When it comes to who will win the US election we are heading for a knife edge. Prediction markets, from Metacalculus and PredictIt, are all roughly 50-50 for Trump-Biden. Polls are equally tight. Pundits are just as divided as ever. But does the outcome matter for investors?

Elections don’t really matter for overall financial returns – stay invested

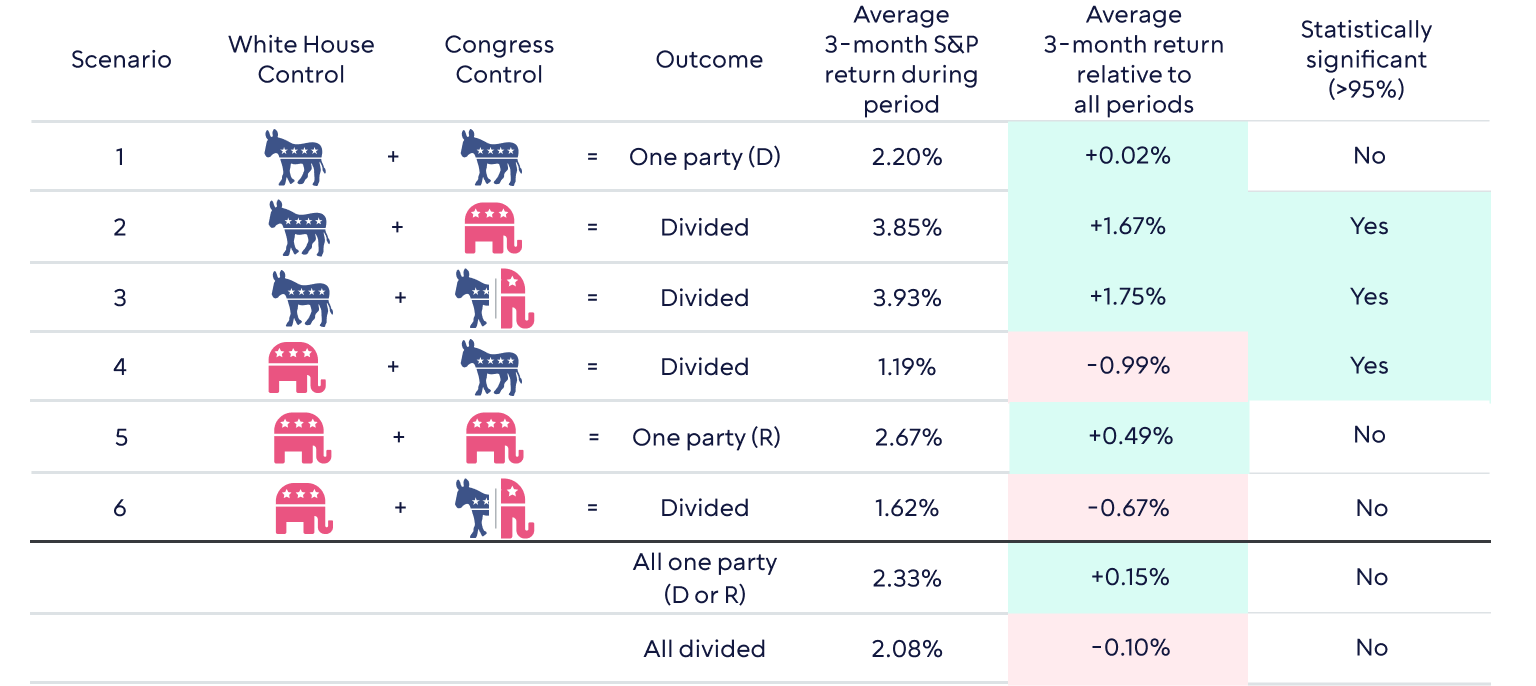

Despite driving a big news cycle and associated narratives, election outcomes generally see positive returns three months after with no real statistically significant difference to other such three month periods.

