By clicking below you acknowledge that you are navigating away from temaetfs.com and will be connected to temafunds. Tema Global Limited manages both domains. Please take note of Tema's privacy policy, terms of use, and disclosures that may vary between sites.

Get in Touch

Back

Back

TOLL

Durable Quality ETF

A U.S.-Focused Portfolio of Quality Companies with Durable, Tangible, and Dominant Moats.

Why Invest in TOLL?

Durability

TOLL selects companies with dominant competitive positions, often providing mission-critical goods and services that generate recurring revenue.

Tangibility

The digital economy has proven ripe for disruption. By contrast, TOLL invests in companies with tangible asset characteristics, including infrastructure, financial services, and network industries.

Investment Expertise

TOLL is actively managed by an experienced investment team with deep expertise in identifying companies that have built durable moats.

Fund Overview

Fund Details

As of March 06, 2026

Fund Summary

The Tema Durable Quality ETF (TOLL) invests in companies with deep moats, high barriers to entry, and strong earnings visibility—many of which hold monopoly positions within their industries.

Portfolio Breakdown

Top 10 holdings

As of March 06, 2026

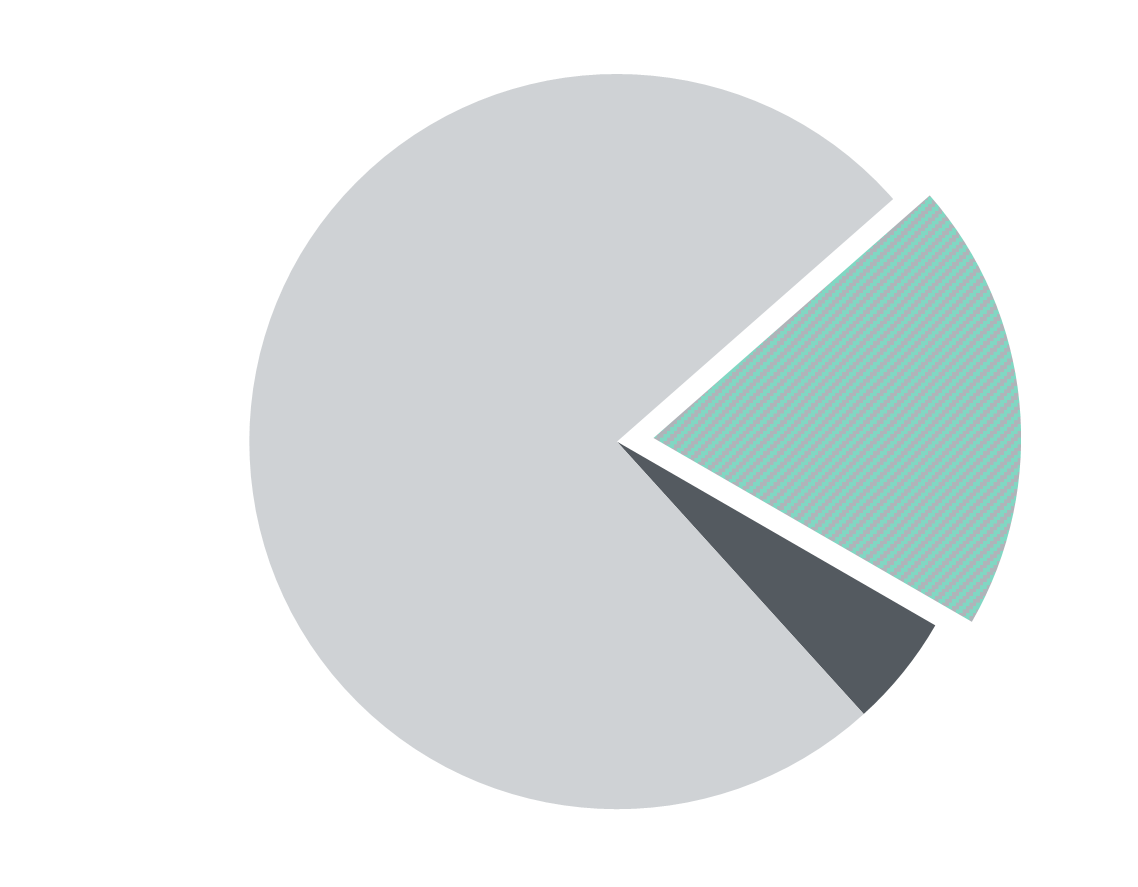

Country Breakdown

United States

91.26%Netherlands

4.48%Spain

2.38%France

0.99%Others

0.89%Industry Breakdown

Financials

28.44%Information Technology

27.54%Industrials

17.31%Health Care

13.58%Consumer Staples

7.21%Materials

3.57%Utilities

1.46%Cash & Cash Equivalents

0.92%- Performance

- Distributions

- Premium / Discount

Prices & Performance

- Feb 28, 2026

- Dec 31, 2025

TOLL

3 months

1 Year

3 Years

5 Years

Since inception

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted. Returns for periods of less than one year are not annualized.

