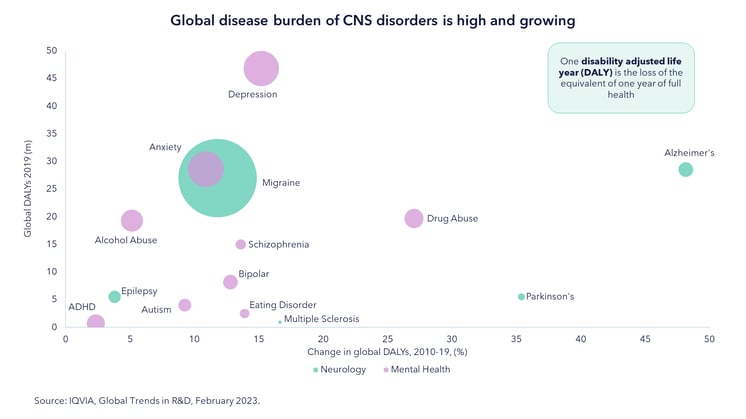

In fact, measured using disability adjusted life years (DALYs) defined as years of life lost due to pre-mature disability or mortality, CNS disorders have a high and, worryingly, growing burden

What are some of the breakthroughs in neuroscience and mental health?

We are at a pivotal moment in neuroscience. Breakthroughs are happening across the field, as companies are building on scientific discoveries in this biologically complex and hard to address therapeutic area.

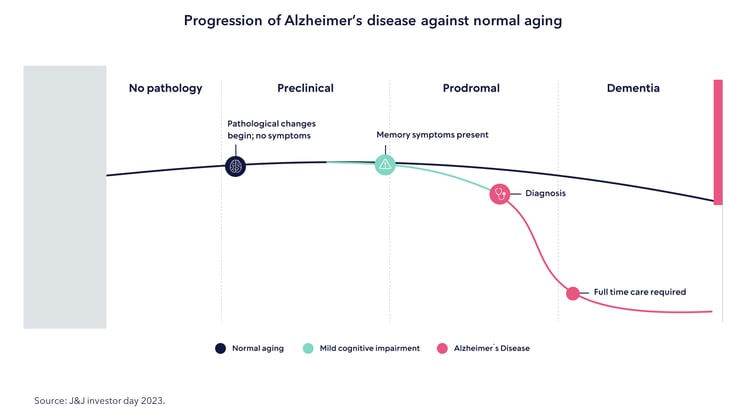

Alzheimer’s disease – the first disease modifying agents

In 1991 John Hardy and David Alsop first proposed the so-called amyloid hypothesis for Alzheimer’s disease, an idea that this neurodegenerative disease was caused by the deposition in the brain of amyloid-beta plaque, a protein that was first identified in 1984. Since then, scientists and companies have dedicated billions to understanding this process which has led to a substantial number of trials. The culmination of this work was the approval last year of Lecanemab, an antibody targeting amyloid-beta, and the first disease modifying treatment for AD with good clinical data. This is soon to be followed by Donanemab, another amyloid-beta antibody, which is expected to be approved in 2024.

The key challenge with Alzheimer’s is the need to treat patients early – sometimes well before clinical diagnosis. This will not only require new approaches, such as those targeting tau where pathology presents decades before the onset of symptoms, but also a large rise in imaging diagnostic use in this patient population.