Historical election outcome scenarios and market performance

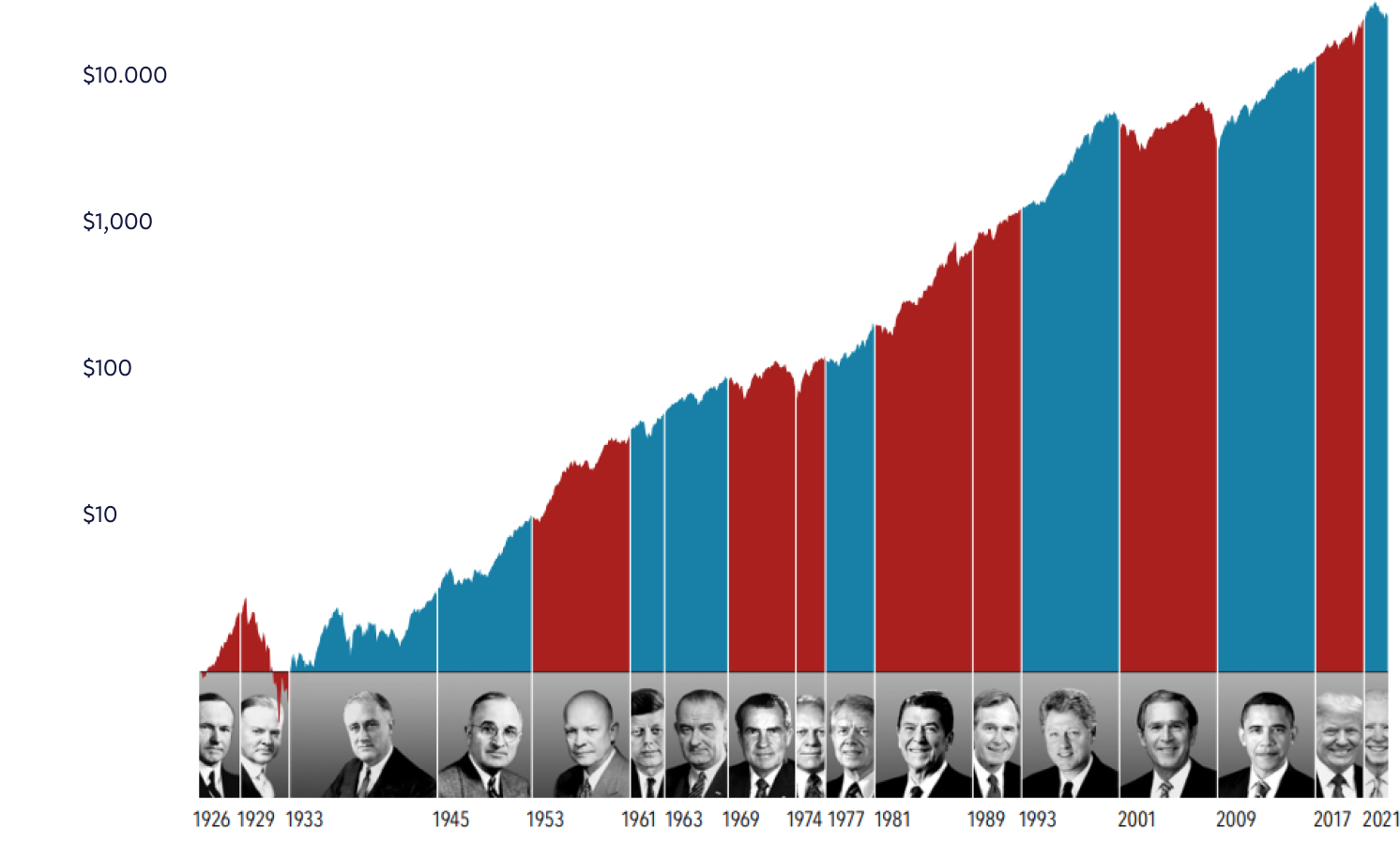

In fact, who is in power in the US has little impact on the long-term performance of markets. This graph shows the hypothetical growth of $1 invested in the S&P 500 from 1926 through 2022 as well as which U.S. President was in office during each year.

Key takeaways:

- Elections have a very limited short, medium or long term impact on overall market outcomes and in general it pays to stay invested.

- What matters much more is the state of the economy, both in terms of growth and inflation.

Elections do mean policy changes which create turbulence under the surface.

While most analysis suggests a benign picture overall, elections lead to changes in policy and funding which can affect certain sectors. In 2024 we are monitoring the following areas:

- Healthcare - Representing 20% of US GDP, healthcare often catches a lot of political flack largely around drug pricing and reform of the insurance system with Democrats tending to be more disruptive.

