Cancer will affect one in every two people in their lifetime. Yet, oncology is on the brink of a revolution, which we expect will trigger a material expansion of oncology investment opportunities. This blog explores this revolution and how to invest behind oncology, one of the largest life sciences investment themes.

Key takeaways

• Cancer is the second leading cause of death [1] and is forecast to cost society $25.2 Tn by 2050 [2] .

• There is a revolution underway, driving significant advances in diagnoses and treatments.

• The listed company opportunity set tied to oncology continues to expand significantly, but oncology remains a complex sector which requires expertise to navigate.

• The biotech sector has recently undergone a sharp de-rating in valuations.

• Big pharma, in need of replacing imminent patent cliffs, has historically relied on M&A [3] at hefty premiums to drive its innovation pipeline. Big pharma’s current ‘dry powder’ is roughly equal to ~75% of the combined market cap of biotech companies [4] .

• We believe oncology stands out as a superior biotech segment across several criteria including growth, innovation, and prevalence.

• The Tema Oncology ETF aims to select the winners of this cancer revolution.

For a list of current fund holdings, please visit the fund web page at www.temaetfs.com/canc. All investments involve risks, including possible loss of principal. For a more complete discussion of the potential investment risks to the topics discussed below see the disclosure section at the end of the document.

What is oncology and why is it such a burden?

Oncology is the study of cancer. In cancer, some of the body’s own cells change and start to divide uncontrollably. It isn’t just one illness, but several different ones, affecting various organs or tissues. As these are the body’s “own cells”, they can evade the immune system response. Worse still, as cancerous cells mutate rapidly, the treatments we have often only work for a period before the cancer eventually evades them and progresses. Cancer eventually becomes deadly when it spreads across the body by a process called metastasis.

Cancer will afflict one in every two people at some point in their lifetime [5] . It is the second leading cause of death, with costs to society forecasted to be over $25 Tn globally from 2020 to 2050[2] .

Oncology attempts to treat cancer, through understanding its fundamental biology both in vitro (in test tubes) and in vivo (in organisms). Ultimately, the field aims to improve prevention through diagnostics and treatment through therapeutics.

What are some of the breakthroughs in cancer research and development?

A biological revolution is driving significant advances in diagnosing and treating cancer.

DNA sequencing revolution is a key underlying driver of innovation

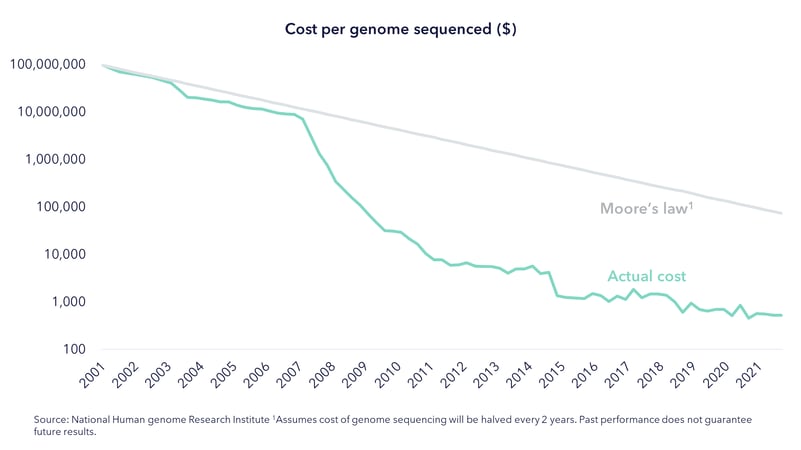

Much of the biological revolution can be attributed to innovations in genome sequencing. Starting with the success of the Human Genome project in 2003, the cost to sequence a human genome has collapsed. Where Moore’s law predicted that the doubling of transistors would halve the cost of computing every two years, the cost of genome sequencing has progressed at an exponentially faster rate. Today a genome can be sequenced for as cheaply as $600 [6] , helping scientific understanding in immeasurable ways.