Genetic approaches to rare neurological disease

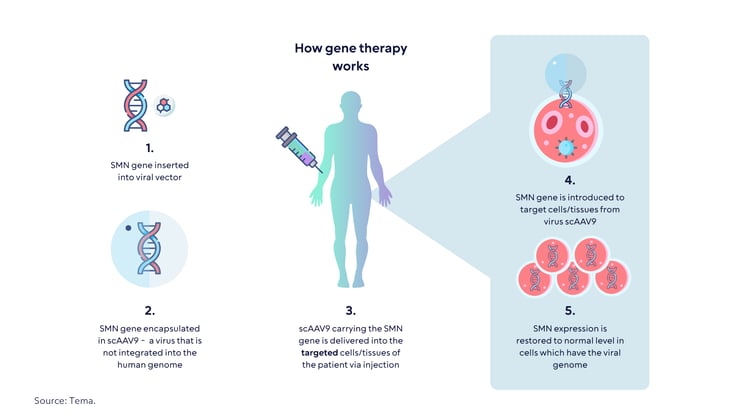

Neurogenetic diseases are caused by a defect in one or more of the genes affecting the nervous system. These diseases can result in severe and often progressive disability. Examples include spinal muscular atrophy (SMA) and muscular dystrophies like Duchenne’s and LGMD. They tend to present early in life and hence disproportionately affect children.

In 2019 the first gene therapy treatment for a genetic neurological disease was approved in the US – Zolgensma for the treatment of SMA. SMA is caused by the mutation in a gene called survival motor neuron 1 (SMN1)7 which produces survival motor neuron (SMN) protein8. In most cases, the entire genetic segment (exon 7) is deleted and not enough SMN protein is produced. What Zolgensma does is to deliver a new working copy of SMN gene – which then makes cellular machinery produce more SMN protein that is vital for neuron cells to function.

Though this was the first gene therapy, other genetic based approaches, such as small molecule splicing modifiers9 and antisense oligonucleotides (ASOs)10, can also help increase the production of SMN protein. Risdiplam, also known as Evrysdi, a small molecule approved in 2020 and developed Roche/PTC and nusinersen, also known as Spinraza, an ASO approved in 2016, developed by Biogen/Ionis represent these approaches, respectively.

These successful biotech modalities are also being tested across many of the nearly 1,700 neurogenetic diseases creating a rich seam of innovation.

Mental health – a path to precision medicine

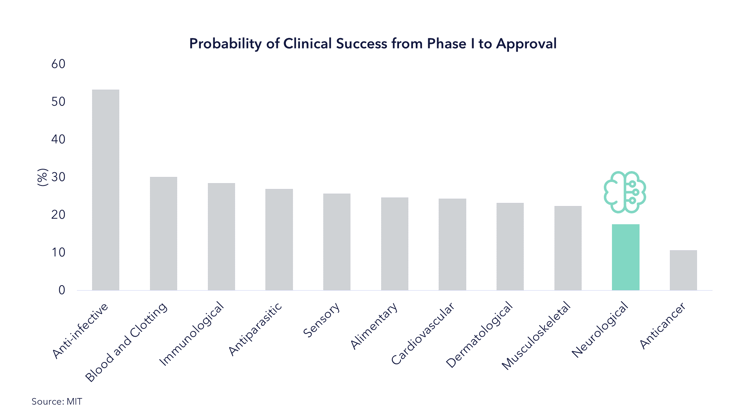

Biotech approaches to mental health have been fraught with difficulties. In fact, according to MIT clinical trial success rates in neurology are one of the lowest among therapeutic areas, second only to oncology.

There are several reasons for this11:

- The biology of mental health is complicated so finding proper drug targets is difficult.

- Animal models have very limited translational value given very different neuroanatomy and behaviors.

- There is considerable heterogeneity even within a single disease like schizophrenia.

- Clinical endpoints are subjective.

- Adherence to medication is a big problem in mental health.

One breakthrough approach is to start to apply modern precision medicine tools. Whereas historic drugs would benefit some patients, other patients would see no benefit or even adverse events. Precision approaches consider the specific features of the patients and their disease. This approach has for example led to the launch of the first new mechanism-of-action in decades for depression in the form of esketamine (Spravato) from Johnson and Johnson. These drugs are part of a broader push to provide treatments based on brain circuitry and biology instead of clinical presentation.

Exploring potential investment opportunities in neuroscience and mental health

The neuroscience and mental health landscape is varied and constantly expanding. It is the second most important therapy area in industry pipelines in 2023 representing around 940 separate clinical programs.