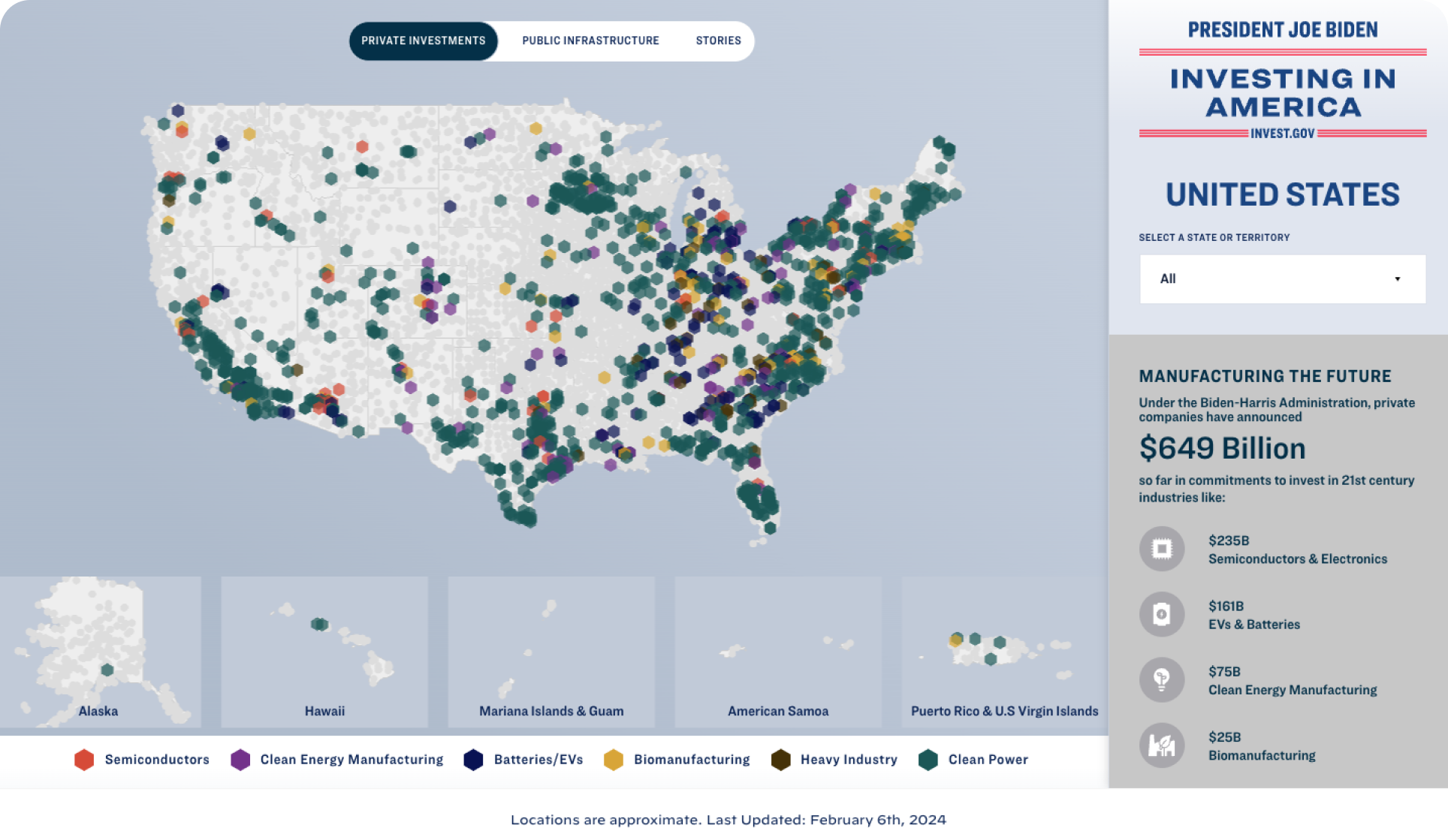

- Infrastructure spending - Both sides have been vocal about rebuilding US infrastructure with the passage of bipartisan bills like IRA, IIJA. However, there could be a change of priorities under the surface. It’s a big topic as seen by the White House website – Investing in America.

- Geopolitics – Tension across the world are on the rise leading to supply disruptions, trade disputes and in some cases wars, and responses from the administration to these challenges will be important.