CAR T-cell therapy

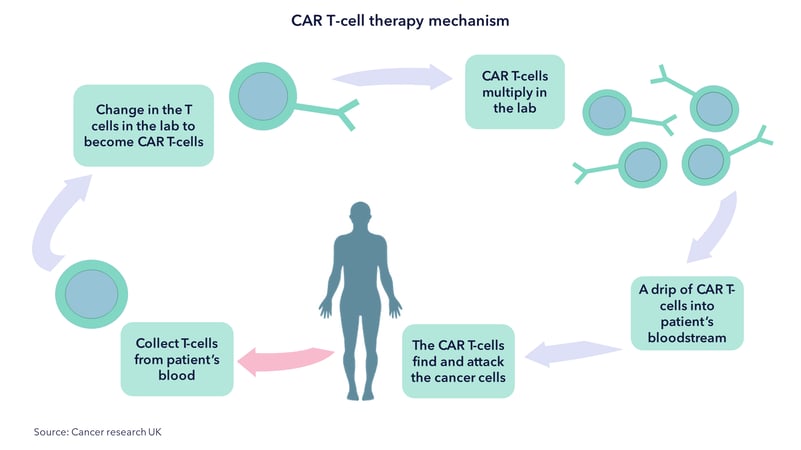

Armed with better scientific understanding, we have started to turn biological machinery to our advantage. Breakthroughs now mean that a patient’s T-cells, the hunter cells of the immune system, can be extracted, genetically engineered to detect cancers, and reinserted into the body. These types of therapies, called chimeric antigen receptor (CAR) T-cells, developed by companies like Novartis and Kite Pharmaceuticals (acquired by Gilead Sciences) are already approved for the treatment of blood cancers, such as lymphoma and chronic leukocytic leukemia.

Technologies like CRISPR gene editing, which allows precise edits to a cell’s DNA, have opened the next generation of cell therapy in two major directions. First, allogenic engineered T-cells could be available “off the shelf”, avoiding the burdensome extraction step. Second, efforts are underway to apply cell therapy to solid tumors, which are more common than blood cancers.

Liquid biopsies

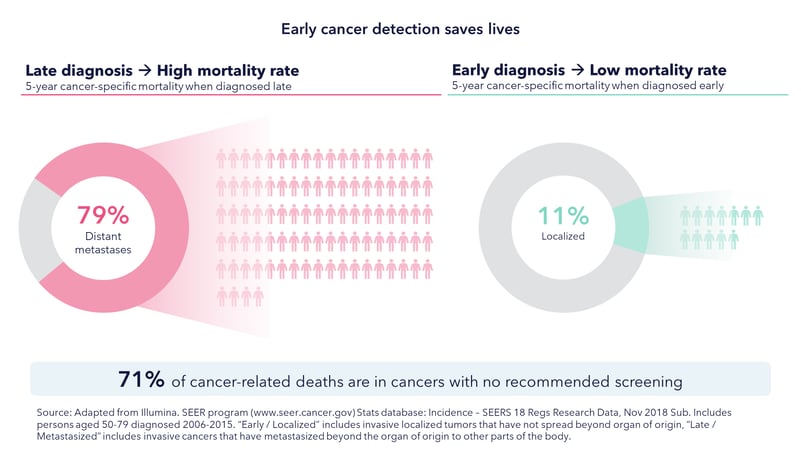

Detecting cancer early is vital. Thanks to years of development by companies like GRAIL and Guardant Health, we now have commercialized cancer diagnostics through a non-invasive blood test. These liquid biopsies are sensitive diagnostics that can detect cancerous genetic material circulating in the blood stream. In addition, some of these diagnostics have the promise to detect multiple cancers in otherwise healthy individuals, and even determine tumor of origin. Early intervention has a greater impact as mortality in metastatic / highly progressive disease tends to be much higher.

Improved liquid biopsies can also be used in treatment selection and post-remission monitoring. Increasingly, information from these diagnostics could improve clinical trials development.