Many areas, such as Alzheimer’s and mental health disorders, have been historically fraught with clinical failures, requiring considerable expertise to navigate these risks.

How does the CNS segment compare to investing in biotech?

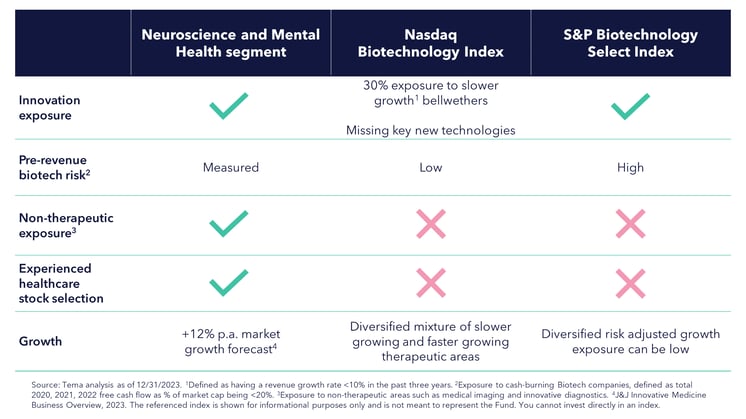

Investors might ask whether investing in a broader biotech index might be a better alternative. We believe the CNS segment is attractive compared to general biotech indices:

- As we have seen this disease group is large but also fast growing, estimated by EvaluatePharma to grow 12% p.a.3

- Given historically high clinical risks expertise is very important to avoid problematic approaches and data read outs. It is also important to take a very measured approach to emerging biotech firms in this space while taking advantage of the innovation upside they offer. An index approach can’t address this risk/reward based risk management.

- The rise of non-therapeutic interventions, such as Penumbra’s neurovascular devices, and newly developed investigational diagnostics, adds a unique exposure to the universe.

Is there a neuroscience and mental health ETF?

Tema Neuroscience and Mental Health ETF (MNTL) is the first active ETF in the world focused on this pressing and exciting area of healthcare. MNTL is managed by an experienced fund manager, David Song MD, PhD, CFA, who has over 25 years healthcare industry and investing experience.

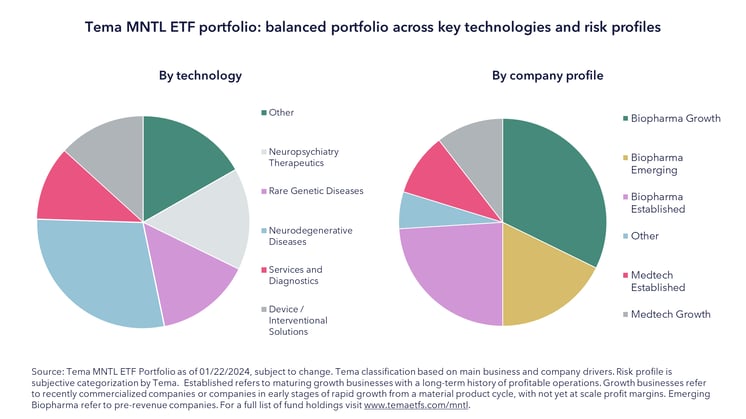

The MNTL portfolio aims to be broadly exposed to breakthrough innovation and to balance risk profiles – with a mixture of emerging biotechnology firms, growing firms with inflecting revenues, and more established companies.

The ETF has a sharp focus on valuation and understanding risk-reward of the ever-expanding CNS investment opportunity set.

Why should you consider investing in the MNTL ETF in the current environment?

