Key Takeaways

-

Private credit has faced a flurry of red flags and souring sentiment after a few high-profile defaults and renewed anxiety about software exposure.

-

Many of the loudest stories are narrow and idiosyncratic, not evidence of systemic stress.

-

The real story is that private credit today is more diversified and structurally protected, with rates of default comparable to leveraged loans and high yield.

Why Private Credit Is in the Headlines

A series of events in late 2025 and early 2026 has pulled private credit back into the spotlight. Tricolor and First Brands defaulted, reviving familiar fears about “cockroaches” in an opaque market.

Then, as software stocks sold off to start 2026 amid AI disruption worries, investors saw reason for further concern. Private credit has been a key lender to the industry, and the market has focused on Business Development Companies (BDCs), which on average have roughly 20 to 25% of their loan portfolios in software.1 As a result, shares of some private-credit-exposed companies like Ares and Blue Owl are down double digits year to date.2

These moves deserve acknowledgment, but they do not define the full asset class.

Look Past the Headlines: Risks Are Real, but Not Systemic

There will be losses in private credit as we progress through the economic cycle and as some industries face disruption. That is normal in lending. The key question is whether today’s anxiety is being extrapolated too broadly.

In the cases of Tricolor and First Brands, most evidence points to borrower-specific issues, including potential fraud, rather than widespread deterioration. Importantly, these exposures were largely bank-originated, not directly sourced by private credit managers.

AI disruption is a real credit risk for private lenders, but diversified platforms should be able to absorb losses, and not every software company faces an existential threat given differences in business models, moats, and ability to adapt.

Software is a meaningful private-markets exposure, but it varies by lender type and firm: PitchBook estimates software is about 9% of private-equity-backed companies and 17% of borrowers in the private-credit universe (e.g. BDCs).3 4 At the large diversified alternative managers, software is typically only mid- to high-single-digit of firmwide total assets. Bottom line: You can’t paint every software company or private credit firm with a broad brush.

A Broader, More Resilient Private Credit Toolkit

Private credit has evolved from a niche corner of distressed debt and highly leveraged sponsor-backed direct lending into a broader, more mainstream financing toolkit. Today it spans asset-based and specialty lending such as infrastructure and project debt, aircraft finance, residential and commercial mortgages, and fund finance. It has also moved up the quality spectrum into investment-grade private debt, including senior secured IG loans, private placements, and other bespoke IG financings for large, well-known issuers. In that context, private credit is no longer just a middle-market story. Leading corporates such as Microsoft, Meta, AT&T, and AB InBev have tapped private markets for capital alongside traditional public-bond issuance.

Credit fundamentals remain constructive. Across the large publicly traded U.S. alternatives managers, portfolios generally show conservative loan-to-value and solid debt service coverage, with nonaccruals still well below historical norms. The macro backdrop also looks more supportive than it did a year ago. Lower interest rates ease refinancing pressure and interest expense and can lift collateral values in asset-based lending. Add the prospect of fiscal stimulus and related investment programs that support activity in infrastructure, industrials, and real assets, and conditions for private credit look more favorable, even as losses normalize.

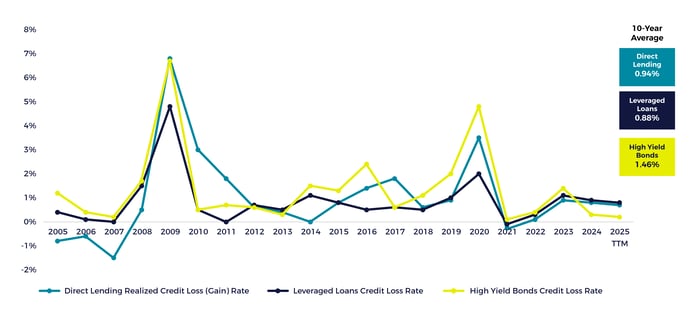

Historically, private credit default rates have tracked closely with leveraged loans and high yield, which reinforces that the asset class is not an outlier.

Private Credit Isn’t an Outlier

Default Rates for Private Credit vs. Leveraged Loans and High Yield Bonds (2005-2025)

Source: iCapital as of Nov 30, 2025

Even within software, the typical structure is designed to absorb stress. These loans are generally senior secured, relatively short-duration, and supported by meaningful equity cushions. Many managers have also been pressure-testing AI disruption risk for years and adjusting underwriting accordingly.

Three Myths About Private Credit

A handful of persistent misconceptions continue to shape how some investors view the space:

-

Myth #1: Private credit isn’t rated. Investment-grade private credit is almost always rated, either internally by a bank or externally by ratings agencies. Regulators are also pushing for better transparency, valuation practices, and investor suitability as retail access grows.

-

Myth #2: Private credit is opaque. In many cases, it’s more transparent than public credit. Private lenders conduct deep due diligence, receive non-public financial information, and have direct access to management.

-

Myth #3: Private credit is an emerging systemic risk. The asset class has grown quickly, but the systemic-risk narrative is likely overstated. Since the post-GFC (Global Financial Crisis) tightening of bank regulation, a meaningful share of lending has moved from deposit-funded banks to the investment marketplace, which is funded by longer-term capital.

Why It Matters for Investors

High-profile defaults and market volatility have renewed scrutiny for private credit. So far, the pressure looks concentrated in narrow segments of leveraged lending and is not indicative of broad deterioration. With disciplined underwriting, structural protections, and a larger opportunity set, private credit—particularly private investment grade—remains fundamentally sound even as losses normalize.

For investors seeking diversified private market exposure to firms operating across private credit, private equity, venture, and real assets, the Tema Alternative Asset Managers ETF (AAUM) offers a curated portfolio of 25–35 companies. AAUM is managed by Investment Partner Kaimon Chung, CFA, who offers nearly two decades of experience covering alternatives. Don't miss, 4 Questions on Private Markets with Investment Partner Kaimon Chung.

For more of our research and recent insights on Alternatives and more, view and subscribe to our insights.

Back

Back