Immuno-oncology

The past decade heralded successfully commercialized antibody-based therapies that capitalized on an important breakthrough in immunology – immune checkpoints. These are essentially the brakes on our immune systems not to overreact. Cancers, by their heavy mutation loads, evade the immune system by in part acting on these brakes. By giving patients checkpoint inhibitors, like PD-1 antibodies, oncologists can remove the “cloak” that tumors use to evade the immune system. This has led to, for the first time, survival curves in some patients and in some cancers (e.g., melanoma) never converging to zero: i.e., a cure.

It is now routine to give these as first-line therapy, which has meant Keytruda, one of the PD-1 inhibitors, is currently the world’s bestselling blockbuster drug forecasted to generate $24 Bn in worldwide sales in 2023 [7] . Despite this enormous progress, only 20% of patients respond [8] , leaving room for newer approaches in immuno-oncology. For example, Immunocore has pioneered a way to let T-cells target proteins inside cancerous cells, opening the possibility of engineered T-cells that could hunt down solid tumor cancers.

Targeted oncology

Today, our understanding of cancer has evolved to the point that we are able to segment patient populations and offer targeted, almost personalized, treatments. Many of these therapies act on the mutations that drive tumorigenesis and hence have the promise of higher efficacy and/or safety. Antibody technology advances have also allowed payloads to be delivered more precisely to cancer tissue. An example of this is Enhertu, which almost doubles progression free survival in a key breast cancer population [9] .

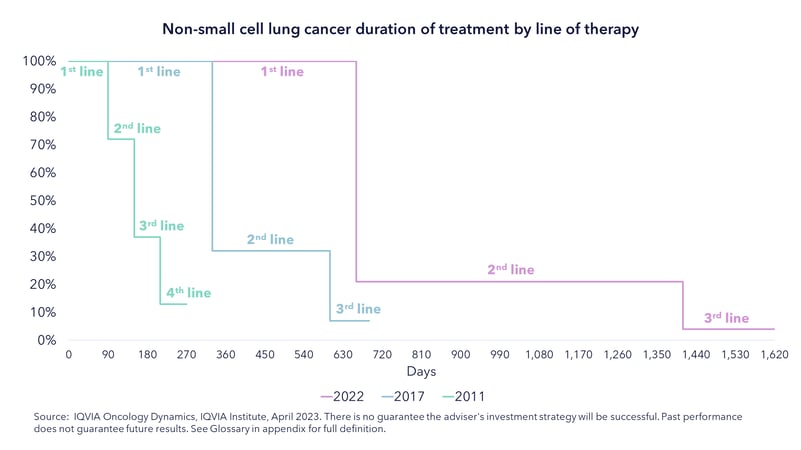

In general, these technologies are driving meaningful improvements in survival and quality of life, with an associated positive uplift to industry revenues.

There is a boom in R&D productivity in Oncology

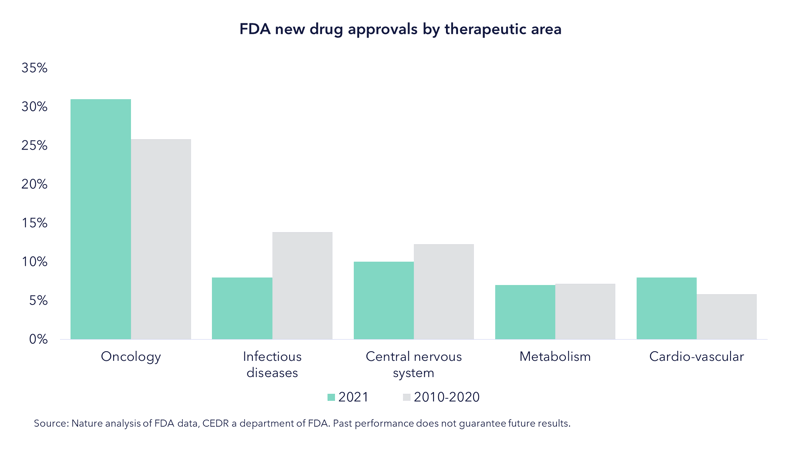

These innovations are part of a boom in drug R&D productivity. The number of new molecular entities approved by the FDA in 2022 doubled from 2010 [10] . Oncology is leading the way, taking a growing share of these approvals.

Oncology market outlook

The evolution of oncology is being driven by several long-term factors.