We believe the Biotechnology sector currently offers exceptional value

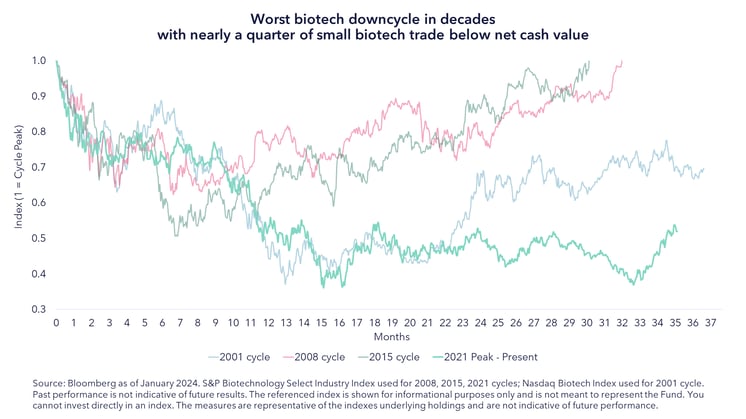

The biotech sector12, a key part of the MNTL ETF, has had a difficult past two years registering the worst downcycle in decades. At the time of writing, after a torrid summer, there are signs of green shoots as the sector saw a modest rally that took it back to levels seen in June 2023.

As a result, based on our analysis, almost a quarter of small biotech firms are trading at market caps below the net cash on their balance sheets i.e., negative enterprise value13. Although some of these firms require these cash resources to deliver their R&D programs, this is a stark reading of how far valuations have come down.

Big pharma needs to replace revenue streams and have the firepower to do it

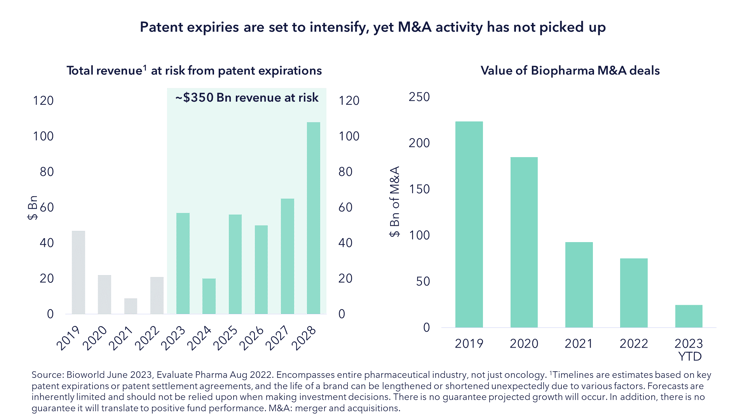

In the next five years, large pharmaceutical firms must find a way to replace an expected $350 Bn of revenue at risk from patent expiry14. One approach is to acquire smaller innovative biotechnology firms, especially in the highly under-penetrated CNS space. According to IQVIA 84% of all innovation in CNS comes from smaller firms vs. the top 30 pharma companies15. To capture this innovation, and according to our calculations, big pharma today is sitting on $838 Bn of “dry powder”, representing 74% of the entire market cap of the S&P biotechnology index16.

As recently as December 2023 Abbvie agreed to acquire Cereval Therapeutics for $8.7bn for an undisturbed premium of 50%. Their objective was to bolster their own neuro-psych position with a promising, though earlier stage, agent. This deal also adds drugs in Parkinson’s (phase III), focal epilepsy, and pain disorder (Phase II).

What are the risks of investing in MNTL?

There are several risks for investors to consider:

- Product risk: consisting of scientific risk (the biological hypothesis doesn’t work), clinical risk (the product does not work in humans), and commercial risk (the product doesn’t produce adequate revenue). We seek to mitigate these risks by avoiding unfavorable risk-reward data read-outs, conducting expert analysis of clinical data, and modeling potential market sizes using third-party commercial data.

- Funding risk: arising from some biotech firms requiring additional financial resources to complete their R&D programs. The fund will seek to risk manage exposure to these firms both via rigorous balance sheet analysis and restricted position sizing.

- Regulatory risk: always present in the healthcare space. We believe the most recent Medicare pricing regulation in the US, though negative, is a manageable risk for the industry.

Bottom line

We believe CNS is on the cusp of true disease-modifying breakthroughs, from Alzheimer’s disease to mental health. Yet to capture it requires, in our view, careful analysis, strict risk management, and expertise to find the most appropriate risk/reward investments.

Back

Back

.png)