The market price returns are based on the official closing price of an ETF share or, if the official closing price isn’t available, the midpoint between the national best bid and national best offer (“NBBO”) as of the time the ETF calculates current NAV per share, and do not represent the returns you would receive if you traded shares at other times. NAVs are calculated using prices as of 4:00 PM Eastern Time. The first trading date is typically several days after the fund inception date. Therefore, NAV is used to calculate market returns prior to the first trade date because there is no bid/ask spread until the fund starts trading.

Distributions

Record Date

Ex-Date

Payable Date

Total Distribution

Income

Premium/Discount

Days Traded at Nav

Days Traded at Premium

Days Traded at Discount

TOLL NAV / Market Price

How does the Tema TOLL ETF fit in a portfolio?

Investment Style Box

Source: Tema. The investment style Box reveal’s a fund’s investment strategy by showing its investment style and market capitalization based on the fund’s portfolio holdings.

Potential Portfolio

Equity Allocation

10-20%

of Equity Core

TOLL ETF

Satellite

Equity core

Where could a position be funded from?

- The TOLL ETF seeks to provides exposure to quality companies with dominant and durable moats, and could serve as a replacement for a large cap blend or growth position.

- Most equity portfolios today are heavily exposed to large and mega cap tech, and TOLL provides a way to diversify away from an overallocation to the technology sector.

- The TOLL ETF may also act as a tax-efficient and liquid way to introduce the quality factor to a portfolio.

Latest Research & Insights

Investors Are Looking to Put a HALO Around Their Portfolio

The “HALO” trade is gaining traction among investors. We explore how tollkeepers and durable moats put this idea into practice.

How to Build a Moat AI Can’t Disrupt

Discover how to build resilient business moats in an AI-driven economy by focusing on physical assets and scarcity rather than intangible digital assets.

Chris Hohn's Tollkeeper Philosophy, Explained

Discover Chris Hohn's tollkeeper philosophy and how Tema's ETFs apply his quality-focused investment approach for durable, long-term growth.

Subscribe for Updates

Risk Information

Carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Fund’s prospectus or summary prospectus, which may be obtained by visiting www.temaetfs.com.

Read the prospectus carefully before investing.

Diversification does not ensure profits or prevent losses.

On 06/27/2025 the Tema Monopolies and Oligopolies ETF was renamed Tema Durable Quality ETF. Investing involves risk including possible loss of principal. There is no guarantee the adviser’s investment strategy will be successful.

Sector Focus Risk: The Fund may invest a significant portion of its assets in one or more sectors, including Engineering and construction, Financial Sector, FinTech, Industrials and Infrastructure, and thus will be more susceptible to the risks affecting those sectors than funds that have more diversified holdings across several sectors.

The success of the Fund’s investment strategy depends in part on the ability of the companies in which it invests to maintain proprietary technology used in their products and services. Companies in which the Fund invests will rely, in part, on patent, trade secret and trademark law to protect that technology, but competitors may misappropriate their intellectual property, and disputes as to ownership of intellectual property may arise.

Similarly, if a company is found to infringe upon or misappropriate a third-party’s patent or other proprietary rights, that company could be required to pay damages to such third-party, alter its own products or processes, obtain a license from the third-party and/or cease activities utilizing such proprietary rights, including making or selling products utilizing such proprietary rights. These disputes and litigations may be detrimental to performance.

Investing in Foreign and emerging markets involves risks relating to political, economic, or regulatory conditions not associated with investments in U.S. securities and instruments. In addition, the fund is exposed to currency risk.

Because the Fund evaluates ESG factors to assess and exclude certain investments for non-financial reasons, the Fund may forego some market opportunities available to funds that do not use these ESG factors.

Tema ETFs LLC serves as the investment adviser to Tema Durable Quality ETF (the “Fund”), and Tidal Investments LLC serves as a sub-adviser to the Fund. The Fund is distributed by Vigilant Distributors, LLC, which is not affiliated with Tema ETFs LLC nor Tidal Investments LLC. Check the background of Vigilant Distributors, LLC on FINRA’s BrokerCheck.