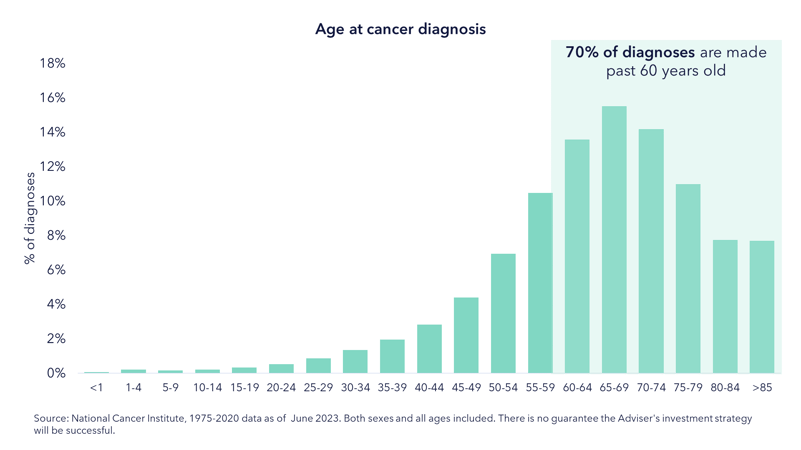

• First, populations are aging. The global population of individuals over the age of 60 is forecast by the UN to go up 2.5x by 2050 to nearly 2.5 billion [11] . Older individuals are much more prone to develop cancer, as one can see from the chart below.

- Second, the growing prevalence of obesity and other lifestyle factors represent alarming long-term drivers of cancer.

- Third, environmental factors, such as industrial pollution, are also key drivers of cancer incidence. A recent European Environmental Agency (EEA) report has estimated that pollution causes 10% of all cancer cases in Europe [12] .

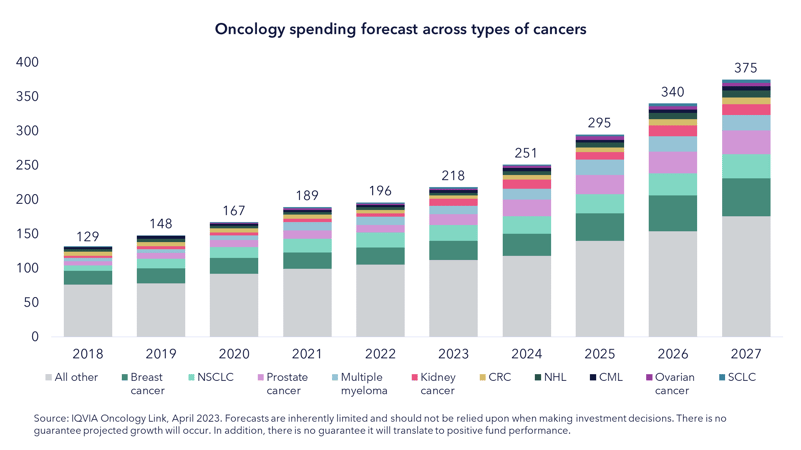

As a result, the oncology market is forecast by IQVIA to hit $375 Bn globally by 2027 [13]