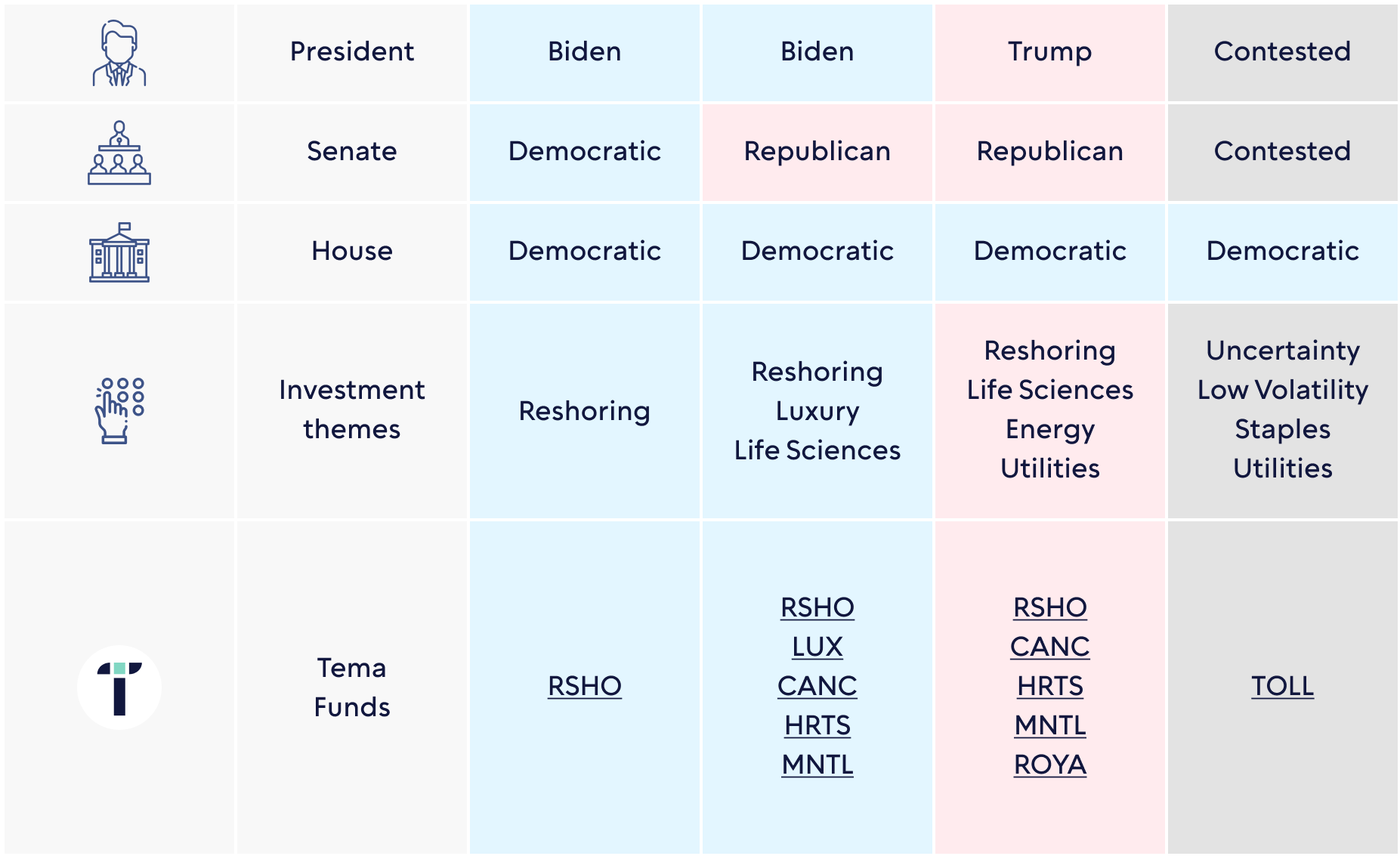

Based on the most likely outcomes this is where we see themes landing and the funds we recommend:

- Reshoring – Geopolitics and rebuilding infrastructure are likely to remain driving forces of US reshoring which our RSHO ETF focuses on.

- Life sciences – Although unable to rule it out out entirely, and safer with a Republican win, we see a healthcare policy risk as behind us. This is largely with the passage of IRA, creating a beneficial environment for our life science suite (CANC, HRTS, MNTL).

- Energy – Our fund is currently 30% invested in oil and gas, especially those in the Texas Permian basin, offering alternative financing to fund further growth of US as an energy exporter.

- Uncertainty – All change can be inherently uncertain, especially if the election (like 2000 and 2020) is contested. As it doesn’t pay to run for the hills it may help to play some defense via our TOLL fund, which is focused on companies with durable and deep moats that can potentially weather any storm.

Back

Back

.png)