Exploring investment opportunities in oncology

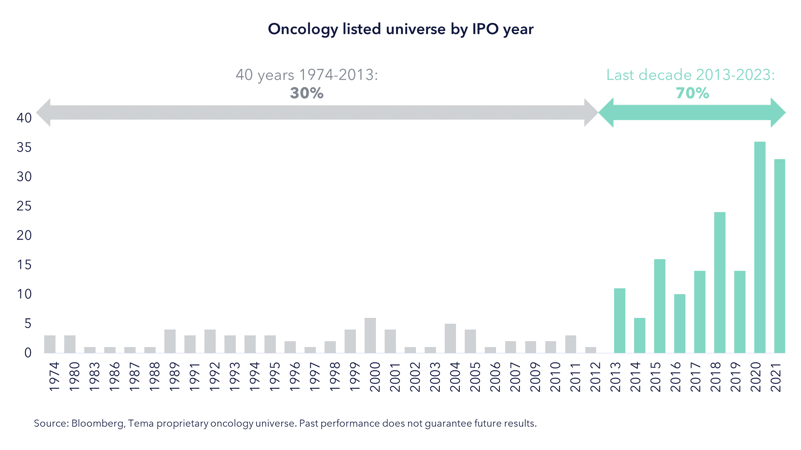

The burst of innovation and healthy capital markets have meant the last decade has seen an almost Cambrian explosion of new oncology companies. If we plot our proprietary Oncology universe [14] by IPO [15] year, we find that 70% of public oncology companies were listed in the last decade [16] . This creates a larger and likely richer set of investment opportunities to pick from.

This creates a larger and likely richer set of investment opportunities to pick from.

Is the oncology segment more attractive than broader biotech?

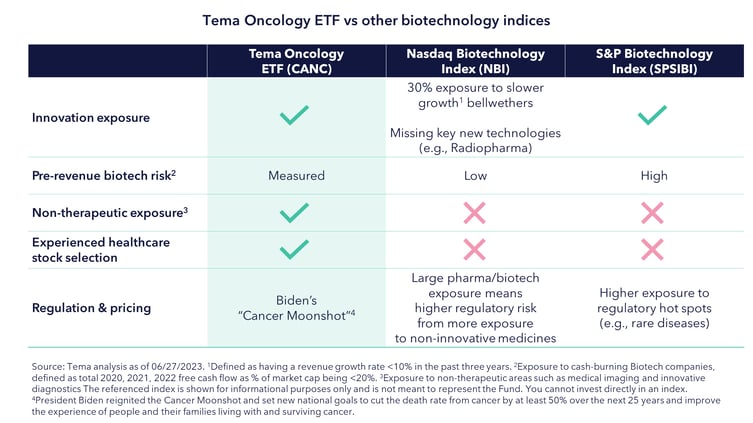

Investors might ask whether investing in a biotech benchmark, like the Nasdaq Biotechnology Index [17] (NBI, consisting of large and small biotech firms) or the equal weighted S&P Biotechnology Select Industry Index [18] (SPSIBI), might offer a better alternative.

We believe that oncology is the superior subsegment:

• Oncology has the potential to offer exposure to innovative fast-growing firms, while the NBI is dominated by slower-growing bellwether firms.

• SPSIBI, on the other hand, may have a higher risk of exposing investors to speculative cash burning companies.

• Neither index benefits from exposure to non-therapeutic areas such as diagnostics.

• We feel that biotech indices such as SPSIBI are backward-looking and overlook company quality factors such as scientific success and management track record.

• Finally, the Biden-Harris administration’s goal to halve the mortality from cancer by 2050 [19] is a policy tailwind for the oncology space. The same can’t be said for broader indices. The NBI is potentially exposed to pricing risks because of a higher exposure to non-innovative medicines, and the SPSIBI is exposed to regulatory hot spots like rare diseases.

Is there an Oncology ETF?

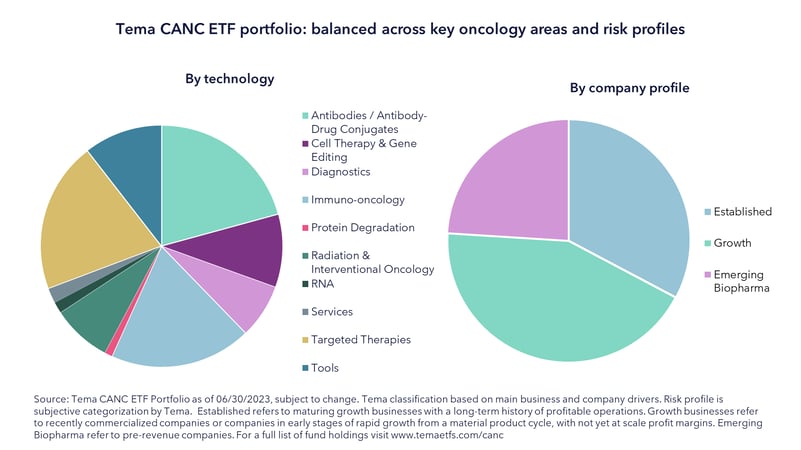

CANC is the first Oncology-focused ETF in the US market. CANC is managed by an experienced portfolio manager with over 25 years of healthcare industry and investing experience. The CANC portfolio aims to be broadly exposed to breakthrough innovation and to balance risk profiles – with a mixture of emerging biotechnology firms, growing firms with inflecting revenues and more established companies. There is a keen focus on valuation and understanding risk-reward of the ever-expanding oncology investment opportunity set.

Why should I consider investing in Oncology ETF in the current environment?

We believe the biotech sector currently offers exceptional value

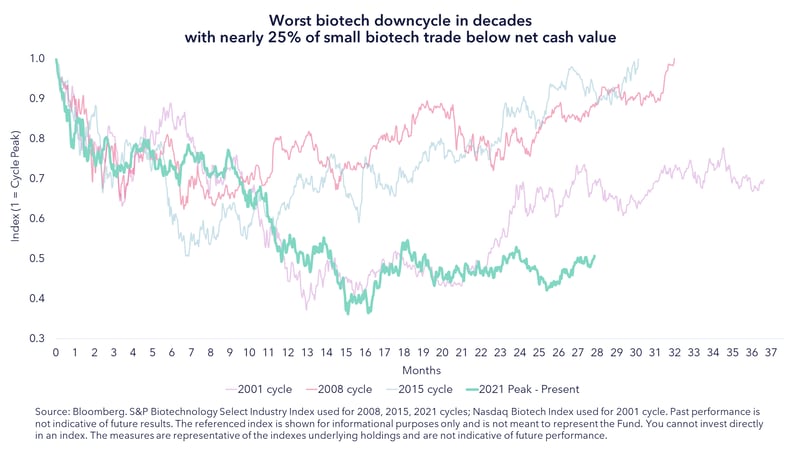

The biotech sector has had a difficult past two years, clocking in the worst downcycle in decades.

In our analysis, almost 25% of small biotech firms are trading at market caps below the net cash on their balance sheets i.e., negative enterprise value. Although some of these firms require cash resources to deliver their R&D programs, this is a stark reading of how far valuations have come down.

In our analysis, almost 25% of small biotech firms are trading at market caps below the net cash on their balance sheets i.e., negative enterprise value. Although some of these firms require cash resources to deliver their R&D programs, this is a stark reading of how far valuations have come down.

Big pharma needs to replace revenue streams and have the firepower to do it

In the next five years, large pharmaceutical firms must find a way to replace an expected $350 Bn of revenue at risk from patent expiry [20] . One approach is to acquire smaller innovative biotechnology firms. In our calculations big pharma today is sitting on $838 Bn of “dry powder” [21] to acquire these firms, representing 74% of the entire market cap of the S&P biotechnology index [22] .

Oncology is a key focus for future pipelines, and a slew of recent deals, like Pfizer’s acquisition of Seagen, bode well for this trend. Such deals have historically been done on average premiums of 98% as per our analysis below.

What are the risks of investing in oncology?

There are several risks for investors to consider:

• Product risk: consisting of scientific risk (the biological hypothesis doesn’t work), clinical risk (the product does not work in humans) and commercial risk (the product doesn’t produce adequate revenue). We seek to mitigate these risks by avoiding unfavorable risk-reward data read-outs, conduct expert analysis of clinical data, and model potential market sizes using third-party commercial data.

• Funding risk: arising from some biotech firms requiring additional financial resources to complete their R&D programs. The fund will seek to risk manage exposure to these firms both via rigorous balance sheet analysis and restricted position sizing.

• Regulatory risk: always present in the healthcare space. We believe the most recent Medicare pricing regulation in the US [23] , though negative, is a manageable risk for the industry. Oncology drugs, because of the huge unmet medical need, are classified as a protected therapeutic category under Medicare – mitigating some of the deleterious impacts from recent reforms.

Bottom line

The oncology revolution is accelerating with an expanding opportunity set of companies, yet expertise is required to identify the companies that will benefit from these tailwinds while diligently managing risk.

Back

Back

.png)